Introduction:

forex trading main learning, knowledge aur experience ka hona bohat zarori hai. Dear members, forex trading me loss say bachny k liye, aur aik profitable trade krny k liye, technical analysis skills aur candlesticks ka knowledge ka hona bohat zarori hai. Aj main ap sy aik important candlestick pattern k bary main discuss krna chahta hu. Wo pattern “Bearish Harami Candlestick” hai. Agar hum loss sy bachna chahty hain aur risk sy avoid karna chahty hain to is pattern ki understanding bohat zarori hai. Isi candlestick ki knowledge gain kr k, hum blind trading sy avoid kar k profit earn kar sakty hain aur risk management kr k loss sy bach sakty hain. Aur perfect trading kar sakty hain

Bearish Harami Candlestick:

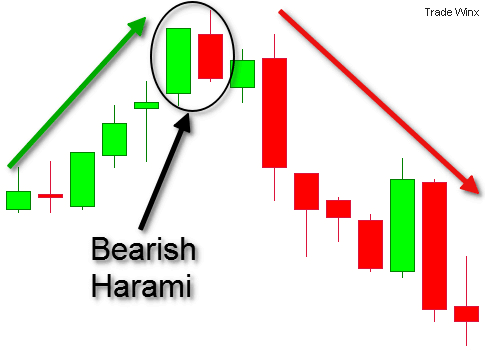

Bearish Harami, two bar ka Japanese candlestick pattern hai, jo batata hai, k prices jald he downside move kar sakti hain. Ye pattern aik lambi white/bullish candle p mushtamil hota hai, jis k bad aik choti c black candle hoti hai. Second candle ki opening aur closing prices, pehli candle k under majud honi chaiye. Bearish Harami ki tashkeel sy pehly aik uptrend hota hai.

Important point of Bearish Harami Candlestick pattern:

1. Bearish harami candlesticks ka aisa chart hai, jo bull price movement main reversal ko indicate karta hai.

2. Ye aam tor p price main thori kami ki taraf, yani black candle ki taraf ishara karta hai. Jo k pichly aik ya do din sy di gyi activity ki uper ki qeemat ki movement main shamil ho sakti hai.

3. Traders technical indicators, jasa k Relative strength index aur stochastic oscillator, jis main bearish harami hai, kamyab trade k chances ko barha sakty hain.

Bearish Harami explained:

Dear members, Bearish Harami main second candle ka size, pattern ki taqat ko zahir karta hai. Jitni ye candle choti ho g, us ki reversal ka chance utna ziada ho ga. Bearish harami ka opposite pattern bullish harami hai, jo k nechy ki taraf jata hai aur suggest karta hai k prices upside ki taraf reverse ho sakti hain.

Trading in “Bearish Harami Candlestick pattern”:

Bearish Harami main trade karty waqt agar hum in chezo ka khayal rakhain, to acha result gain kar sakty hain. Un ma sy kuch point nechy explained hain.

Price action:

Dear members, jab prices Harami pattern main dosri candle sy nechy break hoti hain, to aik short position li ja sakti hai. Ye Harami candlestick sy thora nechy stop-limit order dy kar kia ja sakta hai, ye un traders k lye ideal hai, jin k pass trade dekhny ka time nhi hai. Traders k risk ki bhuk ko dekhty hue, stop-loss order Harami candlestick k uper, ya white candlestick k uper rakha ja sakta hai. Profit ka target set krny k lye, support aur resistance k area ko use kia ja sakta hai.

Indicators:

Dear members, Bearish Harami candlestick pattern main technical indicators ko istemal kar sakty hain, jasa k RSI aur Stochastic oscillator bearish harami k sath successful trade k chances ko barha sakta hai. Jab ye pattern banta hai, aur indicator overbought ka signal deta hai, to aik short position li ja sakti hai. Jasa k downtrend main bearish harami ki trade karna behtar hai, is k lye indicators ko ziada sensitive banana beneficial sabit ho sakta hai. Ta k ye is trend main buying k doran ziada buying ko register kary. Profit us time liya ja sakty hain, jab indicators wapis oversold territory k area main enter ho jaye. Wo trader jo ziada profit chahty hain, wo aik he indicator ko bry time frame main use kar sakty hain.

forex trading main learning, knowledge aur experience ka hona bohat zarori hai. Dear members, forex trading me loss say bachny k liye, aur aik profitable trade krny k liye, technical analysis skills aur candlesticks ka knowledge ka hona bohat zarori hai. Aj main ap sy aik important candlestick pattern k bary main discuss krna chahta hu. Wo pattern “Bearish Harami Candlestick” hai. Agar hum loss sy bachna chahty hain aur risk sy avoid karna chahty hain to is pattern ki understanding bohat zarori hai. Isi candlestick ki knowledge gain kr k, hum blind trading sy avoid kar k profit earn kar sakty hain aur risk management kr k loss sy bach sakty hain. Aur perfect trading kar sakty hain

Bearish Harami Candlestick:

Bearish Harami, two bar ka Japanese candlestick pattern hai, jo batata hai, k prices jald he downside move kar sakti hain. Ye pattern aik lambi white/bullish candle p mushtamil hota hai, jis k bad aik choti c black candle hoti hai. Second candle ki opening aur closing prices, pehli candle k under majud honi chaiye. Bearish Harami ki tashkeel sy pehly aik uptrend hota hai.

Important point of Bearish Harami Candlestick pattern:

1. Bearish harami candlesticks ka aisa chart hai, jo bull price movement main reversal ko indicate karta hai.

2. Ye aam tor p price main thori kami ki taraf, yani black candle ki taraf ishara karta hai. Jo k pichly aik ya do din sy di gyi activity ki uper ki qeemat ki movement main shamil ho sakti hai.

3. Traders technical indicators, jasa k Relative strength index aur stochastic oscillator, jis main bearish harami hai, kamyab trade k chances ko barha sakty hain.

Bearish Harami explained:

Dear members, Bearish Harami main second candle ka size, pattern ki taqat ko zahir karta hai. Jitni ye candle choti ho g, us ki reversal ka chance utna ziada ho ga. Bearish harami ka opposite pattern bullish harami hai, jo k nechy ki taraf jata hai aur suggest karta hai k prices upside ki taraf reverse ho sakti hain.

Trading in “Bearish Harami Candlestick pattern”:

Bearish Harami main trade karty waqt agar hum in chezo ka khayal rakhain, to acha result gain kar sakty hain. Un ma sy kuch point nechy explained hain.

Price action:

Dear members, jab prices Harami pattern main dosri candle sy nechy break hoti hain, to aik short position li ja sakti hai. Ye Harami candlestick sy thora nechy stop-limit order dy kar kia ja sakta hai, ye un traders k lye ideal hai, jin k pass trade dekhny ka time nhi hai. Traders k risk ki bhuk ko dekhty hue, stop-loss order Harami candlestick k uper, ya white candlestick k uper rakha ja sakta hai. Profit ka target set krny k lye, support aur resistance k area ko use kia ja sakta hai.

Indicators:

Dear members, Bearish Harami candlestick pattern main technical indicators ko istemal kar sakty hain, jasa k RSI aur Stochastic oscillator bearish harami k sath successful trade k chances ko barha sakta hai. Jab ye pattern banta hai, aur indicator overbought ka signal deta hai, to aik short position li ja sakti hai. Jasa k downtrend main bearish harami ki trade karna behtar hai, is k lye indicators ko ziada sensitive banana beneficial sabit ho sakta hai. Ta k ye is trend main buying k doran ziada buying ko register kary. Profit us time liya ja sakty hain, jab indicators wapis oversold territory k area main enter ho jaye. Wo trader jo ziada profit chahty hain, wo aik he indicator ko bry time frame main use kar sakty hain.

تبصرہ

Расширенный режим Обычный режим