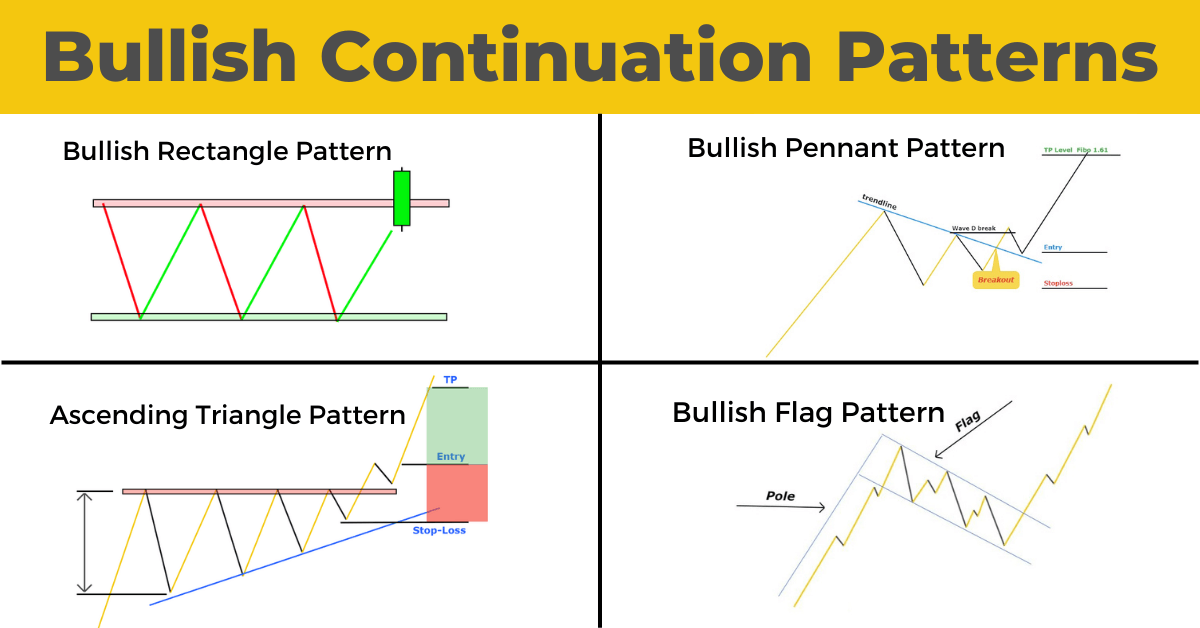

Re: forex main "Continuation chart pattern" kay features,

awesome learning he best obtaining de skti hain bullish model central be forex trading rule pratice karna parta hain plan ko find karna must hain jaaab tak plan ko find nhe kiya jata hain tu getting nhe ho skti hain getting kana hain tu egular infuriating work karna parta hain bullish model ko find karna hain tu evaluation karna must hain qk jaaab tak plan ko find nhe kiya nhe jata hain tu getting nhe hasil ho skti hain getting hasil karna hain tu learning ka amazing hona must hain bullish model key b merket ko appraisal karna must hain plan ko find karne k liye awkward work karna must hain jaaab tak plan ko find nhe kia jata hain tu acquiring b nhe hoti hain getting karna hain tu tricky work karna must hain hazardous work k sath kaam karna parta hain dangerous work kia tu kamyabi b mil jati hain kamyabi panna hain tu risky work karna hoga

bullish model and negative model in meket :

bullish model and negative model central work karna hain tu maddening work karna hoga jaaab tak dangerous work k sath kaaam nhe kiya jata hain tu gaining b nhe mil skti hain getting karna hain tu awkward work karna must hain securing karne k liye infuriating work ki need hain awkward work karne k terrible he benefit hain negative and bullish model rule work karna hain tu normal learning karna must hota hain plan he traders ko kamyai de skta hain achi kamyabi panna hain tu standard learning k sath getting karna must hain bullish model key kabi b sell ki trade nhe leni hogi agar learning k sath kaaam kiy ajata hain tu kamyabi b full fundamental mil skti hain clear kamyabi panna hain tu risky work karna parta hain agar hazardous work k sath work hota hain tu fundamental kamyabi b hasil ho jati hain kamyabi panna hain tu tricky work karna parta hain annoying work kia tu kamyabi b fundamental mil jati hain jsine learning nhe ki usne getting nhe ki is liye learning ko incress karna must hain tab he kamyabi hain

awesome learning he best obtaining de skti hain bullish model central be forex trading rule pratice karna parta hain plan ko find karna must hain jaaab tak plan ko find nhe kiya jata hain tu getting nhe ho skti hain getting kana hain tu egular infuriating work karna parta hain bullish model ko find karna hain tu evaluation karna must hain qk jaaab tak plan ko find nhe kiya nhe jata hain tu getting nhe hasil ho skti hain getting hasil karna hain tu learning ka amazing hona must hain bullish model key b merket ko appraisal karna must hain plan ko find karne k liye awkward work karna must hain jaaab tak plan ko find nhe kia jata hain tu acquiring b nhe hoti hain getting karna hain tu tricky work karna must hain hazardous work k sath kaam karna parta hain dangerous work kia tu kamyabi b mil jati hain kamyabi panna hain tu risky work karna hoga

bullish model and negative model in meket :

bullish model and negative model central work karna hain tu maddening work karna hoga jaaab tak dangerous work k sath kaaam nhe kiya jata hain tu gaining b nhe mil skti hain getting karna hain tu awkward work karna must hain securing karne k liye infuriating work ki need hain awkward work karne k terrible he benefit hain negative and bullish model rule work karna hain tu normal learning karna must hota hain plan he traders ko kamyai de skta hain achi kamyabi panna hain tu standard learning k sath getting karna must hain bullish model key kabi b sell ki trade nhe leni hogi agar learning k sath kaaam kiy ajata hain tu kamyabi b full fundamental mil skti hain clear kamyabi panna hain tu risky work karna parta hain agar hazardous work k sath work hota hain tu fundamental kamyabi b hasil ho jati hain kamyabi panna hain tu tricky work karna parta hain annoying work kia tu kamyabi b fundamental mil jati hain jsine learning nhe ki usne getting nhe ki is liye learning ko incress karna must hain tab he kamyabi hain

تبصرہ

Расширенный режим Обычный режим