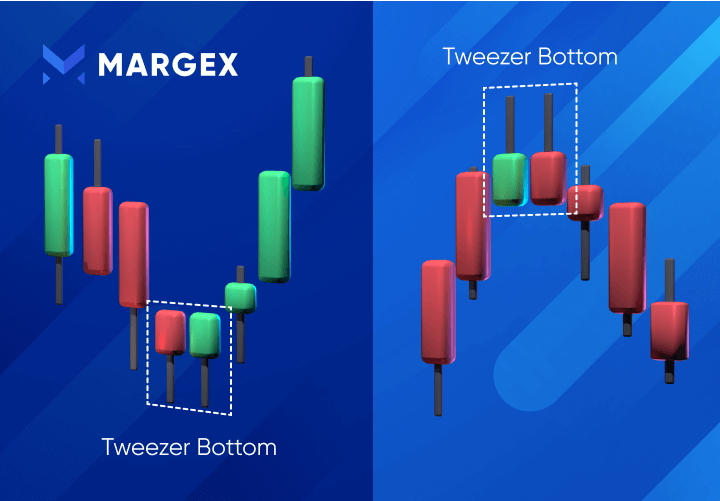

Tweezer bottom and tweezer top:

Ya support and resistances par bana i size ki 2 candles hoti ha

Tweezers wohi kam kati ha jo open pin bar ka karti ha

Sari candlestick patterns ik ghanata sa upr ka time frame ma behtreen result show karti ha

indicators

Upr ham na candlesticks ka bara ma batya ha kahi traders in patterns ko use karna ka sath kuch alag sa be alamat istamil karta ha jin ko ham indicators kahta ha

Ya indicators tadat ma bhot zada hota ha mgr ham log sirf kuch specific indicators zada use karta ha

Fibonacci

Fibonacci kia ha is ka majad kon tha is ki calculation kasa hoti ha ham is ma detail ma nai jaya gaya . support and resistances ka bara ma ham logo ko pata ha ka kabhi be price seedhi nahi jati chalti hai stairs ki shakal ma upr and neechay jati ha . stairs ka levels ko hum log Fibonacci kehta hai . In levels ko ) 23.6%) (38.2%)(50.0%) (61.8%) (76.4%) ka hisaab ma rakha gaya ha . agr price up trend ma ha to am deal dalna ka liya intazr kiya jaya ka price kisi muqam par wapus murha. Is murhna koretracement kahta ha. Usually price upr diya gaya level ma kisi ik level ka bad wapis aya jati ha aur yaha sa dobra upr jana ka safr shuru karti ha neechay di gayi shakl price upr jaya rahi thi ka wapis neechay murhi aur 38.2% sa dobra upar chalna shuru hui yeh maqam price ko buy karna ka liya bhot faida mand ha

Aur downtrend ma is ka ulta hoga jasa ka neechay di gayi shakl ma dekha jaya sakhta ha

Ya support and resistances par bana i size ki 2 candles hoti ha

Tweezers wohi kam kati ha jo open pin bar ka karti ha

Sari candlestick patterns ik ghanata sa upr ka time frame ma behtreen result show karti ha

indicators

Upr ham na candlesticks ka bara ma batya ha kahi traders in patterns ko use karna ka sath kuch alag sa be alamat istamil karta ha jin ko ham indicators kahta ha

Ya indicators tadat ma bhot zada hota ha mgr ham log sirf kuch specific indicators zada use karta ha

Fibonacci

Fibonacci kia ha is ka majad kon tha is ki calculation kasa hoti ha ham is ma detail ma nai jaya gaya . support and resistances ka bara ma ham logo ko pata ha ka kabhi be price seedhi nahi jati chalti hai stairs ki shakal ma upr and neechay jati ha . stairs ka levels ko hum log Fibonacci kehta hai . In levels ko ) 23.6%) (38.2%)(50.0%) (61.8%) (76.4%) ka hisaab ma rakha gaya ha . agr price up trend ma ha to am deal dalna ka liya intazr kiya jaya ka price kisi muqam par wapus murha. Is murhna koretracement kahta ha. Usually price upr diya gaya level ma kisi ik level ka bad wapis aya jati ha aur yaha sa dobra upr jana ka safr shuru karti ha neechay di gayi shakl price upr jaya rahi thi ka wapis neechay murhi aur 38.2% sa dobra upar chalna shuru hui yeh maqam price ko buy karna ka liya bhot faida mand ha

Aur downtrend ma is ka ulta hoga jasa ka neechay di gayi shakl ma dekha jaya sakhta ha

TWEEZER TOP OF BULLISH phir next dusre day traders Apne market ke sentiment ko ullat Dete Hain Jaise market open hoti hai aur jab Do Ya Do Se zyada candle stick tweezer top pattern ke liye ek hi niche ko touch karti hai Ek Bullish tops niche ka trend Hota Hai Jab bears price ko kam Karte rahte hain Jis Se day Ek kam hone ke kareeb Hota Hai tweezer Top ki identify two candles stick Se Ki Jaati Hai Ek tweezer Ke Niche two candle Nazar Aayenge Jiske Bajaye ISI Tarah Ke back To back Lows hongi

TWEEZER TOP OF BULLISH phir next dusre day traders Apne market ke sentiment ko ullat Dete Hain Jaise market open hoti hai aur jab Do Ya Do Se zyada candle stick tweezer top pattern ke liye ek hi niche ko touch karti hai Ek Bullish tops niche ka trend Hota Hai Jab bears price ko kam Karte rahte hain Jis Se day Ek kam hone ke kareeb Hota Hai tweezer Top ki identify two candles stick Se Ki Jaati Hai Ek tweezer Ke Niche two candle Nazar Aayenge Jiske Bajaye ISI Tarah Ke back To back Lows hongi  BEARISH INDICATOR OF BULLS Investment ki strategy amlitar Pare traders ko market ke trend se fayda uthane ki Ek level pesh Karti Hain tweezer different types ki forms taiyar kar Leti Hain trends traders ke liye trading signals provides karne ke liye market ke analysis Ko istemal Kiya jata hai next day 1 Barish candle banana chahie Jiski unchai Pichhle Day ki candles stick se milti hai candles stick ke bare mein janne ke liye stockk market ke Tamam 35 candle stock chart patterns per Hamara blog read Karen Jab bull price ko Upar ki taraf dhakelte hain to support and resistance ko niche ki taraf Rakhna chahie

BEARISH INDICATOR OF BULLS Investment ki strategy amlitar Pare traders ko market ke trend se fayda uthane ki Ek level pesh Karti Hain tweezer different types ki forms taiyar kar Leti Hain trends traders ke liye trading signals provides karne ke liye market ke analysis Ko istemal Kiya jata hai next day 1 Barish candle banana chahie Jiski unchai Pichhle Day ki candles stick se milti hai candles stick ke bare mein janne ke liye stockk market ke Tamam 35 candle stock chart patterns per Hamara blog read Karen Jab bull price ko Upar ki taraf dhakelte hain to support and resistance ko niche ki taraf Rakhna chahie

تبصرہ

Расширенный режим Обычный режим