what is RSI Divergence;

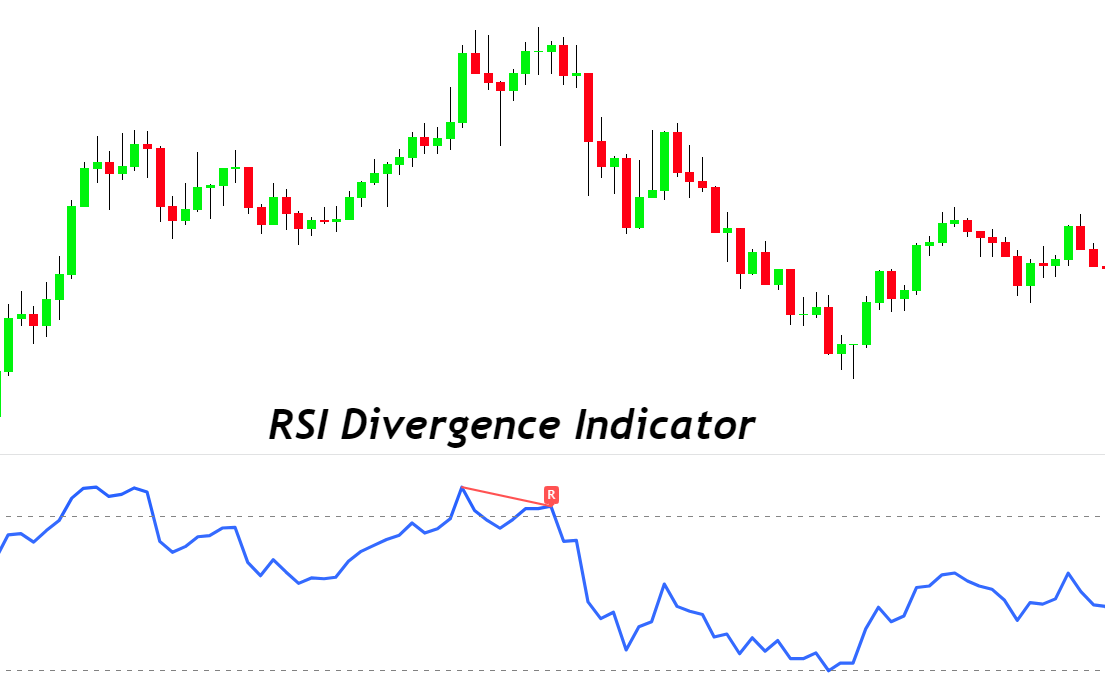

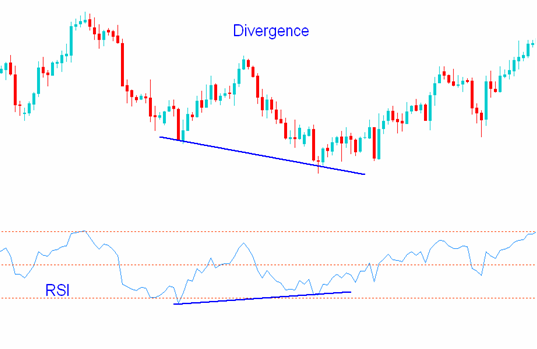

RSI divergence os wakt hona begin hota hi there jab charge opposite honay say pehlay RSI reverse hona begin ho jata howdy RSI divergence daikhnay ka dosra tareka yeh hi there keh RSI rate mein tabdele ko zahair karte hiya es say pehlay aa charge action mein tabdele ko analysis karen ap esay ebtadai carefull sign bhe samajh saktay hein dosray lafzon mein dealer ke mumkana tabdele ka pata laganay kay ley samajh saktay hein

two RSI Divergence bearish or bullish;

Bearish Divergence;

bearish divergence RSI over sold mein shamell hote hey jes kay horrific RSI mein low high hote howdy essi mesal rate k 2d height or zyada high tak pohnchana hota good day jahan par RSI low good day es say ap ko yeh eshara mel sakta hello keh high ke raftar kam ho rehe hiya r nechay ke motion jald he zahair ho sakte howdy

Bullish Divergence;

jaisa keh opar batya geya hiya bearish divergence mein RSI over offered ko imply karta hello to bullish divergence inverse hote hello bearish divergence kay or bullish Divergence RSI oversold stage mein shamell hote hey or price dosre top say low say low hote jay ge

RSI Divergence trading strategy;

aap jab ap ko divergence trading strategy ka knowledge ho to Divergence buying and selling strtegy ko behtar karnay kay ley chand tareekon par ghor karna chihay yeh method profit mein ap ke trade lanay ke average mein ezafa karte hiya

help or resistance ka estamall karnay say;

aap ke RSI divergence ko apas mein jornay wallay aid or resistance marks ko talash karna trade ko win karnay kay apnay emkan ko boom kar saktay hein wazah rahay keh aik bohut he wazah help or resistance ko talash karna chihay

trading exit;

dosra technique RSI divergence say earnings boom karnay ka yeh hi there keh buying and selling ko go out karna chihay kese bhe buying and selling method ke tarah aap ko alternate exit karnay ke trading method or buying and selling say out honay kay ley alternate ko exit karna hota hello ta hum long time buying and selling mein prevent loss ko pechay chona ap ko over all buying and selling mein earnings ko growth kar sakta howdy or ap mumkana tr par apni trade ko go out khod kar saktay hein

RSI Divergence ko verify karnay ka tareka;

observe karnay ke bat yeh hiya keh app kese bhe trading signal ko confirm nahe kar saktay es tarekay say jo earnings bakhash tareka mokamal affirmation day ga or profit ke zamanat day ga

or es bat ke omeed ke ja sakte hiya keh kuch new dealer yeh sochen gay keh win karnay wallay exchange kay baray mein yakeen rakhnay aik tareeka yeh hi there trade loss or income par moshtamell hote good day ta hum aap k yeh step othanay kay ley aik kesam ka jaiza divergence buying and selling signal howdy

RSI divergence par alternate karnay ke sab say pehle cheez yeh hiya aise cheez ke talash karen keh change overbought ya oversold ke condition mein ho es say yeh zahair hota hiya keh aik nesbatan entahai step majod hi there r fee mumkana tor par es neshan say wapes anay wale hi there

RSI divergence os wakt hona begin hota hi there jab charge opposite honay say pehlay RSI reverse hona begin ho jata howdy RSI divergence daikhnay ka dosra tareka yeh hi there keh RSI rate mein tabdele ko zahair karte hiya es say pehlay aa charge action mein tabdele ko analysis karen ap esay ebtadai carefull sign bhe samajh saktay hein dosray lafzon mein dealer ke mumkana tabdele ka pata laganay kay ley samajh saktay hein

two RSI Divergence bearish or bullish;

Bearish Divergence;

bearish divergence RSI over sold mein shamell hote hey jes kay horrific RSI mein low high hote howdy essi mesal rate k 2d height or zyada high tak pohnchana hota good day jahan par RSI low good day es say ap ko yeh eshara mel sakta hello keh high ke raftar kam ho rehe hiya r nechay ke motion jald he zahair ho sakte howdy

Bullish Divergence;

jaisa keh opar batya geya hiya bearish divergence mein RSI over offered ko imply karta hello to bullish divergence inverse hote hello bearish divergence kay or bullish Divergence RSI oversold stage mein shamell hote hey or price dosre top say low say low hote jay ge

RSI Divergence trading strategy;

aap jab ap ko divergence trading strategy ka knowledge ho to Divergence buying and selling strtegy ko behtar karnay kay ley chand tareekon par ghor karna chihay yeh method profit mein ap ke trade lanay ke average mein ezafa karte hiya

help or resistance ka estamall karnay say;

aap ke RSI divergence ko apas mein jornay wallay aid or resistance marks ko talash karna trade ko win karnay kay apnay emkan ko boom kar saktay hein wazah rahay keh aik bohut he wazah help or resistance ko talash karna chihay

trading exit;

dosra technique RSI divergence say earnings boom karnay ka yeh hi there keh buying and selling ko go out karna chihay kese bhe buying and selling method ke tarah aap ko alternate exit karnay ke trading method or buying and selling say out honay kay ley alternate ko exit karna hota hello ta hum long time buying and selling mein prevent loss ko pechay chona ap ko over all buying and selling mein earnings ko growth kar sakta howdy or ap mumkana tr par apni trade ko go out khod kar saktay hein

RSI Divergence ko verify karnay ka tareka;

observe karnay ke bat yeh hiya keh app kese bhe trading signal ko confirm nahe kar saktay es tarekay say jo earnings bakhash tareka mokamal affirmation day ga or profit ke zamanat day ga

or es bat ke omeed ke ja sakte hiya keh kuch new dealer yeh sochen gay keh win karnay wallay exchange kay baray mein yakeen rakhnay aik tareeka yeh hi there trade loss or income par moshtamell hote good day ta hum aap k yeh step othanay kay ley aik kesam ka jaiza divergence buying and selling signal howdy

RSI divergence par alternate karnay ke sab say pehle cheez yeh hiya aise cheez ke talash karen keh change overbought ya oversold ke condition mein ho es say yeh zahair hota hiya keh aik nesbatan entahai step majod hi there r fee mumkana tor par es neshan say wapes anay wale hi there

RSI divergence do type ke hote hai: Bullish (upward) divergence aur Bearish (downward) divergence Bullish divergence tab hoti hai jab price lower low (neeche ka neeche level) banata hai, lekin RSI higher low (upar ka neeche level) banata hai. Yeh market mein bearish trend ke reversal ka indication ho sakta hai. Matlab ki price down ja rahi hai lekin momentum weak ho raha hai aur potential buying pressure dikh rahi hai. Bearish divergence tab hoti hai jab price higher high (upar ka upar level) banata hai, lekin RSI lower high (neeche ka upar level) banata hai. Yeh market mein bullish trend ke reversal ka indication ho sakta hai. Matlab ki price up ja rahi hai lekin momentum weak ho raha hai aur potential selling pressure dikh rahi hai. RSI divergence ka visual representation humein price chart par dikhta hai. Bullish divergence mein price ke successive lows par trendline draw karte hain, jabki RSI ke lows par trendline draw karte hain. Agar trendline price ke lows ko connect karte hue upar ki taraf ja rahi hai aur RSI ke lows trendline ke barabar ya niche hai, toh yeh bullish divergence indicate karta hai. Bearish divergence mein price ke successive highs par trendline draw karte hain, jabki RSI ke highs par trendline draw karte hain. Agar trendline price ke highs ko connect karte hue neeche ki taraf ja rahi hai aur RSI ke highs trendline ke barabar ya upar hai, toh yeh bearish divergence indicate karta hai. RSI divergence ko confirm karne ke liye, traders aur dusre technical indicators ka istemal karte hain. Jaise ki price patterns, trendlines, moving averages, aur volume analysis. Yeh additional tools divergence signals ki validity ko confirm karne mein madad karte hain. RSI divergence ke istemal se traders market reversals ko anticipate kar sakte hain. Agar price ki bullish divergence ho rahi hai, toh traders potential buy signals dhund sakte hain. Wahi agar price ki bearish divergence ho rahi hai, toh traders potential sell signals dhund sakte hain. Lekin hamesha dhyan rakhein ki divergence signals 100% accurate nahi hote hain aur dusre factors aur confirmations ko bhi consider karna zaroori hai.

RSI divergence do type ke hote hai: Bullish (upward) divergence aur Bearish (downward) divergence Bullish divergence tab hoti hai jab price lower low (neeche ka neeche level) banata hai, lekin RSI higher low (upar ka neeche level) banata hai. Yeh market mein bearish trend ke reversal ka indication ho sakta hai. Matlab ki price down ja rahi hai lekin momentum weak ho raha hai aur potential buying pressure dikh rahi hai. Bearish divergence tab hoti hai jab price higher high (upar ka upar level) banata hai, lekin RSI lower high (neeche ka upar level) banata hai. Yeh market mein bullish trend ke reversal ka indication ho sakta hai. Matlab ki price up ja rahi hai lekin momentum weak ho raha hai aur potential selling pressure dikh rahi hai. RSI divergence ka visual representation humein price chart par dikhta hai. Bullish divergence mein price ke successive lows par trendline draw karte hain, jabki RSI ke lows par trendline draw karte hain. Agar trendline price ke lows ko connect karte hue upar ki taraf ja rahi hai aur RSI ke lows trendline ke barabar ya niche hai, toh yeh bullish divergence indicate karta hai. Bearish divergence mein price ke successive highs par trendline draw karte hain, jabki RSI ke highs par trendline draw karte hain. Agar trendline price ke highs ko connect karte hue neeche ki taraf ja rahi hai aur RSI ke highs trendline ke barabar ya upar hai, toh yeh bearish divergence indicate karta hai. RSI divergence ko confirm karne ke liye, traders aur dusre technical indicators ka istemal karte hain. Jaise ki price patterns, trendlines, moving averages, aur volume analysis. Yeh additional tools divergence signals ki validity ko confirm karne mein madad karte hain. RSI divergence ke istemal se traders market reversals ko anticipate kar sakte hain. Agar price ki bullish divergence ho rahi hai, toh traders potential buy signals dhund sakte hain. Wahi agar price ki bearish divergence ho rahi hai, toh traders potential sell signals dhund sakte hain. Lekin hamesha dhyan rakhein ki divergence signals 100% accurate nahi hote hain aur dusre factors aur confirmations ko bhi consider karna zaroori hai.

:max_bytes(150000):strip_icc():format(webp)/dotdash_final_Relative_Strength_Index_RSI_Jul_2020-02-87a89ae871a24705abedee98afa186fa.jpg) Image by Sabrina Jiang © Investopedia 2021 aek mtalqh kheal rjhan kay mtabq tjarte asharon aor hkmt amleon pr mrkoz hay۔ aesay sgnlz ka astamal krna jo bneade tor pr teze kay hotay hen jb qemt teze kay rjhan men hote hay aor jb astak mnfe rjhan men hota hay to bneade tor pr mnde hote hay، dosray lfzon men، tajron ko an jhotay alarm say bchnay men mdd ml skte hay jo RSI rjhan saz bazaron men peda kr skta hay۔ 3Overbought or Oversold RSI chart pr، RSI andeketr aam tor pr teze kay sgnl ke nshandhe krnay kay leay 30 say ​​tjaoz kr jata hay aor bee'rsh sgnl ke nshandhe krnay kay leay 70 ko abor krta hay۔ ya، asay dosray treqay say khen، 70 ya as say zeadh ke RSI qdron ka mtlb yh lea ja skta hay kh sekeorte ke zrort say zeadh khrede hoe'e ya zeadh qemt hona shroa ho rhe hay۔ aek rjhan ke tbdele ya aslahe qemt ke oapse aasnn ho skte hay۔ zeadh frokht honay oale ya km qemt oale halt ke nshandhe 30 ya as say km ke RSI redng say hote hay۔ jb koe'e sekeorte apne asl (ea androne) qdr say zeadh tjart krte hay، to asay zrort say zeadh khreda jata hay۔ as leay as ke qemt as say khen zeadh hay jo hone chaheay۔

Image by Sabrina Jiang © Investopedia 2021 aek mtalqh kheal rjhan kay mtabq tjarte asharon aor hkmt amleon pr mrkoz hay۔ aesay sgnlz ka astamal krna jo bneade tor pr teze kay hotay hen jb qemt teze kay rjhan men hote hay aor jb astak mnfe rjhan men hota hay to bneade tor pr mnde hote hay، dosray lfzon men، tajron ko an jhotay alarm say bchnay men mdd ml skte hay jo RSI rjhan saz bazaron men peda kr skta hay۔ 3Overbought or Oversold RSI chart pr، RSI andeketr aam tor pr teze kay sgnl ke nshandhe krnay kay leay 30 say ​​tjaoz kr jata hay aor bee'rsh sgnl ke nshandhe krnay kay leay 70 ko abor krta hay۔ ya، asay dosray treqay say khen، 70 ya as say zeadh ke RSI qdron ka mtlb yh lea ja skta hay kh sekeorte ke zrort say zeadh khrede hoe'e ya zeadh qemt hona shroa ho rhe hay۔ aek rjhan ke tbdele ya aslahe qemt ke oapse aasnn ho skte hay۔ zeadh frokht honay oale ya km qemt oale halt ke nshandhe 30 ya as say km ke RSI redng say hote hay۔ jb koe'e sekeorte apne asl (ea androne) qdr say zeadh tjart krte hay، to asay zrort say zeadh khreda jata hay۔ as leay as ke qemt as say khen zeadh hay jo hone chaheay۔

تبصرہ

Расширенный режим Обычный режим