Assalam Alaikum dear members Kunk aap forex trading market mein successful trading karna chahte hain, to ismein aapko hamesha trading sa related and associated all most information ka maximum idea hona cheye, us time aap jay kay kamyabi hasil kar sakhty hain. Margin or leverage ko jab aap study krty hain, tu en ka apis main bahut zyda relation hota hai. Margin or leverage ki kuch information main bhi aap sa share krna chahta hun.

WHAT IS MARGIN :

Jab aap metatrader 4 main kei trade open krty hain, tu definitely is kay liye aap kay pas available balance hona cheye. Jab aik trade open krny kay liye aik specific required amount ki fulfilment krty hain, tu isko aap forex trading mein Margin kaha jata hai. Margin ki basis per aap trade la sakhty hain. Basically market main entry hasil krny kay liye minimum required amount ka availability hona margin khelata hai.

WHAT IS LEVERAGE :

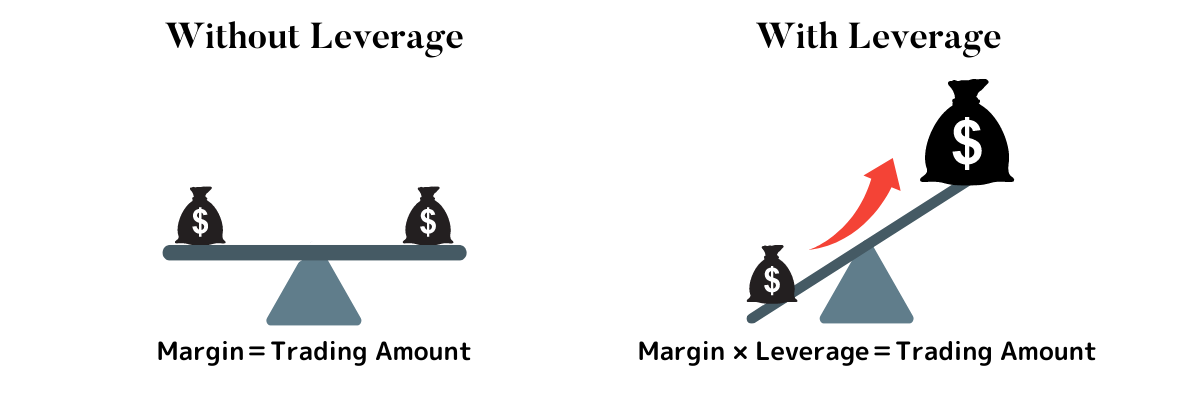

Leverage basically aik credit facility hoti hai, jo aapko broker provide kar raha hota hai. Is facility ki waja sa aapko minimum account balance per bhi bahut achi trading facility available ho sakhti hai. Jab aap ki leverage facility zyda ho ge tu aap minimum account balance per bhi trade kar sakhty hain. Kunk is ki waja sa aapka margin bahut kam utilised hota hai.

LINK OF MARGIN & LEVERAGE :

Dear members Forex trading market mein jab aap leverage aur margin ko samjna start krty hain, tu aapko ya idea milta hai kay margin aur leverage ka aapis main bahut zyda relation hota hai. Kunk jab leverage facility zyda ho ge tu us condition main aapka margin bahut minimum use ho ga. Is waja sa aap minimum remaining balance per bhi entry la sakhty hain. Liken aapko ya bhi yad rakhna ho ga kay maximum leverage sometime bahut zyda dangerous bhi ho sakhti hai.

NOTE :

Leverage facility and margin ki complete study aap kay liye most important ho sakhti hai. Kunk is education sa aapko ya idea milta hai kay aik pair per trade open krny kay liye minimum kitna required balance hona cheye or is per kitna balance utilise hota hai.

WHAT IS MARGIN :

Jab aap metatrader 4 main kei trade open krty hain, tu definitely is kay liye aap kay pas available balance hona cheye. Jab aik trade open krny kay liye aik specific required amount ki fulfilment krty hain, tu isko aap forex trading mein Margin kaha jata hai. Margin ki basis per aap trade la sakhty hain. Basically market main entry hasil krny kay liye minimum required amount ka availability hona margin khelata hai.

WHAT IS LEVERAGE :

Leverage basically aik credit facility hoti hai, jo aapko broker provide kar raha hota hai. Is facility ki waja sa aapko minimum account balance per bhi bahut achi trading facility available ho sakhti hai. Jab aap ki leverage facility zyda ho ge tu aap minimum account balance per bhi trade kar sakhty hain. Kunk is ki waja sa aapka margin bahut kam utilised hota hai.

LINK OF MARGIN & LEVERAGE :

Dear members Forex trading market mein jab aap leverage aur margin ko samjna start krty hain, tu aapko ya idea milta hai kay margin aur leverage ka aapis main bahut zyda relation hota hai. Kunk jab leverage facility zyda ho ge tu us condition main aapka margin bahut minimum use ho ga. Is waja sa aap minimum remaining balance per bhi entry la sakhty hain. Liken aapko ya bhi yad rakhna ho ga kay maximum leverage sometime bahut zyda dangerous bhi ho sakhti hai.

NOTE :

Leverage facility and margin ki complete study aap kay liye most important ho sakhti hai. Kunk is education sa aapko ya idea milta hai kay aik pair per trade open krny kay liye minimum kitna required balance hona cheye or is per kitna balance utilise hota hai.

تبصرہ

Расширенный режим Обычный режим