Asalamualaikum!

Dear members i hope ap sab kehriyat sy hon gay, or trading main achi earning kar rahy hon gay.agr ap market main profitable trading karna chahty hain to us main ap different factor par study karn hai.ta k ap acha result hasil kar sakyn, Aaj main apko diversions ki kuch information dena chahti hun, jo ap ki Trading ko successful bana sakhti hai.

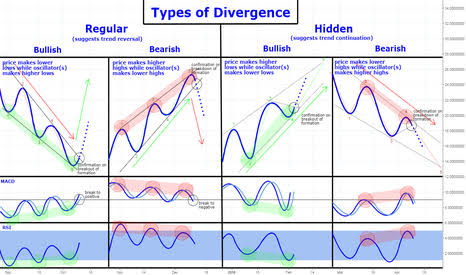

WHAT IS BULLISH DIVERGENCE:

Aik eisi situation jismein prices or Indicator system aapko divergence show Kar rhy hoty Hain, or is situation main aapko bahut jyada chances uptrend Kay Nazar ah rahy hoty Hain, isko forex market mein bullish Divergence kaha jata hai. Bullish Divergence Concept ko carefully study karna chahte hain, tu following mentioned situation available ho sakti hain.

CONDITION 1

Jab market mein aik strong downtrend hota hai, or support level par jab price aik lowwer point per ja Kay aik new lowwer point banati hai, likn Indicator us lowwer point ko indicate nahin kar raha hota, isk matlab hota hai Kay ab aapko Bullish Divergence bn gya hai, isk bd Market ab uptrend main apni next movement Kar sakhti hai, or agar isk sath aapko bullish inside up Candlestick Pattern ya Doji Candlestick Pattern milta hai, tu aapki trading or bhi zyda effective ho sakhti hai.

CONDITION 2

Dear member Forex trading market mein jab aik strong downtrend main support level per prices aik lowwer high point banati hai, likn Indicator system is Kay against lowwer point bana let's hai, is condition ko aap Forex trading market mein bullish Divergence Concept kaha jata hai. Aagar aap simple words mein bullish Divergence Concept ko completely understand karna chahte hain, tu jab bhi Market mein prices or Indicator main divergence hota hai, usko aap bullish Divergence khety Hain.

WHAT IS BEARISH DIVERGENCE:

Dear members Forex trading market mein agar aap Bearish Divergence Concept ko completely understand krna chahta hain, tu simple words main aapko ya batana chahata hun, Kay jab resistance level per apko Indicator system or price main aik clear difference milta hai, tu eisi situation main aapko bearish Divergence mil raha hota hai. Iska mtlab hota hai market Kay down jany Kay chances ho sakhty Hain ab.

CONDITION 1

Dear member bearish Divergence main phli condition yah ho sakhti hai, Kay jab Price aik new high point ko touch krti hai, likn Indicator is sa disagree Kar Raha hota hai. Is sa aapko idea lga Lena cheye Kay market mein ab bearish trend expected ho sakhta hai, agar is Level per apko kei downside pattern ya kei reversal candlestick milti hai, tu aapka accuracy level maximum ho sakhta hai.

CONDITION 2

Bearish Divergence main 2nd situation main eisa hota hai, Kay jab resistance level per price low side pa ati hai, or Indicator system is ko disagree Kar Raha hota hai, or wo highest position show Kar Raha hota hai. Isko aap bearish Divergence Concept kaha jata hai.

WORKING IN BEARISH DIVERGENCE:

Dear Bearish Divergence ki bahut simple interpretation hoti hai, jab bhi aik strong resistance level per aapko Indicator system or price main disagreement milta hai, or isk sath kei downtrend pattern milta hai, tu aapko aik perfect bearish trend mil raha hota hai. Isliye aapko hamesha market mein careful hokar apni trading activities ko complete karne ke liye above mentioned details ko find out karna hota hai.

Dear members i hope ap sab kehriyat sy hon gay, or trading main achi earning kar rahy hon gay.agr ap market main profitable trading karna chahty hain to us main ap different factor par study karn hai.ta k ap acha result hasil kar sakyn, Aaj main apko diversions ki kuch information dena chahti hun, jo ap ki Trading ko successful bana sakhti hai.

WHAT IS BULLISH DIVERGENCE:

Aik eisi situation jismein prices or Indicator system aapko divergence show Kar rhy hoty Hain, or is situation main aapko bahut jyada chances uptrend Kay Nazar ah rahy hoty Hain, isko forex market mein bullish Divergence kaha jata hai. Bullish Divergence Concept ko carefully study karna chahte hain, tu following mentioned situation available ho sakti hain.

CONDITION 1

Jab market mein aik strong downtrend hota hai, or support level par jab price aik lowwer point per ja Kay aik new lowwer point banati hai, likn Indicator us lowwer point ko indicate nahin kar raha hota, isk matlab hota hai Kay ab aapko Bullish Divergence bn gya hai, isk bd Market ab uptrend main apni next movement Kar sakhti hai, or agar isk sath aapko bullish inside up Candlestick Pattern ya Doji Candlestick Pattern milta hai, tu aapki trading or bhi zyda effective ho sakhti hai.

CONDITION 2

Dear member Forex trading market mein jab aik strong downtrend main support level per prices aik lowwer high point banati hai, likn Indicator system is Kay against lowwer point bana let's hai, is condition ko aap Forex trading market mein bullish Divergence Concept kaha jata hai. Aagar aap simple words mein bullish Divergence Concept ko completely understand karna chahte hain, tu jab bhi Market mein prices or Indicator main divergence hota hai, usko aap bullish Divergence khety Hain.

WHAT IS BEARISH DIVERGENCE:

Dear members Forex trading market mein agar aap Bearish Divergence Concept ko completely understand krna chahta hain, tu simple words main aapko ya batana chahata hun, Kay jab resistance level per apko Indicator system or price main aik clear difference milta hai, tu eisi situation main aapko bearish Divergence mil raha hota hai. Iska mtlab hota hai market Kay down jany Kay chances ho sakhty Hain ab.

CONDITION 1

Dear member bearish Divergence main phli condition yah ho sakhti hai, Kay jab Price aik new high point ko touch krti hai, likn Indicator is sa disagree Kar Raha hota hai. Is sa aapko idea lga Lena cheye Kay market mein ab bearish trend expected ho sakhta hai, agar is Level per apko kei downside pattern ya kei reversal candlestick milti hai, tu aapka accuracy level maximum ho sakhta hai.

CONDITION 2

Bearish Divergence main 2nd situation main eisa hota hai, Kay jab resistance level per price low side pa ati hai, or Indicator system is ko disagree Kar Raha hota hai, or wo highest position show Kar Raha hota hai. Isko aap bearish Divergence Concept kaha jata hai.

WORKING IN BEARISH DIVERGENCE:

Dear Bearish Divergence ki bahut simple interpretation hoti hai, jab bhi aik strong resistance level per aapko Indicator system or price main disagreement milta hai, or isk sath kei downtrend pattern milta hai, tu aapko aik perfect bearish trend mil raha hota hai. Isliye aapko hamesha market mein careful hokar apni trading activities ko complete karne ke liye above mentioned details ko find out karna hota hai.

تبصرہ

Расширенный режим Обычный режим