Aslam u Alaikum! Dear members i hope ap sab kehriyat sy hon gay, or market main achi earning kar rhy hon gy. Dear agr ap market main kamyabi Hasil karna chahty hain to aapko Hamesha experience k satg kam karna hota hai aur apni learning ko perfect banana hota hai. Tab hi ap kamyabi hasil kar sakte hain.Forex trading mein agar aap successful trading karna chahte hain. To ap ko different factor par study karty hain to ap ko bhot zyda advantages available hoty hain

HEDGING TRADING STRATEGY

Dear members Hedge ka matlab hai k aik hi waqat me ya mukhtasir waqat k leye do alag alag stocks ko buy ya sell karna. Ye technique mukhtalif markets jaise stocks, options ya forex me hi sar-anjam deya ja sakta hai.Financial market me chote bare (small ya large) sabe traders risk ko kam karne k tareeqay talash karte rehte hen aur risk management ki techniques ka istemal karke apne trades ko successful banane ki imkanant ko barhane ki koshash karte hen. Forex trading k bohut se tareeqay hen, aur aik qabele-amal "Hedging" in me sab se ziada taqatwar technique hai.Dar-asal hedging trading technique losses ko kam se kam karne aur kamyabi k imkanant ko barhane ka aik behtareen technique me se aik hai. Yahi waja hai k bohut sare traders is ko khas tawar par qeematon k bare (major) peroid movement k dowran apne trading ka aik lazmi juzz banate hen. Yahan tak k kuch investment fund ka naam bhi "hedge" ki bunyad par "Hedging Fund" rakha gaya hai.

HEDGING TECHNIQUE:

Dear member Hedging techniques forex trading me bohut ziada aam istemal hota hai. Forex me Hedging k leye trader do (two) musbat (positive) "correlation pair" jaise; EUR/USD aur GBP/USD ya AUD/USD aur NZD/USD ka intekhab karke, dono par mukhalif smeat (opposite direction) me trades open karta hai. Hedging Trading Strategy market k gher-yaqeeni soratehal me losses ko kam se kam karna hai, jis pe ye aik acha kaam karta hai.Account ki safety aik trader ka basic kaam nahi hai, q k trading na karne se kabhi bhi loss ka khadsha nahi hota. Humen hedging techniques ki madad se safety bhi qayem karni hai aur munfa bhi hasil karna hai, isi wajah se analyst is hedging ki analysis correlated pairs par hi sar-anjam dete hen. Jab bhi trader ka hedging technique pe trading ka irada ho to us k leye wo do correlated pair pe analysis karen, agar wo same behaviour k sath market me move na kar rahi ho, yani agar aik bullish jata hai to dosra sideways ya bearish movement kar raha ho.

IMPORTANCE :

Dear member Forex trading k kisi single pair pe do opposite side se buy aur sell ki trades open karne k amal ko "Direct Forex hedging strategy" kaha jata hai. Lekin 2009 me great recession k baad US Commodity Futures Trading Commission ne new regulations issue jari karke is techniques ko band kar deya hai. Misal k tawar par agar aik trader EURUSD par long term ki trades k sath alehda se short term ki trading karta hai, to new rules k mutabiq brokers k pas 1st trades ko band (close) karne ka ikhteyar hai. Lekin agar trader mukhtalif currencies joron par mixup se hedging karta hai, to ye amal jayez hai.

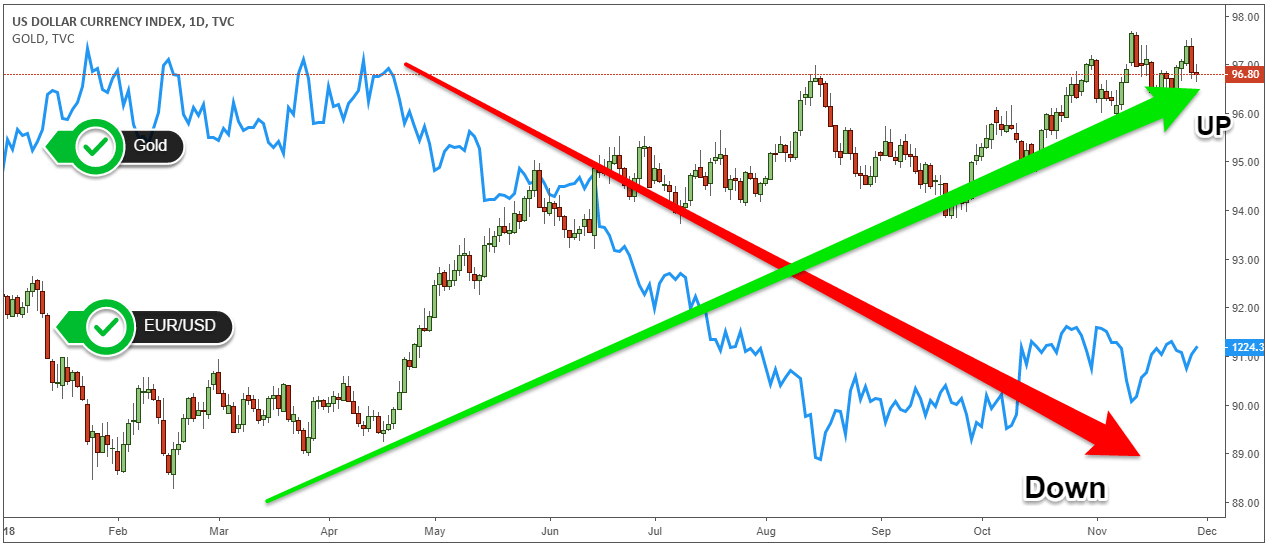

CHART IN ANALYSIS IN FOREX :

Dear members market main successful Hona Chahte Hain. To aapko different candlestick k related proper information honi chahie ta k ap successful trading kar sakyn, es ki explanation ap sy chart main share karn gi. Dear members Jab market ka trend aik khaas direction sy dosri direction mein change hota hy hum is hony wali changing ko Reversal kehty hen. Dosto Reversal ky ban'ny sy pehly market jis taraf move kar rahi hoti hy usi he same direction mein barrhti chali jati hy.agr ap market main kamyabi Hasil karna chahte hain to ismein ap ko bhot acha profit milta hai. market mein koi trend temporary toor par Reversal hota hy to ham isy Retracement ka naam dety hen. Matlab ye ky market ka trend completely toor par change nahin ho raha hota balky market thory time k liye Reversal hoti hy. Es ki tafseel main ap sy chart main share karun gi.

HEDGING TRADING STRATEGY

Dear members Hedge ka matlab hai k aik hi waqat me ya mukhtasir waqat k leye do alag alag stocks ko buy ya sell karna. Ye technique mukhtalif markets jaise stocks, options ya forex me hi sar-anjam deya ja sakta hai.Financial market me chote bare (small ya large) sabe traders risk ko kam karne k tareeqay talash karte rehte hen aur risk management ki techniques ka istemal karke apne trades ko successful banane ki imkanant ko barhane ki koshash karte hen. Forex trading k bohut se tareeqay hen, aur aik qabele-amal "Hedging" in me sab se ziada taqatwar technique hai.Dar-asal hedging trading technique losses ko kam se kam karne aur kamyabi k imkanant ko barhane ka aik behtareen technique me se aik hai. Yahi waja hai k bohut sare traders is ko khas tawar par qeematon k bare (major) peroid movement k dowran apne trading ka aik lazmi juzz banate hen. Yahan tak k kuch investment fund ka naam bhi "hedge" ki bunyad par "Hedging Fund" rakha gaya hai.

HEDGING TECHNIQUE:

Dear member Hedging techniques forex trading me bohut ziada aam istemal hota hai. Forex me Hedging k leye trader do (two) musbat (positive) "correlation pair" jaise; EUR/USD aur GBP/USD ya AUD/USD aur NZD/USD ka intekhab karke, dono par mukhalif smeat (opposite direction) me trades open karta hai. Hedging Trading Strategy market k gher-yaqeeni soratehal me losses ko kam se kam karna hai, jis pe ye aik acha kaam karta hai.Account ki safety aik trader ka basic kaam nahi hai, q k trading na karne se kabhi bhi loss ka khadsha nahi hota. Humen hedging techniques ki madad se safety bhi qayem karni hai aur munfa bhi hasil karna hai, isi wajah se analyst is hedging ki analysis correlated pairs par hi sar-anjam dete hen. Jab bhi trader ka hedging technique pe trading ka irada ho to us k leye wo do correlated pair pe analysis karen, agar wo same behaviour k sath market me move na kar rahi ho, yani agar aik bullish jata hai to dosra sideways ya bearish movement kar raha ho.

IMPORTANCE :

Dear member Forex trading k kisi single pair pe do opposite side se buy aur sell ki trades open karne k amal ko "Direct Forex hedging strategy" kaha jata hai. Lekin 2009 me great recession k baad US Commodity Futures Trading Commission ne new regulations issue jari karke is techniques ko band kar deya hai. Misal k tawar par agar aik trader EURUSD par long term ki trades k sath alehda se short term ki trading karta hai, to new rules k mutabiq brokers k pas 1st trades ko band (close) karne ka ikhteyar hai. Lekin agar trader mukhtalif currencies joron par mixup se hedging karta hai, to ye amal jayez hai.

CHART IN ANALYSIS IN FOREX :

Dear members market main successful Hona Chahte Hain. To aapko different candlestick k related proper information honi chahie ta k ap successful trading kar sakyn, es ki explanation ap sy chart main share karn gi. Dear members Jab market ka trend aik khaas direction sy dosri direction mein change hota hy hum is hony wali changing ko Reversal kehty hen. Dosto Reversal ky ban'ny sy pehly market jis taraf move kar rahi hoti hy usi he same direction mein barrhti chali jati hy.agr ap market main kamyabi Hasil karna chahte hain to ismein ap ko bhot acha profit milta hai. market mein koi trend temporary toor par Reversal hota hy to ham isy Retracement ka naam dety hen. Matlab ye ky market ka trend completely toor par change nahin ho raha hota balky market thory time k liye Reversal hoti hy. Es ki tafseel main ap sy chart main share karun gi.

تبصرہ

Расширенный режим Обычный режим