Assalamu alaikum dear member kesy hn tamam members umeed krti hn sb khariyat sy hun gye or apna Kam achy sy kr rhy hn gye dear member aj main apke sath ek important topic share krna chahiti hn jo k position trading k bare me information share kry ga.

Important point

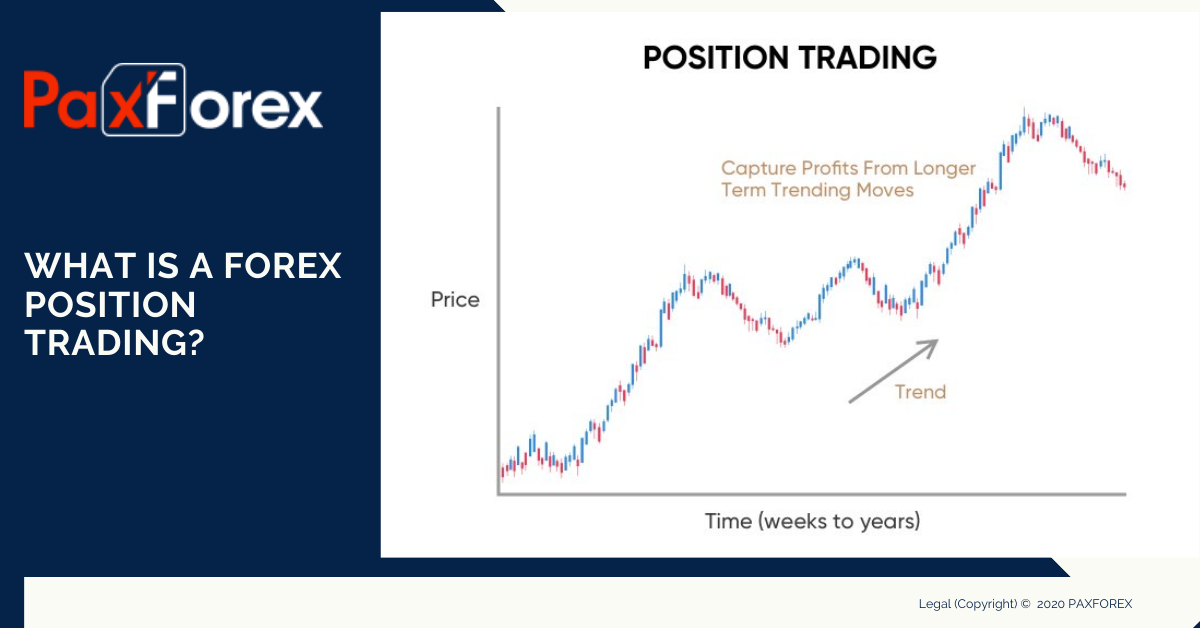

Dear members position trading ek long term trading strategy hai jo ek trader ko allow krta hai iski position ki hold krny k ek long time period me jo k ek month or ek year tak bhi ho skta hai or yeh short term trading ko ignore krta or uski movement ko bhi ignore krta or prefer krta hai Long term trading ko or fundamental analysis krny ko

Features of position trader

Dear members jaisa ki main aapke sath upar share kiya hai ki position trading mein short term trading co ignore kiya jata hai aur long term trading co prefer Kiya jata hai kyunki uski vajah se Hi aapko fayda milta hai ismein Ham technical analysis aur fundamental analysis ko jyada importance dete Hain taake hamen uski vajah se fayda Mil sake position trading ko samajhne ka bahut hi aasan tarika hota hai yah Ham Ek sal ja 1 month tak bhi iski trading co Jag Rakh sakte hain yah Ek long term trading Hoti hai ismein trading ka aasan Kafi sada hota hai aur aap ko iske liye jyada information aur knowledge Hona bhi jaruri hota hai uske liye aapko technical analysis aur fundamental analysis donon hi karna hote Hain uske bad agar aap trading karenge to aapko bahut jyada fayda milega aur is mein agar aap acchi entry Lena chahte Hain To uske liye aapko trading ke trend ko dekhna Hoga aur pattern ki knowledge Hona bahut jyada jaruri hoti hai aur iska stop-loss aur tak ka phir bhi aap jaise kar sakte hain apni market movement ke hisab se

Position trading strategy

Dear members yeh ek trading strategy hai jo k bht zaida relate krti hai traditional investment py position trading apko bht zaida faida deti hai long term trading k zariye or apko market k trend or uski movement ko smjhny o bd hi is me trading krni chahiye q k yh risky bhi ho skta ha or apki price range norrow ni honi chahiye or market me high volitilty or high price range hoti hai is k trend ko smjhna zaruri hota hai

Important point

Dear members position trading ek long term trading strategy hai jo ek trader ko allow krta hai iski position ki hold krny k ek long time period me jo k ek month or ek year tak bhi ho skta hai or yeh short term trading ko ignore krta or uski movement ko bhi ignore krta or prefer krta hai Long term trading ko or fundamental analysis krny ko

Features of position trader

Dear members jaisa ki main aapke sath upar share kiya hai ki position trading mein short term trading co ignore kiya jata hai aur long term trading co prefer Kiya jata hai kyunki uski vajah se Hi aapko fayda milta hai ismein Ham technical analysis aur fundamental analysis ko jyada importance dete Hain taake hamen uski vajah se fayda Mil sake position trading ko samajhne ka bahut hi aasan tarika hota hai yah Ham Ek sal ja 1 month tak bhi iski trading co Jag Rakh sakte hain yah Ek long term trading Hoti hai ismein trading ka aasan Kafi sada hota hai aur aap ko iske liye jyada information aur knowledge Hona bhi jaruri hota hai uske liye aapko technical analysis aur fundamental analysis donon hi karna hote Hain uske bad agar aap trading karenge to aapko bahut jyada fayda milega aur is mein agar aap acchi entry Lena chahte Hain To uske liye aapko trading ke trend ko dekhna Hoga aur pattern ki knowledge Hona bahut jyada jaruri hoti hai aur iska stop-loss aur tak ka phir bhi aap jaise kar sakte hain apni market movement ke hisab se

Position trading strategy

Dear members yeh ek trading strategy hai jo k bht zaida relate krti hai traditional investment py position trading apko bht zaida faida deti hai long term trading k zariye or apko market k trend or uski movement ko smjhny o bd hi is me trading krni chahiye q k yh risky bhi ho skta ha or apki price range norrow ni honi chahiye or market me high volitilty or high price range hoti hai is k trend ko smjhna zaruri hota hai

Position trading ek trading strategy hai jahan traders lambi avadhi tak positions hold karte hain, yaani ki weeks, months, ya saalo tak. Ismein traders apne nirnay ko lambi avadhi ki drishti se lete hain, aur unka mukhya dhyan arthik mulyankan aur bade paimane par vyavsayik ghatnayein par hota hai.

Position trading ek trading strategy hai jahan traders lambi avadhi tak positions hold karte hain, yaani ki weeks, months, ya saalo tak. Ismein traders apne nirnay ko lambi avadhi ki drishti se lete hain, aur unka mukhya dhyan arthik mulyankan aur bade paimane par vyavsayik ghatnayein par hota hai.  Trend Anusaran: Position traders aksar trend ke anusar vyavsay karte hain, yani ki uptrend mein lambi (kharid) positions lete hain aur downtrend mein lambi (bech) positions lete hain.

Trend Anusaran: Position traders aksar trend ke anusar vyavsay karte hain, yani ki uptrend mein lambi (kharid) positions lete hain aur downtrend mein lambi (bech) positions lete hain. Laabh aur Chunautiyan: Position trading day trading ya swing trading ke mukable kam samay aur nigrani ki aavashyakta hai. Yeh traders ke liye upayukt hai jo lambi avadhi ke nivesh drishti se hain. Fundamental analysis ke adhar par vichar karna suchnao se liye behad mahatvapurna hota hai. Chunautiyan: Lambi avadhi tak positions hold karna manasik roop se chunautipurn ho sakta hai. Traders ko apne moolankan anusandhan mein vishwas hona chahiye. Trade ke moolankan ke badlav ke aadhar par samay samay par apni positions ko punargathan aur sudharit karna hota hai. Toh, saaransh mein, forex market mein position trading ek lambi-term trading strategy hai jahan traders lambi avadhi ke market trends par adharit positions lete hain. Traders ko dhairya, niyam, aur surakshit risk prabandhan ki avashyakta hoti hai. Yeh strategy un logon ke liye upayukt hai jo lambi-term nivesh drishti se hain aur samayik market ki chanchalata ko sahne ki kshamata rakhte hain.

Laabh aur Chunautiyan: Position trading day trading ya swing trading ke mukable kam samay aur nigrani ki aavashyakta hai. Yeh traders ke liye upayukt hai jo lambi avadhi ke nivesh drishti se hain. Fundamental analysis ke adhar par vichar karna suchnao se liye behad mahatvapurna hota hai. Chunautiyan: Lambi avadhi tak positions hold karna manasik roop se chunautipurn ho sakta hai. Traders ko apne moolankan anusandhan mein vishwas hona chahiye. Trade ke moolankan ke badlav ke aadhar par samay samay par apni positions ko punargathan aur sudharit karna hota hai. Toh, saaransh mein, forex market mein position trading ek lambi-term trading strategy hai jahan traders lambi avadhi ke market trends par adharit positions lete hain. Traders ko dhairya, niyam, aur surakshit risk prabandhan ki avashyakta hoti hai. Yeh strategy un logon ke liye upayukt hai jo lambi-term nivesh drishti se hain aur samayik market ki chanchalata ko sahne ki kshamata rakhte hain.

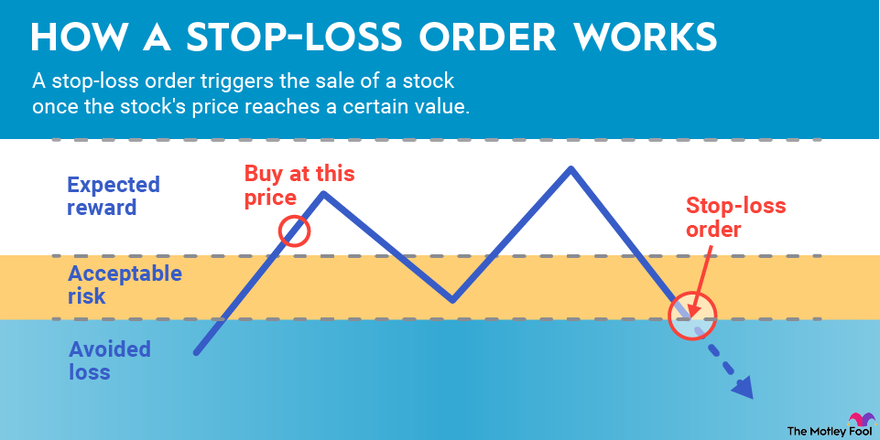

Position traders kam trading karte hain. Ve dhyan se vichar karke apni lambi soch ko saakar karte hain aur lambi samay ke liye un positions ko banaye rakhte hain. Stop-Loss Orders:

Position traders kam trading karte hain. Ve dhyan se vichar karke apni lambi soch ko saakar karte hain aur lambi samay ke liye un positions ko banaye rakhte hain. Stop-Loss Orders:  Lambi positions ko sambhalne aur choti-moti market harkaton ke khilaf surakshit rakhne ke liye, position traders adhikatar chaudi stop-loss orders ka istemal karte hain. Kam Samay Ki Zarurat: Position trading day trading ya swing trading ke mukable kam samay ka istemal karti hai. Traders ko market ko lagatar nazar mein rakhne ki avashyakata nahi hoti, ve bina lagatar badlav kiye bhi positions ko hold kar sakte hain. Rollover Rates: Kyunki positions ko raat bhar ya lambe samay tak rakha jata hai, isliye traders ko rollover rates ya swap rates ka bhi vichar karna hota hai, jo positions ko hold karne ya band karne ke liye lagte hain. Dhairya aur Anushasan: Safalta pane ke liye position trading mein dhairya aur anushasan ki avashyakata hoti hai. Traders ko choti-moti kimat ke badlavon ko sahna pad sakta hai, lekin ve apne lambi soch ko banae rakhte hain. Risk Prabandhan:

Lambi positions ko sambhalne aur choti-moti market harkaton ke khilaf surakshit rakhne ke liye, position traders adhikatar chaudi stop-loss orders ka istemal karte hain. Kam Samay Ki Zarurat: Position trading day trading ya swing trading ke mukable kam samay ka istemal karti hai. Traders ko market ko lagatar nazar mein rakhne ki avashyakata nahi hoti, ve bina lagatar badlav kiye bhi positions ko hold kar sakte hain. Rollover Rates: Kyunki positions ko raat bhar ya lambe samay tak rakha jata hai, isliye traders ko rollover rates ya swap rates ka bhi vichar karna hota hai, jo positions ko hold karne ya band karne ke liye lagte hain. Dhairya aur Anushasan: Safalta pane ke liye position trading mein dhairya aur anushasan ki avashyakata hoti hai. Traders ko choti-moti kimat ke badlavon ko sahna pad sakta hai, lekin ve apne lambi soch ko banae rakhte hain. Risk Prabandhan:

تبصرہ

Расширенный режим Обычный режим