Shooting Star Candlestick.

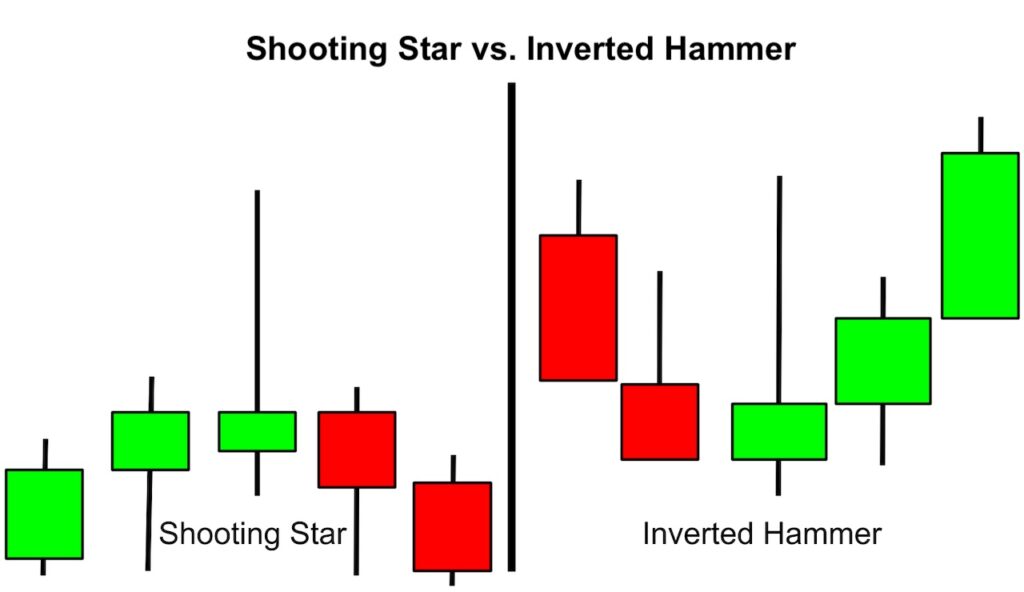

Shooting Star Candlestick ak small real body ki Bullish/bearish ki candle hoti ha jiska upper wick long hota ha aur lower wick smaller ya zero hota ha. Upper long wick kam sa kam real body k double hona chahiye. Ye Candlestick buyers aur sellers k dermiyan indecision ko batati ha. Ye candle hamasha bullish trend k top per resistance level per banti ha.

Shooting Star Candlestick Pattern.

Shooting Star Candlestick Pattern 2 Candlestick per mushtamil hota ha. Is man first candle ""Shooting Star Candlestick" aur second candle bearish ki hoti. Is pattern man second candle shooting Star Candlestick Pattern ki confirmation deti ha. Ager second candle bearish man close de to he is per trade karan lakin ager second candle bullish ki banti ha to ye false pattern ha aur per trade kerna sa avoid karen. Is pattern man ""Shooting Star Candlestick"" ka upper long wick no price active man hona bohat zaroori hai.

Trading with Shooting Star Candlestick Pattern.

Shooting Star Candlestick k bad ager next candle bearish ki banti ha to is sa ye pattern confirm ho jata ha. Second candle k bearish man close k bad new candle k open per trader ko ""Sell ki Trade"" active kerni chaheye. Stoploss ko Shooting Star Candlestick k high sa 6 pips oper place karen aur Take Profit ko next support levels per Tp-1, Tp-2 aur Tp-3 ker k place karen. Aur trader ko chahiye k wo Tp-1 per apni half trade close ker de aur baqi trade ka Stop Loss entry level per place karan.

Use of other indicator with Shooting Star.

Shooting Star Candlestick Pattern k sath ager koi technical indicator b use kiya jae to trade ki mazeed confirmation ho jati ha. Is liye trader is pattern k sath ""Relative Strength Index (RSI) indicator"" ko use kiya to is pattern ki formation k doran RSI 70 k level sa above hona bohat zarori ha. Aur trade entry leta waqt RSI 70 k level ko cross down kar rahe ho to is tarah trade ki confirmation indicator b 100 de deta ha.

Shooting Star Candlestick ak small real body ki Bullish/bearish ki candle hoti ha jiska upper wick long hota ha aur lower wick smaller ya zero hota ha. Upper long wick kam sa kam real body k double hona chahiye. Ye Candlestick buyers aur sellers k dermiyan indecision ko batati ha. Ye candle hamasha bullish trend k top per resistance level per banti ha.

Shooting Star Candlestick Pattern.

Shooting Star Candlestick Pattern 2 Candlestick per mushtamil hota ha. Is man first candle ""Shooting Star Candlestick" aur second candle bearish ki hoti. Is pattern man second candle shooting Star Candlestick Pattern ki confirmation deti ha. Ager second candle bearish man close de to he is per trade karan lakin ager second candle bullish ki banti ha to ye false pattern ha aur per trade kerna sa avoid karen. Is pattern man ""Shooting Star Candlestick"" ka upper long wick no price active man hona bohat zaroori hai.

Trading with Shooting Star Candlestick Pattern.

Shooting Star Candlestick k bad ager next candle bearish ki banti ha to is sa ye pattern confirm ho jata ha. Second candle k bearish man close k bad new candle k open per trader ko ""Sell ki Trade"" active kerni chaheye. Stoploss ko Shooting Star Candlestick k high sa 6 pips oper place karen aur Take Profit ko next support levels per Tp-1, Tp-2 aur Tp-3 ker k place karen. Aur trader ko chahiye k wo Tp-1 per apni half trade close ker de aur baqi trade ka Stop Loss entry level per place karan.

Use of other indicator with Shooting Star.

Shooting Star Candlestick Pattern k sath ager koi technical indicator b use kiya jae to trade ki mazeed confirmation ho jati ha. Is liye trader is pattern k sath ""Relative Strength Index (RSI) indicator"" ko use kiya to is pattern ki formation k doran RSI 70 k level sa above hona bohat zarori ha. Aur trade entry leta waqt RSI 70 k level ko cross down kar rahe ho to is tarah trade ki confirmation indicator b 100 de deta ha.

تبصرہ

Расширенный режим Обычный режим