Assalam O Alaikum!

Friends, Umeed hai ap sab kheriat sy hon gy. Forex ki market mn kamyab trading karny ky liye humain forex ki basics, technical analysis or fundamental analysis ky bary mn knowledge hasil karna chahye. Agar hamary pas axha knowledge ho ga to hum axhi trading kar saken gy. Forex ki market 1 risky market hai. Without knowledge humain iss market mn trade karny sy loss ho sakta hai. Issi bat ko mady nazar rakhty huay aj hum Range Bound Strategy ky topic par bat Karen gy. Umeed hai meri information ap ky liye profitable hon gi.

What Is Range Bond Strategy?

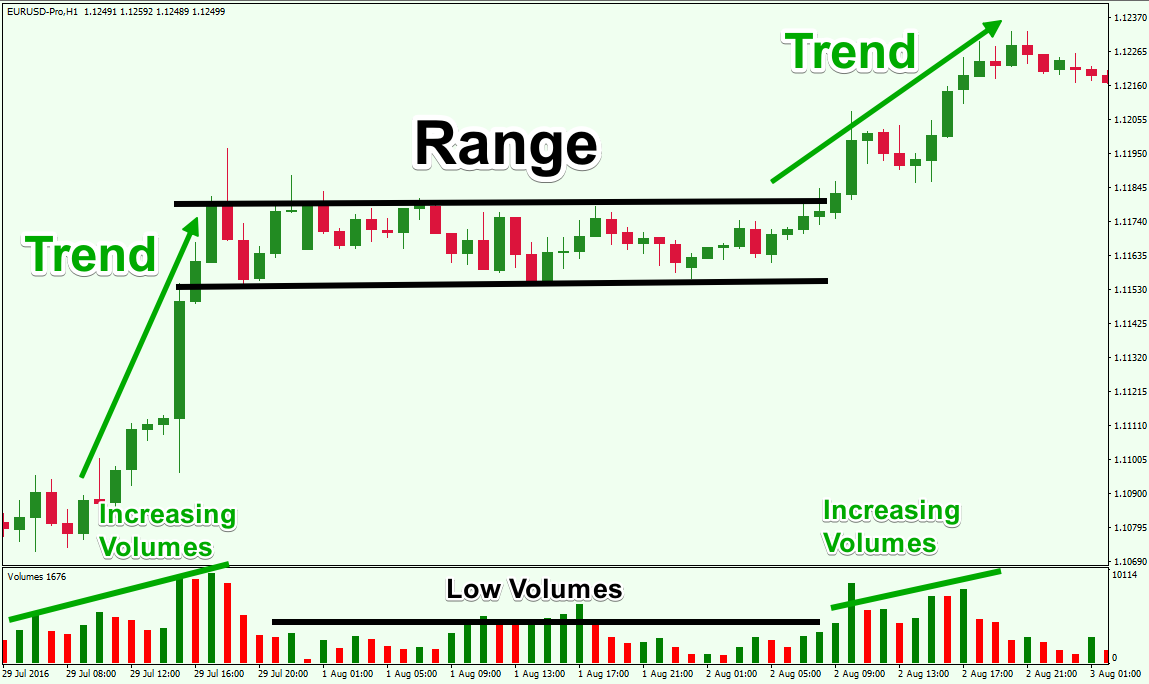

Dear companions Range bound system ko dealers Market ki sideways developments mein use karty huey benefits bannay ki koshish karty hain. Lekin yeh ek exceptionally hazardous methodology hai. Aur is mein aap ko ek range mein bound ho kar kam karna parta hai. Us range ka andazaa ap is trha laga skty hain ky sideways development mein punch market 3 se multiple times Resistance level aur Support level ko contact karti hai to aap un levels ko flat lines se jor kar ek Range select kar skty hain jis ky andar reh kar aap bht si exchanges lagaty hain. Aur benefit kama skty hain.

Clarification Of Range Bound Strategy:

Range Bound procedure mein range select karny ky awful merchants ki yeh technique hoti hai. Ky woh exchanges lagaty waqt support level standard purchasing karty hain aur Resistance level standard selling kar ky benefits bnaty hain.

Clarification At Resistance Level

Opposition level pe Traders Sell ki exchanges lagaty hain aur SL instrument ko use karty huey obstruction level se oopar STOP LOSS apparatus use karty hain. Jo ky un ko significant misfortunes se bachata hai. Isi trha market mein supoort aur opposition ky darmian ki width ki range mein rehty tone exchanging karty hain. Aur Jahan se exchange lgae jati hai. Whan se misfortune ki limit benefit ky muqably mrin 50% rkhi jati hai. Aur 2:1 mein benefit :misfortune rkha jata hai. Aur jitna benefit required ho woh gain kar ky exchanges se leave hua jata hai. Is trha yeh merchants bht si exchanges lgaty hain in spans mein aur bht benefit kama lety hain.

Clarification At Support Level

Hit market support level standard hoti hai to dealers Buy ki exchanges lagaty hain aur market range ky mutabiq market ky width ky hisab se apni parcel sizes select karty hain. Brokers stop misfortune ki limit support range se thora nechy sleect kar lety hain ta ky un ko significant greenery nah hon. Aur Take benefit range ky mutabiq rkhty hain. Aur width ky lihaz se esi parcel size rkhty hain jo ky un Ko 2:1 ky hisab se benefit ya misfortune karwari hai. For instance agar un ko benefit ho rha ho to 2 dollars tk ka benefit hota hai aur misfortune ki surat mein woh stop misfortune ki limit 1 dollar tk rkhty hain. Is trha bary accounts standard enormous parcels rkh kay woh 2:1 keep up with rkh skty hain.

Friends, Umeed hai ap sab kheriat sy hon gy. Forex ki market mn kamyab trading karny ky liye humain forex ki basics, technical analysis or fundamental analysis ky bary mn knowledge hasil karna chahye. Agar hamary pas axha knowledge ho ga to hum axhi trading kar saken gy. Forex ki market 1 risky market hai. Without knowledge humain iss market mn trade karny sy loss ho sakta hai. Issi bat ko mady nazar rakhty huay aj hum Range Bound Strategy ky topic par bat Karen gy. Umeed hai meri information ap ky liye profitable hon gi.

What Is Range Bond Strategy?

Dear companions Range bound system ko dealers Market ki sideways developments mein use karty huey benefits bannay ki koshish karty hain. Lekin yeh ek exceptionally hazardous methodology hai. Aur is mein aap ko ek range mein bound ho kar kam karna parta hai. Us range ka andazaa ap is trha laga skty hain ky sideways development mein punch market 3 se multiple times Resistance level aur Support level ko contact karti hai to aap un levels ko flat lines se jor kar ek Range select kar skty hain jis ky andar reh kar aap bht si exchanges lagaty hain. Aur benefit kama skty hain.

Clarification Of Range Bound Strategy:

Range Bound procedure mein range select karny ky awful merchants ki yeh technique hoti hai. Ky woh exchanges lagaty waqt support level standard purchasing karty hain aur Resistance level standard selling kar ky benefits bnaty hain.

Clarification At Resistance Level

Opposition level pe Traders Sell ki exchanges lagaty hain aur SL instrument ko use karty huey obstruction level se oopar STOP LOSS apparatus use karty hain. Jo ky un ko significant misfortunes se bachata hai. Isi trha market mein supoort aur opposition ky darmian ki width ki range mein rehty tone exchanging karty hain. Aur Jahan se exchange lgae jati hai. Whan se misfortune ki limit benefit ky muqably mrin 50% rkhi jati hai. Aur 2:1 mein benefit :misfortune rkha jata hai. Aur jitna benefit required ho woh gain kar ky exchanges se leave hua jata hai. Is trha yeh merchants bht si exchanges lgaty hain in spans mein aur bht benefit kama lety hain.

Clarification At Support Level

Hit market support level standard hoti hai to dealers Buy ki exchanges lagaty hain aur market range ky mutabiq market ky width ky hisab se apni parcel sizes select karty hain. Brokers stop misfortune ki limit support range se thora nechy sleect kar lety hain ta ky un ko significant greenery nah hon. Aur Take benefit range ky mutabiq rkhty hain. Aur width ky lihaz se esi parcel size rkhty hain jo ky un Ko 2:1 ky hisab se benefit ya misfortune karwari hai. For instance agar un ko benefit ho rha ho to 2 dollars tk ka benefit hota hai aur misfortune ki surat mein woh stop misfortune ki limit 1 dollar tk rkhty hain. Is trha bary accounts standard enormous parcels rkh kay woh 2:1 keep up with rkh skty hain.

تبصرہ

Расширенный режим Обычный режим