Gann Line

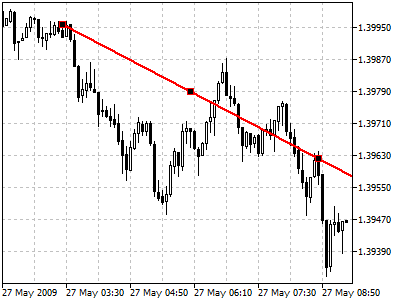

represents a line drawn on the perspective of 45 stages. This line is also called "one to 1" (1x1) what approach one change of the rate within one unit of time.According to Gann’s concept, the line having the slope of forty-five tiers represents a protracted-time period trendline (ascending or descending). While costs are above the ascending line, the marketplace holds bull directions. If prices keep underneath the descending line, the marketplace is characterized as a endure one. Intersection of the Gann Line typically signals of breaking the basic trend. When costs go all the way down to this line for the duration of an ascending fashion, time and rate end up fully balanced. The in addition intersection of Gann Line is the evidence of breaking of this stability and feasible converting the fashion.

Drawing

To draw the Gann line, one must pick this item and then choose an initial point within the chart. After that protecting the mouse button one have to draw a line in the vital course. Additional parameters could be shown close to the cursor: distance from the initial point alongside the time axis, distance from the preliminary factor along the charge axis. Besides, at some point of line construction additional vertical traces are proven for the accurate positioning of the initial and stop factor of the road.

Controls

On the road there are 3 points that can be moved by using a mouse. By shifting the first and the last factors you can still trade the slope of a line, as well as its period (if "Ray Right" and "Ray Left" parameters are disabled inside the item parameters). The central point (moving factor) is used for transferring the road within the chart without converting its length or slope.

Parameters

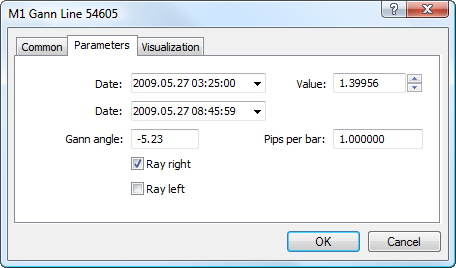

There are the subsequent parameters of the Gann Line:Date/Value — coordinates of the initial factor (date/cost of the fee scale);Date — coordinates of the closing factor along the time axis;Gann Angle — slope attitude of the Gann line relative to a horizontal line drawn thru the initial point at the size 1:1 (one fee exchange to one time unit);Pips Per Bar — scale for plotting the Gann Line in a chart. Ratio of pips wide variety to 1 bar;Ray Right — endless length of a trendline to the proper;Ray Left — countless length of a trendline to the left.

represents a line drawn on the perspective of 45 stages. This line is also called "one to 1" (1x1) what approach one change of the rate within one unit of time.According to Gann’s concept, the line having the slope of forty-five tiers represents a protracted-time period trendline (ascending or descending). While costs are above the ascending line, the marketplace holds bull directions. If prices keep underneath the descending line, the marketplace is characterized as a endure one. Intersection of the Gann Line typically signals of breaking the basic trend. When costs go all the way down to this line for the duration of an ascending fashion, time and rate end up fully balanced. The in addition intersection of Gann Line is the evidence of breaking of this stability and feasible converting the fashion.

Drawing

To draw the Gann line, one must pick this item and then choose an initial point within the chart. After that protecting the mouse button one have to draw a line in the vital course. Additional parameters could be shown close to the cursor: distance from the initial point alongside the time axis, distance from the preliminary factor along the charge axis. Besides, at some point of line construction additional vertical traces are proven for the accurate positioning of the initial and stop factor of the road.

Controls

On the road there are 3 points that can be moved by using a mouse. By shifting the first and the last factors you can still trade the slope of a line, as well as its period (if "Ray Right" and "Ray Left" parameters are disabled inside the item parameters). The central point (moving factor) is used for transferring the road within the chart without converting its length or slope.

Parameters

There are the subsequent parameters of the Gann Line:Date/Value — coordinates of the initial factor (date/cost of the fee scale);Date — coordinates of the closing factor along the time axis;Gann Angle — slope attitude of the Gann line relative to a horizontal line drawn thru the initial point at the size 1:1 (one fee exchange to one time unit);Pips Per Bar — scale for plotting the Gann Line in a chart. Ratio of pips wide variety to 1 bar;Ray Right — endless length of a trendline to the proper;Ray Left — countless length of a trendline to the left.

تبصرہ

Расширенный режим Обычный режим