Aslam u Alaikum Dear member i hope ap sab thk hon gay, or acha kam kar rahy hon gay.Dear Agar Ham market me successful trading karna chahte hain to ismein humko fundamental analysis ki bahut jyada jarurat hoti Hai. Forex trading market Mein technical analysis ko complete karne ke sath sath fundamental analysis per bahut jyada tawajjha dene ki jarurat hoti Hai. Agar aap fundamental analysis ko ignore karte Hain to aap successful trader nahin Ban sakte hain aur aapko bahut jyada nuksan ho sakta hai. Fundamental analysis ki vajah se market mein bahut jyada movement hoti hai aur ismein aapko bahut jyada nuksan ho sakta hai.Forex trading man trader currency pairs aur commodities ki price movements ko smajhna k liye price chart ko read kerta ha, q k price chart patterns man changes, momentum aur price k trend man change ko accuracy k sath identify kerta hai.

EXPLANATION:

Dear member Forex trading main pips ya point market kay point kay up down ko kahty hain jaisa kah ap kah rhay hian agr crude oil ki price 67.99 pr hay aor kuch time bad main oil ki price 68.10 tk chli jati ha to is ko hm khty hian kah gold 11 points ya pips up howa hay aor trader jb lot size ka intkhab krta hay to trader ko us kay mutabiq trading market main pips , points kay hisab say profit earn hota hay is liay trader ko forex trading main in baton ka khyal krna hay trader ko market main pips points ka pta ho trader forex trading market ki price movement ko smjhna hay trader market main lots size ko balance kay mutabiq use karay high lots ka use na karay pips aor point ka mtlb to aik hi hay is bat ki smjh to mara khayal say ap ko a gai ho gi koi mushkil bat to na hay kah pips kia hay aor points kia hain.

WHAT IS PIP (POINT IN PERCENTAGE)

Dear member Point in percentage ya jisko short main pip kehty hain kise bhe currency ke value main sab say small change hoti hai usko pips main count kartey hain. Maslan ab agar aik pair GBPUSD ke pirce 1.2900 hai aur phir price 1.2901 ho jaati hai to us currency main 0.0001 ke Change aai hai aur esko 1 pip change kehty hain. Ab agar wohi pair GBPUSD 1.2900 sy 1.2950 par aa jata hai to total us currency main. 0.0050 ke change hui ya usko ham ye kahin gy kay 50 pips change aai hai.

Ab zaida tarr pair kay lasy main 4 digits he aaty hain magar kuch pairs jesa kay GBPJPY ya phir USDJPY enn pairs main last main decimal place kay baad 2 pips aaty hain to us main yn 2 pips ma jo tabdeeli aai hai us ko pips main count karte hain.

CALCULATIONS:

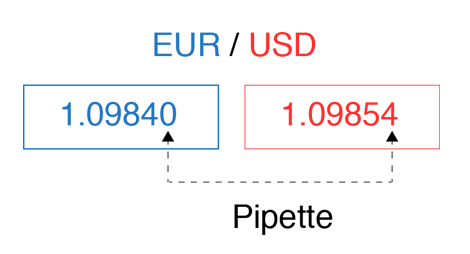

Dear member Kise broker par aapko currency ke value decimal place main 4 digits main milte hai aur kise broker main aapko currency ke value decimal place kay baad 5 digits main milte hai. To us paanchwin digit ko ham pipette kehty hain. Maslan agar GBPUSD ke value 1.29000 hai aur phir 1.29001 ho jaati hai to esko ham 0.00001 ke jo tabdeedi hoti hai wo 1 pipette kehlaati ha.

CHART IN ANALYSIS:

Dear member market main ap ko diffrent factor par study kr k achi tara judgement karna hai. ta k ap successfull trading krain, jab ap analysis karty hain to ap ko bhot zyada advantage available hoty hain.ap ko humesh khoshish krna ho gi k candlestick pattern ko achi tara study krain. ager achhay real chart mein faling window ko identify karnay mein moshkel hote hey laken medan mein kadam rakhnay say pehlay apni salaheton ko action mein lanay say ki moshkell nahe hote hey opar de gai example mein ap asan red arrows ka sahara lein apnay tor par falling window ko talash karen,Dear members, Nechy diy gay chart me ap clearly round bottom chart pattern ko daikh sakty hain. Agr ap is pattern ki clear understanding lay laity hain to ap ko trade krny main buht asani hogi.Forex trading ki agr bat ki jaye to es ma linear regression kay tor par time or place ko use kiya jata hai. Kisi bi time period ma daye gaye data ko observe karny sy ham future performance ko find kar sakty hain. Linear bhot zayada effective tb hoti hai jb trader es ko trend ma use karty hain.

EXPLANATION:

Dear member Forex trading main pips ya point market kay point kay up down ko kahty hain jaisa kah ap kah rhay hian agr crude oil ki price 67.99 pr hay aor kuch time bad main oil ki price 68.10 tk chli jati ha to is ko hm khty hian kah gold 11 points ya pips up howa hay aor trader jb lot size ka intkhab krta hay to trader ko us kay mutabiq trading market main pips , points kay hisab say profit earn hota hay is liay trader ko forex trading main in baton ka khyal krna hay trader ko market main pips points ka pta ho trader forex trading market ki price movement ko smjhna hay trader market main lots size ko balance kay mutabiq use karay high lots ka use na karay pips aor point ka mtlb to aik hi hay is bat ki smjh to mara khayal say ap ko a gai ho gi koi mushkil bat to na hay kah pips kia hay aor points kia hain.

WHAT IS PIP (POINT IN PERCENTAGE)

Dear member Point in percentage ya jisko short main pip kehty hain kise bhe currency ke value main sab say small change hoti hai usko pips main count kartey hain. Maslan ab agar aik pair GBPUSD ke pirce 1.2900 hai aur phir price 1.2901 ho jaati hai to us currency main 0.0001 ke Change aai hai aur esko 1 pip change kehty hain. Ab agar wohi pair GBPUSD 1.2900 sy 1.2950 par aa jata hai to total us currency main. 0.0050 ke change hui ya usko ham ye kahin gy kay 50 pips change aai hai.

Ab zaida tarr pair kay lasy main 4 digits he aaty hain magar kuch pairs jesa kay GBPJPY ya phir USDJPY enn pairs main last main decimal place kay baad 2 pips aaty hain to us main yn 2 pips ma jo tabdeeli aai hai us ko pips main count karte hain.

CALCULATIONS:

Dear member Kise broker par aapko currency ke value decimal place main 4 digits main milte hai aur kise broker main aapko currency ke value decimal place kay baad 5 digits main milte hai. To us paanchwin digit ko ham pipette kehty hain. Maslan agar GBPUSD ke value 1.29000 hai aur phir 1.29001 ho jaati hai to esko ham 0.00001 ke jo tabdeedi hoti hai wo 1 pipette kehlaati ha.

CHART IN ANALYSIS:

Dear member market main ap ko diffrent factor par study kr k achi tara judgement karna hai. ta k ap successfull trading krain, jab ap analysis karty hain to ap ko bhot zyada advantage available hoty hain.ap ko humesh khoshish krna ho gi k candlestick pattern ko achi tara study krain. ager achhay real chart mein faling window ko identify karnay mein moshkel hote hey laken medan mein kadam rakhnay say pehlay apni salaheton ko action mein lanay say ki moshkell nahe hote hey opar de gai example mein ap asan red arrows ka sahara lein apnay tor par falling window ko talash karen,Dear members, Nechy diy gay chart me ap clearly round bottom chart pattern ko daikh sakty hain. Agr ap is pattern ki clear understanding lay laity hain to ap ko trade krny main buht asani hogi.Forex trading ki agr bat ki jaye to es ma linear regression kay tor par time or place ko use kiya jata hai. Kisi bi time period ma daye gaye data ko observe karny sy ham future performance ko find kar sakty hain. Linear bhot zayada effective tb hoti hai jb trader es ko trend ma use karty hain.

تبصرہ

Расширенный режим Обычный режим