What is EMA trading strategy;

EMA simple moving average ka result hey EMA aik indicator hey jo keh zyada tar charts pakg par paish kea ja sakta hey j trader ko trend kay sath sath mumkana entry or exit signal ko identify karnay kay kabel banata hey jab baat trend saze ke market ke ho to trader ko strategy kay hawallay say bohut say ekhterat hotay hein

three step EMA trading strategy;

zail mein EMA trading strategy aik series kay estamal kay gard ghomay ge graph bhe kese specific period kay ley price ke average ko indicate kar kay yeh SMA ko indicate karte hey EMA kay hesaab ketaab mein majodah price par zyada zoor daynay kay ley kuch gap par zor dayta hey EMA trend trading kay ley aik behtareen omeedwar hey

Step1 find the trend in forex market;

trend par mobne position mein enter honay kay ley trader sab say pehlay trend ke tasdeeq karne chihay zail mein EUR/USD daily ka chart hey to ghoor karen keh rader higher high bana raha hey jo keh EUR/USD pair kay upper trend aik strong hey es analysis ke tasdeeq chart par neshan zad 200EMA kay estamall say ke ja sakte hey ravaytee tor par jab trade 200EMA say up chalee jate hey t trading bullish say hote hey ager price average down rehte hey t bearish ka shekar hotay hein

Step2 EMA entries ka estamall;

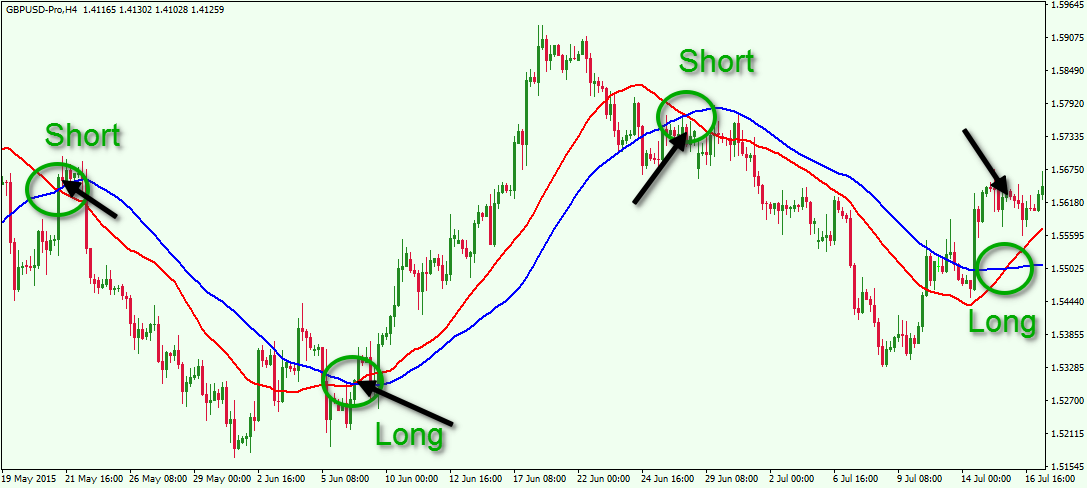

aik bar market ke direction ko indicate karnay kay bad trader market mein enter honay kay ley EMA ke aik series kar saktay hein 12 or 26 EMA kay period ko shamell kea geya hey kun keh trader up trend mein buy hona chahtay hein es ley en area ko neshan dahe karna ho ge jahan par momentum trend direction indicate ho rehe hey EMA trader ko aik aisay area ke pehchan karnay mein help kar sakta hey jahan par short period 12 moving average or long period 26 moving average say up jate hey or es makam par trader market mein buy kar saktay hein

EUR/USD ka chart EMA ka estamall kartay hovay trader kai mumkana buy entry k dekhata hey es action ko down trend kay ley es sorat mein sell ke movement ko nakall kar sakta hey jab 12 ke period 26 EMA say low ho jay

step3 EMA ko exit position ko estamall karnay kay ley ke jate hey

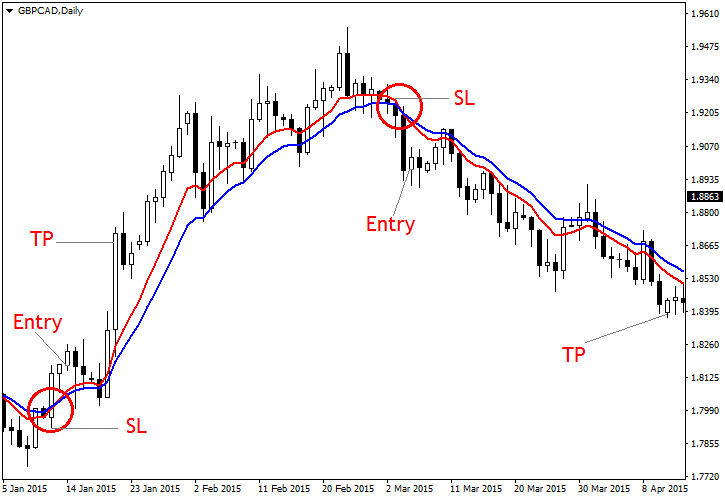

ab jab keh trade ka akhaz ho choka hey trader ko yeh identify karnay ke zaroorat hote hey keh market say exit karnay ka wakt kab ho ga yeh aik kamyaab strategy ka step no 3 hey trader apni trading ke zaroorat k pora karnay kay ley yahan par mokhtalef kesam kay stop loss or risk reward ke rati ko chose karta hey tahum EMA ko trade exit karnay kay ley bhe estamal kea ja sakta hey trade bullish ke raftar mein wapcee par buy kartay hein or 12 period EMA ko touch karte hey to trader ko position ko close karna chihay

trend mein trade kartay wakt stop bhe lagay janay chihay aik asaan tareka yeh hey keh graph par higher highs swing kay down mein stop lagain es tarah ager trend badal jata hey to kese bhe position ko loss kay ley jald az jald exit kea ja sakta hey jaisa keh nechay dey gay chart mein dekhaya geya hey

EMA simple moving average ka result hey EMA aik indicator hey jo keh zyada tar charts pakg par paish kea ja sakta hey j trader ko trend kay sath sath mumkana entry or exit signal ko identify karnay kay kabel banata hey jab baat trend saze ke market ke ho to trader ko strategy kay hawallay say bohut say ekhterat hotay hein

three step EMA trading strategy;

zail mein EMA trading strategy aik series kay estamal kay gard ghomay ge graph bhe kese specific period kay ley price ke average ko indicate kar kay yeh SMA ko indicate karte hey EMA kay hesaab ketaab mein majodah price par zyada zoor daynay kay ley kuch gap par zor dayta hey EMA trend trading kay ley aik behtareen omeedwar hey

Step1 find the trend in forex market;

trend par mobne position mein enter honay kay ley trader sab say pehlay trend ke tasdeeq karne chihay zail mein EUR/USD daily ka chart hey to ghoor karen keh rader higher high bana raha hey jo keh EUR/USD pair kay upper trend aik strong hey es analysis ke tasdeeq chart par neshan zad 200EMA kay estamall say ke ja sakte hey ravaytee tor par jab trade 200EMA say up chalee jate hey t trading bullish say hote hey ager price average down rehte hey t bearish ka shekar hotay hein

Step2 EMA entries ka estamall;

aik bar market ke direction ko indicate karnay kay bad trader market mein enter honay kay ley EMA ke aik series kar saktay hein 12 or 26 EMA kay period ko shamell kea geya hey kun keh trader up trend mein buy hona chahtay hein es ley en area ko neshan dahe karna ho ge jahan par momentum trend direction indicate ho rehe hey EMA trader ko aik aisay area ke pehchan karnay mein help kar sakta hey jahan par short period 12 moving average or long period 26 moving average say up jate hey or es makam par trader market mein buy kar saktay hein

EUR/USD ka chart EMA ka estamall kartay hovay trader kai mumkana buy entry k dekhata hey es action ko down trend kay ley es sorat mein sell ke movement ko nakall kar sakta hey jab 12 ke period 26 EMA say low ho jay

step3 EMA ko exit position ko estamall karnay kay ley ke jate hey

ab jab keh trade ka akhaz ho choka hey trader ko yeh identify karnay ke zaroorat hote hey keh market say exit karnay ka wakt kab ho ga yeh aik kamyaab strategy ka step no 3 hey trader apni trading ke zaroorat k pora karnay kay ley yahan par mokhtalef kesam kay stop loss or risk reward ke rati ko chose karta hey tahum EMA ko trade exit karnay kay ley bhe estamal kea ja sakta hey trade bullish ke raftar mein wapcee par buy kartay hein or 12 period EMA ko touch karte hey to trader ko position ko close karna chihay

trend mein trade kartay wakt stop bhe lagay janay chihay aik asaan tareka yeh hey keh graph par higher highs swing kay down mein stop lagain es tarah ager trend badal jata hey to kese bhe position ko loss kay ley jald az jald exit kea ja sakta hey jaisa keh nechay dey gay chart mein dekhaya geya hey

تبصرہ

Расширенный режим Обычный режим