Assalam alaikum dear forum members!

umeed ha ap sb khairiat se hn gy or apki trading bhht achi jaa rahi ho ge.

dear members aj hum forex main trading k lye useful indicators ko study karen gy or dekhen gy k inko kesy use kia jay.

Moving Average Indicator:

Dear members moving average aik technical indicator ha jo k forex market main hamen market k trend or support & resistance k bary main btata ha.

ye aik lagging market indicator ha jo k forex market k main chart main use hota ha or market ki movement k sth sth move karta rhta ha.

eski different values hoti hain or hum inko manually bhi set kar skty hain.

MA 10

MA 50

MA100

MA 200

dear members jitna bara time frame use karen gy hum hamen chahye k utni zada value ki moving average use karen.

moving average simple bhi hoti hain or exponential bhi laikin exponenctial moving averages better result dyti ha es lye main exponential use karta hn.

Or moving average ko agr candles ki closing price py apply kia jy to ye bhtr kaam karti hain.

Trading with moving averages:

Dear members jb hm market ko analyse karty hain agr hum es main moving averages ko use karen to hamen market k trend main help hoti ha.

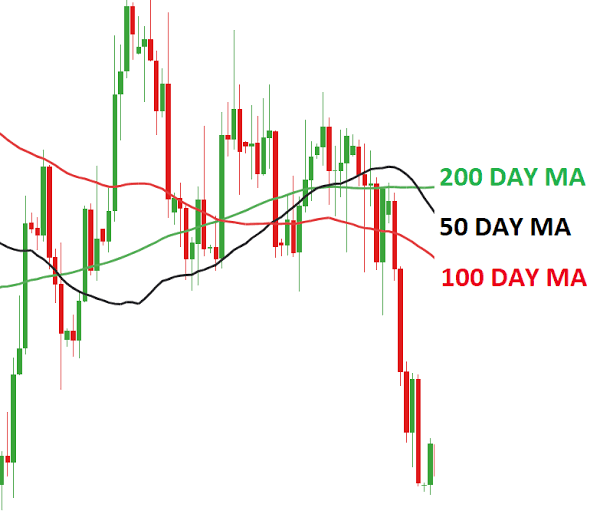

or agr hum 50 , 100 or 200 ki moving averages ko chart py apply kar len to ye bhtr kam karti hain mil k.

ye hamen trend or support & resitance ka btati hain.

agr to market in 3 moving averages k opr move kar rhi ho to ye uptrend main smjhi jati ha.

jb k agr market in k nechy aa jy to market downtrend main smjhi jati ha.

Or in 3 moving averages k cross bhi hoty hain agr ye moving averages aik dosry ko nechy se opr ki trf cross karen to ye hp trend ki nishani hoti ha.

jb k agr ye 3 koving averages opr se nechy ki trf cross karen to ye bearish trend ki nishani hota ha.

Relative Strength Index:

Dear members relative strength index aik oscillator trend indicator ha jo hamen market k trend k bary main btata ha. Ye indicator main chart main apply ni hota.

es k 3 levels hoty hain 80, 50 or 10.

Ye levels hm manually bhi change kar skty hain.

RSI hamen market ki overbought or oversold situation k bary main btata ha.

overbought & oversold RSI:

Dear members jb RSI ki value 80 ya us se opr ho to market ko overbought smjha jata ha or es wqt market main trend reversal expect kia jata ha.

or jb RSI 20 ya us se nechy ho to market oversold hoti ha or es k bad trend reversal expect kia jata ha or market bullish ho skti ha.

umeed ha ap sb khairiat se hn gy or apki trading bhht achi jaa rahi ho ge.

dear members aj hum forex main trading k lye useful indicators ko study karen gy or dekhen gy k inko kesy use kia jay.

Moving Average Indicator:

Dear members moving average aik technical indicator ha jo k forex market main hamen market k trend or support & resistance k bary main btata ha.

ye aik lagging market indicator ha jo k forex market k main chart main use hota ha or market ki movement k sth sth move karta rhta ha.

eski different values hoti hain or hum inko manually bhi set kar skty hain.

MA 10

MA 50

MA100

MA 200

dear members jitna bara time frame use karen gy hum hamen chahye k utni zada value ki moving average use karen.

moving average simple bhi hoti hain or exponential bhi laikin exponenctial moving averages better result dyti ha es lye main exponential use karta hn.

Or moving average ko agr candles ki closing price py apply kia jy to ye bhtr kaam karti hain.

Trading with moving averages:

Dear members jb hm market ko analyse karty hain agr hum es main moving averages ko use karen to hamen market k trend main help hoti ha.

or agr hum 50 , 100 or 200 ki moving averages ko chart py apply kar len to ye bhtr kam karti hain mil k.

ye hamen trend or support & resitance ka btati hain.

agr to market in 3 moving averages k opr move kar rhi ho to ye uptrend main smjhi jati ha.

jb k agr market in k nechy aa jy to market downtrend main smjhi jati ha.

Or in 3 moving averages k cross bhi hoty hain agr ye moving averages aik dosry ko nechy se opr ki trf cross karen to ye hp trend ki nishani hoti ha.

jb k agr ye 3 koving averages opr se nechy ki trf cross karen to ye bearish trend ki nishani hota ha.

Relative Strength Index:

Dear members relative strength index aik oscillator trend indicator ha jo hamen market k trend k bary main btata ha. Ye indicator main chart main apply ni hota.

es k 3 levels hoty hain 80, 50 or 10.

Ye levels hm manually bhi change kar skty hain.

RSI hamen market ki overbought or oversold situation k bary main btata ha.

overbought & oversold RSI:

Dear members jb RSI ki value 80 ya us se opr ho to market ko overbought smjha jata ha or es wqt market main trend reversal expect kia jata ha.

or jb RSI 20 ya us se nechy ho to market oversold hoti ha or es k bad trend reversal expect kia jata ha or market bullish ho skti ha.

تبصرہ

Расширенный режим Обычный режим