Intra day trading strategy

Dear Friends, Forex me different time frames ki help sy market ko predict kiya jata hai. Kuch trader 1 hour wala time frame use karty hain or kuch trader 4 hour wala time frame use karty hain. Ese he tarha kuch trader 1 day time frame ko use karty hain. Expert trader hamesa ye bat kehty hain k time frame jetna big ho ga trader ko market ma etna he reliable signal mel jae ga. Trader jetna small time frame ko use karyn gy wo etna he casual signal hasil kar payn gy jis ko use kar k profit hasil karna bhot mushkil ho jata hai.

Intraday Trading With Small Lots

Forex trading ma trader wo he kamyab hota hai jo small lot k sath trade karta hai. Intraday time frame ma trader ko bhot acha signal mel sakta hai but esk sath trader ko hamesa small lot he use karni chahe. Jo trader intraday time frame k sath big lot size ko use karty hain unko profit hasil karny ma bhot problems hoti hai. Forex trading ma big lot sy trader karna easy hai or es ma profit acha hasil ho jata hai but trader ko agr loss ho jae to etna big hota hai k trader ka account he wash ho jata hai or trader chah kar b es big loss ko recover ni kar paty. Forex trading ma big loss ko recover karna trader k lae possible ni hota or esk lae ye asan ho jata hai k wo account he wash karwa dey or phr sy acha capital jama karna start kar dey but acha capital jama karna b bhot mushkil ho jata hai.

Importance and advantages of intraday trading strategy.

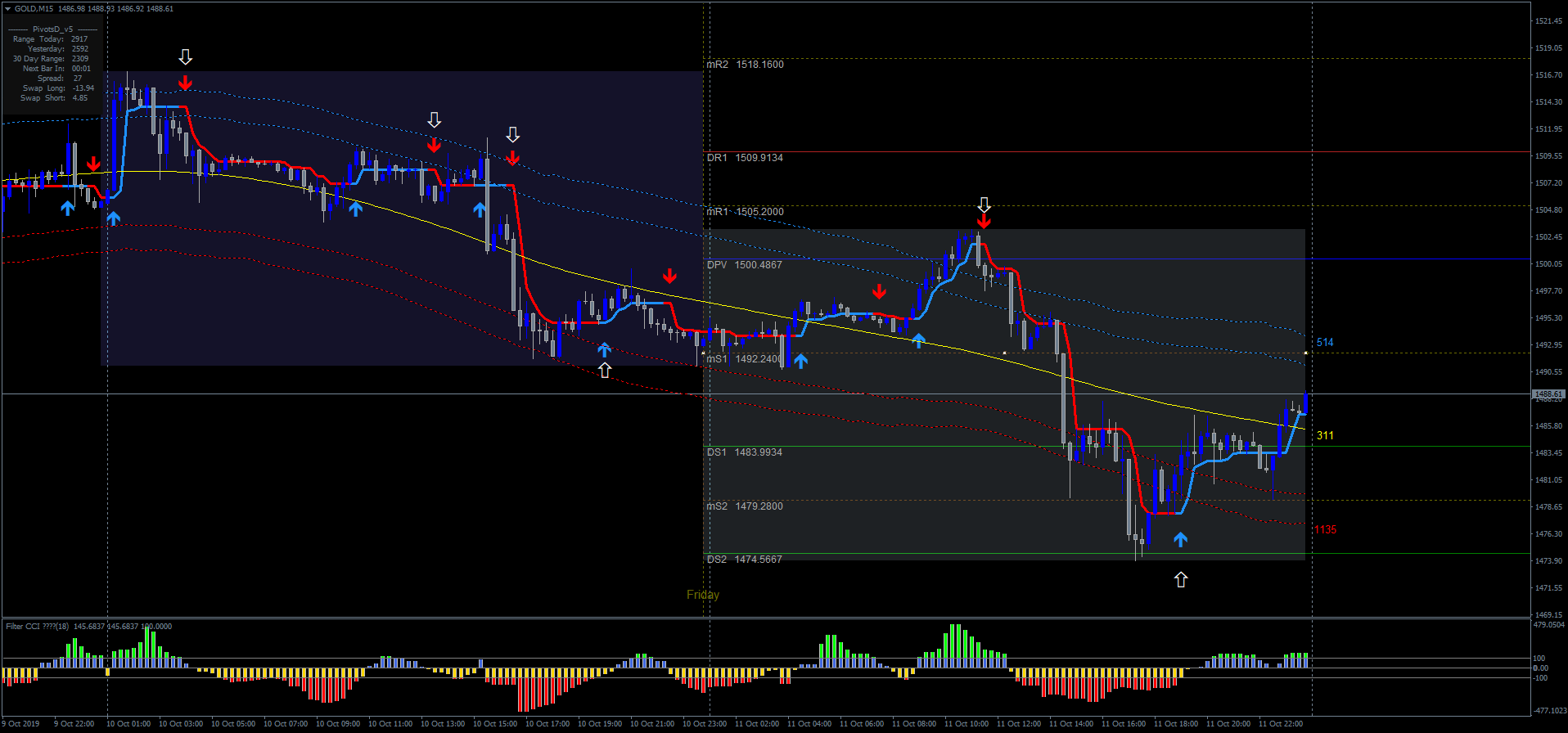

Agr is ki importance aur advantages ki baat ki jay to kuch trader daily trade kar kay profit and loss lainy per he iktifa karty hain aur apna trading order market close hony say pehly he close karty hain. Ye intraday strategy kehlati hay aur mery khial say is kay teht trading karna bahut mufeed hota hay. Q keh daily market jab close hoti hay to next day baz dafa gap banati hay, aur last session ko continue nai karti isi tarah market ka daily pivot point, support and resistance point bhi change ho jata hay. Youn jo traders market kay pivot point, support and resistance ko find kar laity hain woh isky mutabiq daily basis per short term trading karty hain. Agarcheh inka profit some limited he rehta hay buy ye at the end of the day baghair kisi tension kay trading say exit ho jaty hain. Next ager market gap say bhi open ho to ye is effect say bachy rehty hain.

Technical Point of View

Lazmi nai keh aik trader ager intraday main trading kary ga to isko daily he acha profit ho, sometimes aisa bhi hota hay keh market is trader ki favour main nai hoti aur youn isko ya to trade loss main close karna par jati hay ya phir next opening session main isko continue karna hota hay. But ager trader ko trading main ziada loss ho raha ho to usy chahiye keh woh back up plan bana kar apni trading ko loss say nikaly.

Dear Friends, Forex me different time frames ki help sy market ko predict kiya jata hai. Kuch trader 1 hour wala time frame use karty hain or kuch trader 4 hour wala time frame use karty hain. Ese he tarha kuch trader 1 day time frame ko use karty hain. Expert trader hamesa ye bat kehty hain k time frame jetna big ho ga trader ko market ma etna he reliable signal mel jae ga. Trader jetna small time frame ko use karyn gy wo etna he casual signal hasil kar payn gy jis ko use kar k profit hasil karna bhot mushkil ho jata hai.

Intraday Trading With Small Lots

Forex trading ma trader wo he kamyab hota hai jo small lot k sath trade karta hai. Intraday time frame ma trader ko bhot acha signal mel sakta hai but esk sath trader ko hamesa small lot he use karni chahe. Jo trader intraday time frame k sath big lot size ko use karty hain unko profit hasil karny ma bhot problems hoti hai. Forex trading ma big lot sy trader karna easy hai or es ma profit acha hasil ho jata hai but trader ko agr loss ho jae to etna big hota hai k trader ka account he wash ho jata hai or trader chah kar b es big loss ko recover ni kar paty. Forex trading ma big loss ko recover karna trader k lae possible ni hota or esk lae ye asan ho jata hai k wo account he wash karwa dey or phr sy acha capital jama karna start kar dey but acha capital jama karna b bhot mushkil ho jata hai.

Importance and advantages of intraday trading strategy.

Agr is ki importance aur advantages ki baat ki jay to kuch trader daily trade kar kay profit and loss lainy per he iktifa karty hain aur apna trading order market close hony say pehly he close karty hain. Ye intraday strategy kehlati hay aur mery khial say is kay teht trading karna bahut mufeed hota hay. Q keh daily market jab close hoti hay to next day baz dafa gap banati hay, aur last session ko continue nai karti isi tarah market ka daily pivot point, support and resistance point bhi change ho jata hay. Youn jo traders market kay pivot point, support and resistance ko find kar laity hain woh isky mutabiq daily basis per short term trading karty hain. Agarcheh inka profit some limited he rehta hay buy ye at the end of the day baghair kisi tension kay trading say exit ho jaty hain. Next ager market gap say bhi open ho to ye is effect say bachy rehty hain.

Technical Point of View

Lazmi nai keh aik trader ager intraday main trading kary ga to isko daily he acha profit ho, sometimes aisa bhi hota hay keh market is trader ki favour main nai hoti aur youn isko ya to trade loss main close karna par jati hay ya phir next opening session main isko continue karna hota hay. But ager trader ko trading main ziada loss ho raha ho to usy chahiye keh woh back up plan bana kar apni trading ko loss say nikaly.

تبصرہ

Расширенный режим Обычный режим