Dosto aaj hum bat karainge analysis ke types par magar muktalif Indicators ko use kar kay ham analysis kar saktay hain. Trading mein analysis bahut matter karta hai , analysis ka bagair trading impossible hai.

Analysis ki 3-types hain:

"Trade analysis aik most important tool hai jo keh successful investors stocks ko pick karnay ka liay use kartay hain aur intelligent investment decisions lenay ka liay. Yeh investor ko enable karta hai share market mein advance mein prepare honay ka liay aur purchase stocks jo keh future mein profitable hotay hain.

1 Technical analysis

2 fundamental analysis

3 sacramental analysis

1.Fundamental analysis (FA):

Fundamental analysis aik aisa method hai jo keh security ki intrinsic value ko measure karnay mein use hota hai related economic aur financial factors ko examining karnay ka liay. Fundamental analysts har us cheez ko study karta hai security ki value ko affect karti hai, macroeconomic factors such as state ki economy aur industry conditions sa microeconomic factors like effectiveness mein company ki management etc.

Fundamental analysis aik method hai jo keh stock ki real ya "fair market" value ko determine karta hai.Fundamental analysts aisay stocks ki search kartay hain jo keh currently trading kartay hain asi prices per prices jo keh higher ya lower hon real value sa.Agar fair market value higher ho market price sa, stock is undervalued hota hai aur buy recommendation dia jata hai.Contrast mein, technical analysts fundamentals ko study mein historical price trends ki favour mein ignore kartay hai stock sa.

2.Technical analysis:

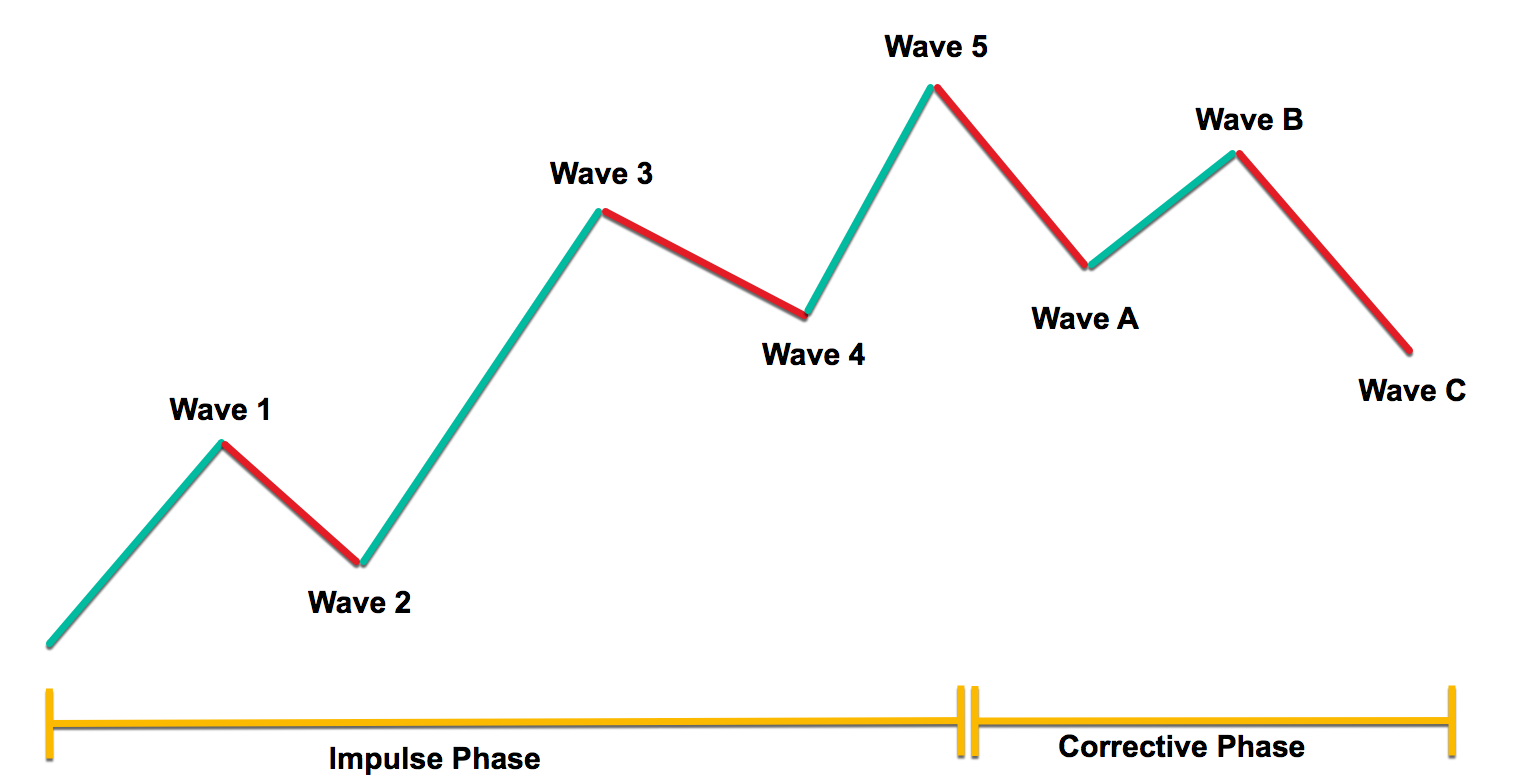

Technical analysis aik asa trading discipline hai investments ko evaluate karnay aur trading opportunities ko identify karnay, statistical trends jo trading activity sa miltay hain unko analyzing karnay mein use hota hai, jesa keh price movement aur volume.

Technical analysis aik trading discipline hai investments ko evaluate karnay aur trading opportunities ko price trends mein identify karnay aur patterns jo charts per dikhtay hain us ka liay use hota hai.Technical analysts past trading activity per believe kartay hain aur security ki price changes valuable indicators hotay hain security ki future price movements mein.Technical analysis mein fundamental analysis sa difference hota hai, jo keh company ki financial per depend karta hai , historical price patterns ya stock trends ki bajay.

3.Sentiment analysis:

Traders ki feelings ko guage karnay mein use hota hai, whether yeh overall currency market ka baray mein hai particular currency pair ka baray mein hai. Har trader ki apni opinion hoti hai keh kesay market acting position mein hai aur yeh keh trade same direction ki market mein hogi ya against .

Aaj ke shear ke gai malomat aap ke liye bahtar sabit honge

Shukarya

Analysis ki 3-types hain:

"Trade analysis aik most important tool hai jo keh successful investors stocks ko pick karnay ka liay use kartay hain aur intelligent investment decisions lenay ka liay. Yeh investor ko enable karta hai share market mein advance mein prepare honay ka liay aur purchase stocks jo keh future mein profitable hotay hain.

1 Technical analysis

2 fundamental analysis

3 sacramental analysis

1.Fundamental analysis (FA):

Fundamental analysis aik aisa method hai jo keh security ki intrinsic value ko measure karnay mein use hota hai related economic aur financial factors ko examining karnay ka liay. Fundamental analysts har us cheez ko study karta hai security ki value ko affect karti hai, macroeconomic factors such as state ki economy aur industry conditions sa microeconomic factors like effectiveness mein company ki management etc.

Fundamental analysis aik method hai jo keh stock ki real ya "fair market" value ko determine karta hai.Fundamental analysts aisay stocks ki search kartay hain jo keh currently trading kartay hain asi prices per prices jo keh higher ya lower hon real value sa.Agar fair market value higher ho market price sa, stock is undervalued hota hai aur buy recommendation dia jata hai.Contrast mein, technical analysts fundamentals ko study mein historical price trends ki favour mein ignore kartay hai stock sa.

2.Technical analysis:

Technical analysis aik asa trading discipline hai investments ko evaluate karnay aur trading opportunities ko identify karnay, statistical trends jo trading activity sa miltay hain unko analyzing karnay mein use hota hai, jesa keh price movement aur volume.

Technical analysis aik trading discipline hai investments ko evaluate karnay aur trading opportunities ko price trends mein identify karnay aur patterns jo charts per dikhtay hain us ka liay use hota hai.Technical analysts past trading activity per believe kartay hain aur security ki price changes valuable indicators hotay hain security ki future price movements mein.Technical analysis mein fundamental analysis sa difference hota hai, jo keh company ki financial per depend karta hai , historical price patterns ya stock trends ki bajay.

3.Sentiment analysis:

Traders ki feelings ko guage karnay mein use hota hai, whether yeh overall currency market ka baray mein hai particular currency pair ka baray mein hai. Har trader ki apni opinion hoti hai keh kesay market acting position mein hai aur yeh keh trade same direction ki market mein hogi ya against .

Aaj ke shear ke gai malomat aap ke liye bahtar sabit honge

Shukarya

تبصرہ

Расширенный режим Обычный режим