Technical Indicators

Dear Friends, Forex me technichal indicators wo indicators hain jo trader use karty hain market analysis k laey or ye indicator signal provide karty hain using average previous price action data. technichal indicators jesa k name sy he zahir hai market ko lagg karty hain. Es ma trader signal ki verification sy pehle es ekdam ka mosahida karty hain. Es ka matlab hai k trader start ma kuch pips sy mehroom ho jaty hain. En pips ko khona bhot sy trader zaruri samajty hain or kuch trader ye samajty hain k unho ny enter hony ka moka he ganwa deya hai.

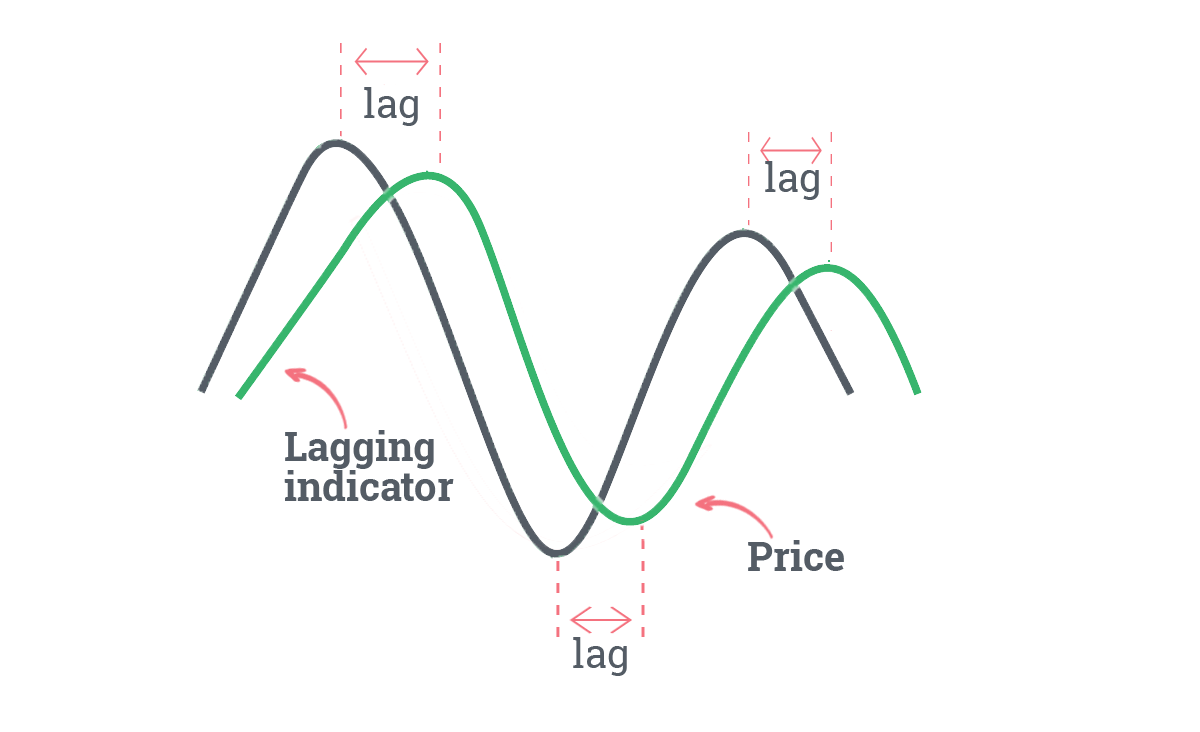

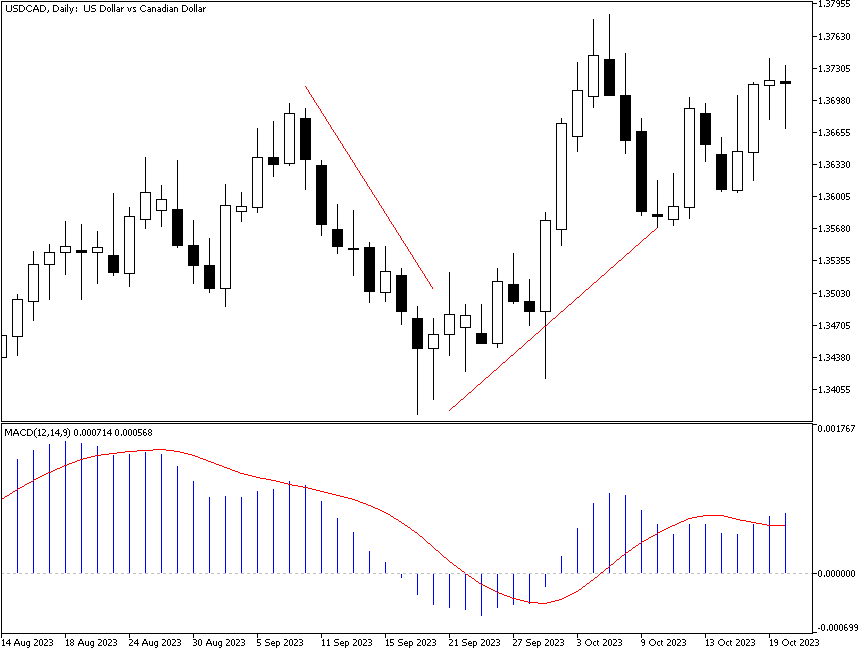

Lagging Indicators

Common lagging indicators ye hain Moving Average Convergence Divergence (MACD), Simple Moving Average (SMA), Stochastic Oscillator and Relitive Strength Index (RSI) wagera asy technical indicator hoty hain jo use karty hain previous price data or es sy forecast karty hain market ki future price movement. Ye indicators allow karty hai k trader move k start ma he market ma in ho jayn. Es ka disadvantage ye hai k trader ko us time par anticipate karna hota hai jb ye move start he ni howa hota. Es k result ma aksar wo buri jaga py ya trend reversal k time par market ma in ho jaty hain.

Leading Indicators

In me Fibonacci retacement, Donchian Channels, Support and Resistance Level and Client sentiments. indicators help kar dety hain trend ki important se Koi inkar nahin kar sakta , kyun ki trend ke sath kam karne se aap ko mostly fayda hota hai aur agar aap opposite to the trend jaen ge to nuksan ki chances barh jaate Hain. Forex trading ki learning mein sab se mushkil kam yahi hota hai ki trend ko judge kaise karna hai, jis trader's ko judgement ka idea ho jata hai us ke liye trading karna bahut aasan ho jata hai. Trend hamesha calculation ki buniyad per develop hota hai aur is mein dono technical of fundamental effects ko madhya nazar rakha jata hai. Trading trend do qisam ke hote Hain ek hota hai short term trading aur dusra hota hai long term trend in donon ko follow Kiya jata hai jo bhi trend ko follow nahi kerta wo aisay businessmen jo trends ko follow ker rahey hotay hain unn say bohat peechay rehjata hai. Issi tarah yeh formula forex trading business mai bhi kaam kerta hai kiyu kay forex bhi aik business he hai bus faraq currencies aur commodities ka aur aam goods ka hai. Investment dono businesses mai hoti hai aur profit loss bhi dono businesses mai he hota hai.

Dear Friends, Forex me technichal indicators wo indicators hain jo trader use karty hain market analysis k laey or ye indicator signal provide karty hain using average previous price action data. technichal indicators jesa k name sy he zahir hai market ko lagg karty hain. Es ma trader signal ki verification sy pehle es ekdam ka mosahida karty hain. Es ka matlab hai k trader start ma kuch pips sy mehroom ho jaty hain. En pips ko khona bhot sy trader zaruri samajty hain or kuch trader ye samajty hain k unho ny enter hony ka moka he ganwa deya hai.

Lagging Indicators

Common lagging indicators ye hain Moving Average Convergence Divergence (MACD), Simple Moving Average (SMA), Stochastic Oscillator and Relitive Strength Index (RSI) wagera asy technical indicator hoty hain jo use karty hain previous price data or es sy forecast karty hain market ki future price movement. Ye indicators allow karty hai k trader move k start ma he market ma in ho jayn. Es ka disadvantage ye hai k trader ko us time par anticipate karna hota hai jb ye move start he ni howa hota. Es k result ma aksar wo buri jaga py ya trend reversal k time par market ma in ho jaty hain.

Leading Indicators

In me Fibonacci retacement, Donchian Channels, Support and Resistance Level and Client sentiments. indicators help kar dety hain trend ki important se Koi inkar nahin kar sakta , kyun ki trend ke sath kam karne se aap ko mostly fayda hota hai aur agar aap opposite to the trend jaen ge to nuksan ki chances barh jaate Hain. Forex trading ki learning mein sab se mushkil kam yahi hota hai ki trend ko judge kaise karna hai, jis trader's ko judgement ka idea ho jata hai us ke liye trading karna bahut aasan ho jata hai. Trend hamesha calculation ki buniyad per develop hota hai aur is mein dono technical of fundamental effects ko madhya nazar rakha jata hai. Trading trend do qisam ke hote Hain ek hota hai short term trading aur dusra hota hai long term trend in donon ko follow Kiya jata hai jo bhi trend ko follow nahi kerta wo aisay businessmen jo trends ko follow ker rahey hotay hain unn say bohat peechay rehjata hai. Issi tarah yeh formula forex trading business mai bhi kaam kerta hai kiyu kay forex bhi aik business he hai bus faraq currencies aur commodities ka aur aam goods ka hai. Investment dono businesses mai hoti hai aur profit loss bhi dono businesses mai he hota hai.

تبصرہ

Расширенный режим Обычный режим