Dear members, Forex trading aik asa business hai jis main trade krny say pehly ap ko buht si Baton ka khiyal rakhna hota hai. Is jab ap broker select krty hain, tu wo broker select krna chaiy jo maximum leverage facility day. Aj main apni post me, main ap say leverage kiya hai, aur is k advantage aur disadvantages, say related knowledge share krna chata hoon.

What is Leverage:

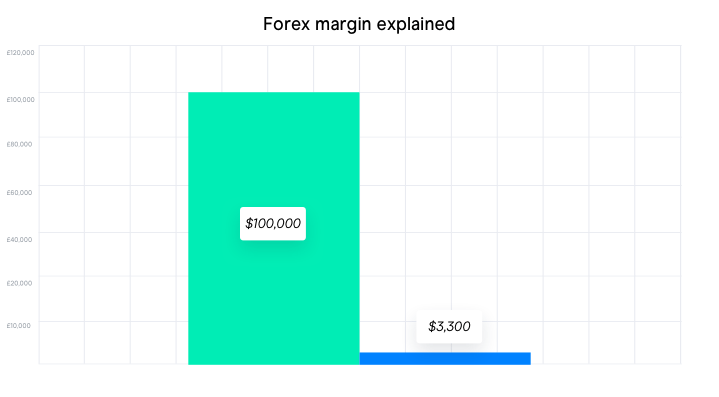

Dear members, Forex trading market main, Leverage aik credit facility hoti hai, jo ap k broker, ap ko daita hai. Is facility ko use kr k ap apny account balance sa zyda trading kar sakhty Hain.

Advantage of Leverage:

Dear members, Forex trading main leverage ka sab say bara benefit yah hota hai, keh ap apny deposit say zayda trading kr sakty hain. Ap jitni zayda leverage facility lyty hain, to ap kam balance k sath, maximum lot ka istemal kr sakty hain. Forex trading me, Leverage aik credit hota hai, jo ap ka broker aapko provided karta hai.

Disadvantages of leverage:

Dear members, Forex trading market main ager ap zayda leverage istemal krty hain, tu is mein faiday k sath sath kuch nuksan bi hain. Jab aap leverage ko use krty howy bari lot lagwaty hain, tu is main aapko loss bhi zayda ho sakhta hai, aur ager loss zayda ho jata hai to, broker ki taraf say ap ko margin call ho jati hai.

Benefits of leverage to broker:

Dear members, Jab broker ap ko leverage facility daita hai, tu broker ko bi is say benefits hoty hain. Jab broker ap ko zayda leverage daita hai to ap bari lot use kr sakty hain aur zayda trading krty hain to broker ko zayda commission milta hai. Is tarah zayda leverage say broker aur trader, dono ko advantages hota hai.

What is Leverage:

Dear members, Forex trading market main, Leverage aik credit facility hoti hai, jo ap k broker, ap ko daita hai. Is facility ko use kr k ap apny account balance sa zyda trading kar sakhty Hain.

Advantage of Leverage:

Dear members, Forex trading main leverage ka sab say bara benefit yah hota hai, keh ap apny deposit say zayda trading kr sakty hain. Ap jitni zayda leverage facility lyty hain, to ap kam balance k sath, maximum lot ka istemal kr sakty hain. Forex trading me, Leverage aik credit hota hai, jo ap ka broker aapko provided karta hai.

Disadvantages of leverage:

Dear members, Forex trading market main ager ap zayda leverage istemal krty hain, tu is mein faiday k sath sath kuch nuksan bi hain. Jab aap leverage ko use krty howy bari lot lagwaty hain, tu is main aapko loss bhi zayda ho sakhta hai, aur ager loss zayda ho jata hai to, broker ki taraf say ap ko margin call ho jati hai.

Benefits of leverage to broker:

Dear members, Jab broker ap ko leverage facility daita hai, tu broker ko bi is say benefits hoty hain. Jab broker ap ko zayda leverage daita hai to ap bari lot use kr sakty hain aur zayda trading krty hain to broker ko zayda commission milta hai. Is tarah zayda leverage say broker aur trader, dono ko advantages hota hai.

تبصرہ

Расширенный режим Обычный режим