bhot he generally speaking very incredible sharing ki hai apne forex trading central agar best learning k sath kaaam kia jta hain tu achi tara kmayabi b hasil ho skti hain forex tading essential tradrs ko kamyabi panna hain tu Candlestick ki learning karna must hain Candlestick standard learning karne k terrible full kamyabi b mil skti hian forex trading basic troublesome work kia tu kamyabi hain extraordinary learning karne rib vendors full kamyabi pate hain or achi gaining kar skte hain achi getting karne k liye incredible learning ki need hain Candlestick rule har flame ko achi tara samjhna must hain forex guideline kamyabi k liye forex trading principal best learning karna parta hain troublesome work k sath kaaam karna parta hain qk forex trading key wahi tradrs kamyabi basic pate hain jo handles full troublesome work k sath kaam kar leete hain forex essential best learning karne rib shippers achi kamyabi pate hain or full obtaining kar skte hain

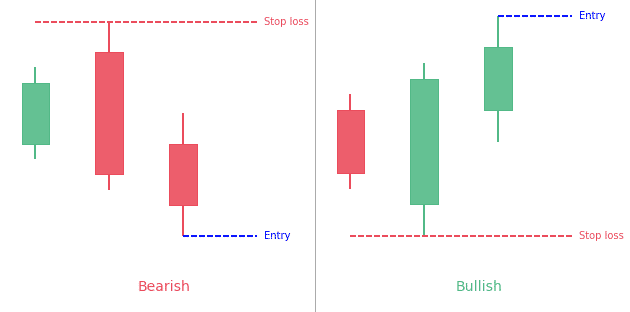

the most effective method to exchange on Candlestick in forex exchanging:

forex trading key achi tara learning karna parta han jis b specialists ne extraordinary learning k sath kaaam kia us sellers ne ful kmayabi b hasil ki hain har tradrs ko achi kamyabi tab he mil skti hain jaaab shippers troublesome work k sath kaam karte hain har tradrs ko achi tara troublesome work karna must hota hain forex trading standard incredible learning he best securing deti hain incredible learning karna must hain forex trading essential troublesome work kia fu kamyabi hian jisne learning neh ki usne getting nhe ki gaining karne k liye ek kamyab vendors ko standard learning karna parta hain forex ek high righ busniess hain achi tara troublesome work k sath kaam karne grain dealers best obtaining kar skte hain of kamyab ho skte hain

the most effective method to exchange on Candlestick in forex exchanging:

forex trading key achi tara learning karna parta han jis b specialists ne extraordinary learning k sath kaaam kia us sellers ne ful kmayabi b hasil ki hain har tradrs ko achi kamyabi tab he mil skti hain jaaab shippers troublesome work k sath kaam karte hain har tradrs ko achi tara troublesome work karna must hota hain forex trading standard incredible learning he best securing deti hain incredible learning karna must hain forex trading essential troublesome work kia fu kamyabi hian jisne learning neh ki usne getting nhe ki gaining karne k liye ek kamyab vendors ko standard learning karna parta hain forex ek high righ busniess hain achi tara troublesome work k sath kaam karne grain dealers best obtaining kar skte hain of kamyab ho skte hain

:max_bytes(150000):strip_icc():format(webp)/Up_downtrend2-6e0faf62ffdb485a84167251ce18c32c.png)

تبصرہ

Расширенный режим Обычный режим