Introduction:

Assalamualaikum Umeed karta hu sub khairiyat se ho gaye thek ho gaye Forex aik aisa business hn joh bhot he zada chal raha hain iss main 5 trillion Dollars ki trade daily basis per hoti hain Humain iss main daily basis per trading kar k iss main sy bhot he acha profit bana sagta hain or iss main aik achi earning kar sakta hai humein iss main mehnat karni chahiye hum agr iss main kamyab hona chahte hain toh humein iss main apni skills to Develop karna ho ga tabhi hum iss main agye bar sagta hain or Apna aik acha profit bana sakta hai jis sy hum iss main kamyab trader ban sakta hai humein iss main learning per focus karna chaiye humain iss main mehnat karni nahi chorni chahiye aik kamyab insan tabhi banta hain jab woh mehnat karta hain learning karta hain or apna experience gain karta hain tabhi woh iss business main agye bar sakta hai aur kamyabi ki taraf chal sakta hai humein iss main mehnaat sy kam lana chaiye apna experience gain karna chahiye apni skills ko improve karna chaiye tabhi hum iss main earn karna k kabhi ho sakta hain iss business main.

Tokyo Section:

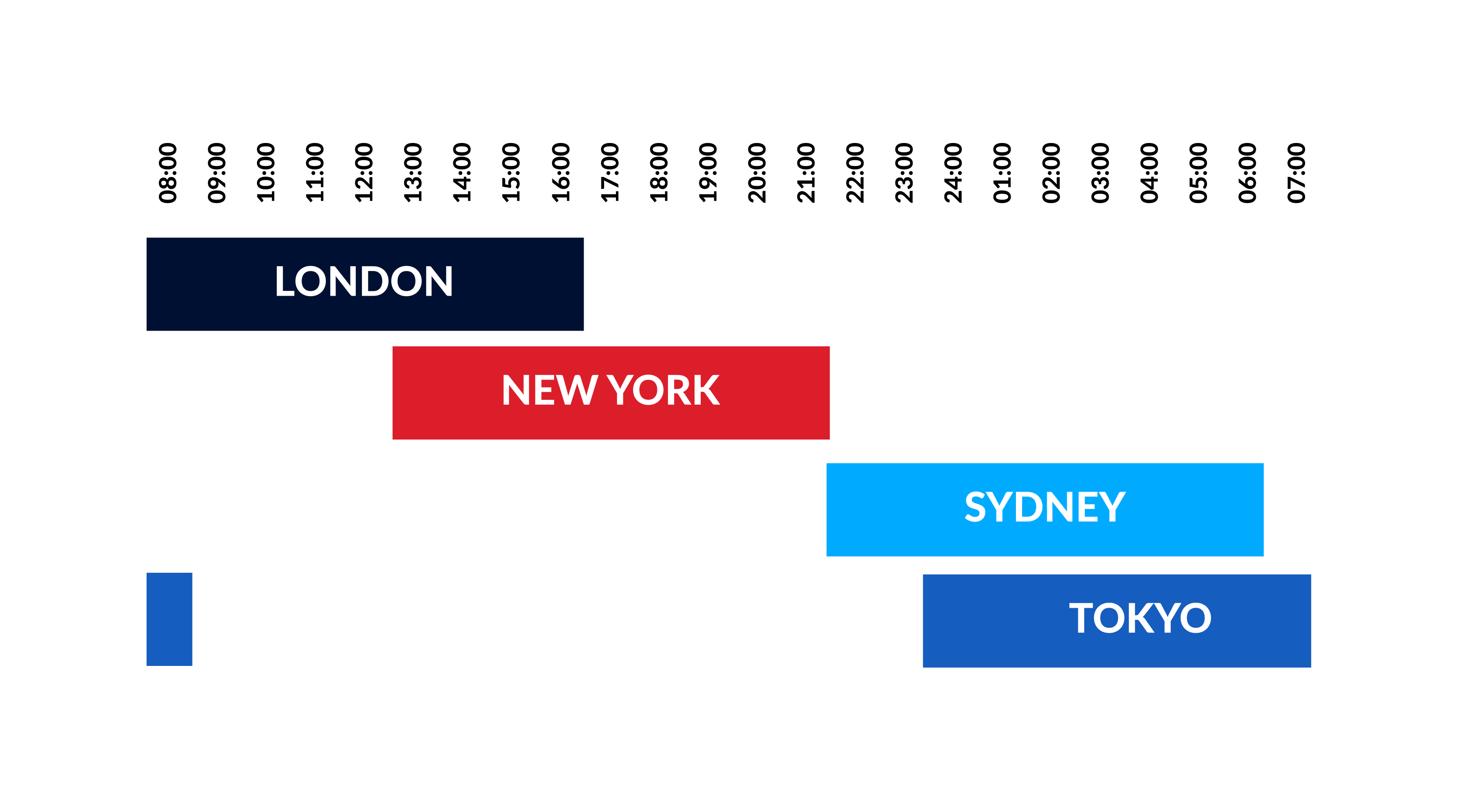

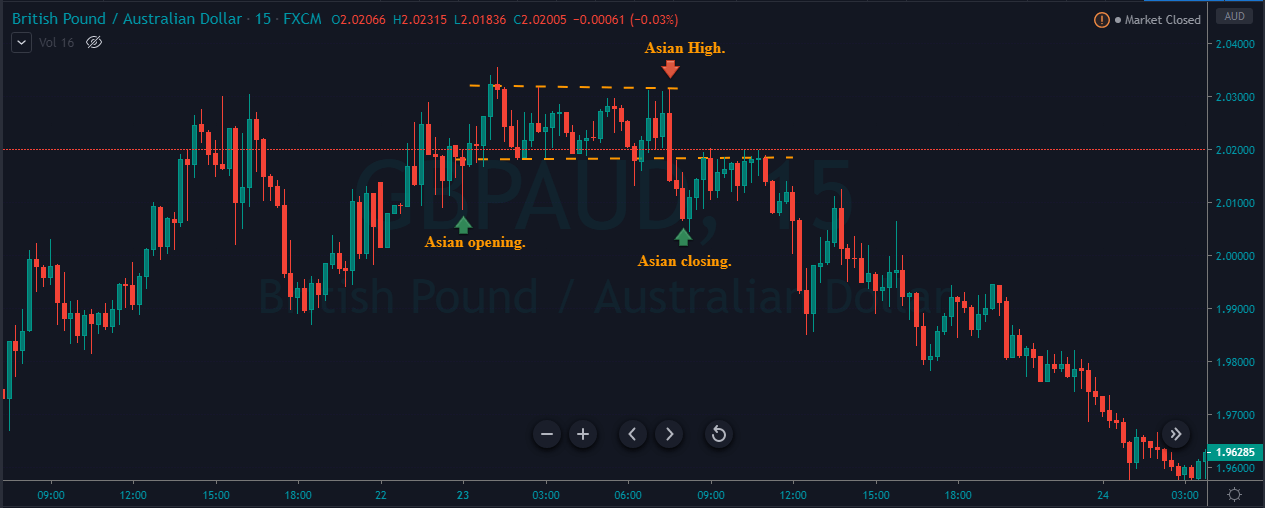

Sub sy phlye Tokyo Section Start hota han.Iss sy Asian Section bhi kaha jata han.Japan Duniya main 3rd mashi quwwat hai.Japani currency kah forex main 16.50fesaat hisa hn or yen ki 21 fesaat trade asian Section main hoti hai.

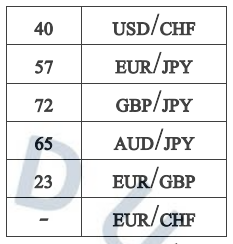

Necha dya gaye Asian Section mmain different Currency ki aost movement Pips main de gaye hain

Assalamualaikum Umeed karta hu sub khairiyat se ho gaye thek ho gaye Forex aik aisa business hn joh bhot he zada chal raha hain iss main 5 trillion Dollars ki trade daily basis per hoti hain Humain iss main daily basis per trading kar k iss main sy bhot he acha profit bana sagta hain or iss main aik achi earning kar sakta hai humein iss main mehnat karni chahiye hum agr iss main kamyab hona chahte hain toh humein iss main apni skills to Develop karna ho ga tabhi hum iss main agye bar sagta hain or Apna aik acha profit bana sakta hai jis sy hum iss main kamyab trader ban sakta hai humein iss main learning per focus karna chaiye humain iss main mehnat karni nahi chorni chahiye aik kamyab insan tabhi banta hain jab woh mehnat karta hain learning karta hain or apna experience gain karta hain tabhi woh iss business main agye bar sakta hai aur kamyabi ki taraf chal sakta hai humein iss main mehnaat sy kam lana chaiye apna experience gain karna chahiye apni skills ko improve karna chaiye tabhi hum iss main earn karna k kabhi ho sakta hain iss business main.

Tokyo Section:

Sub sy phlye Tokyo Section Start hota han.Iss sy Asian Section bhi kaha jata han.Japan Duniya main 3rd mashi quwwat hai.Japani currency kah forex main 16.50fesaat hisa hn or yen ki 21 fesaat trade asian Section main hoti hai.

Necha dya gaye Asian Section mmain different Currency ki aost movement Pips main de gaye hain

تبصرہ

Расширенный режим Обычный режим