Forex trading market mein jab aap Technical Analysis ko completely understand krty hain, tu ismein aapko zone ki study krna hoti hai. Aaj main aapko zone ki importance sa related kuch information provide krna chahta hun, jo aap ki decision making process or SL ki appointment ko further clear kr da ge.

Zone Area

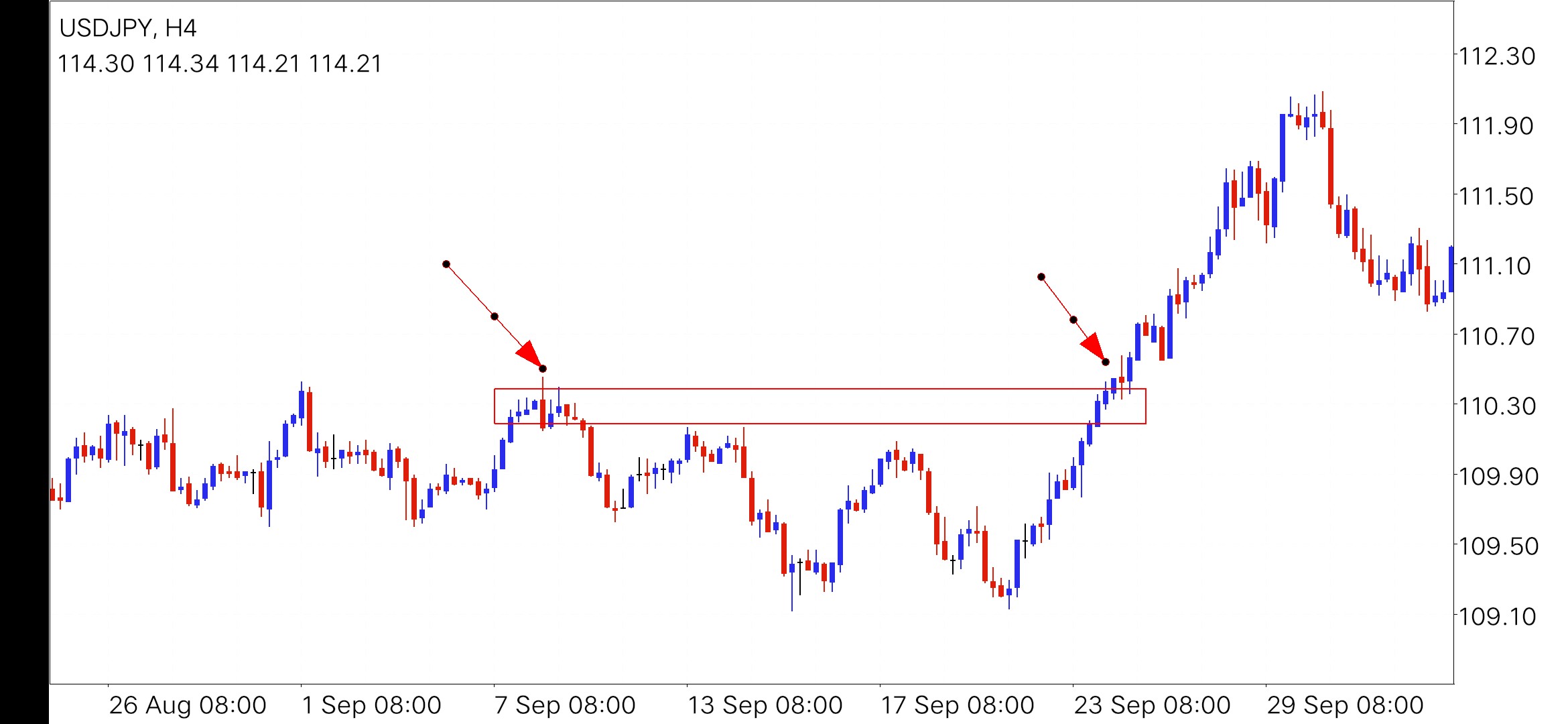

Dear jab aap zone ki study krna chahty hain, tu Technical analysis ko complete krny kay liye aap aik zone ko draw krty hain, ya aik specific area hota hai, jis main aapko confirmation mil rahi hoti hai. Jab aap zone draw krty hain, tu ismein following points ko mentioned krna hota hai.

Candlestick's Body

Zone ko study krny kay liye Jab aap zone ko draw krty hain, tu is main aap na zone ka aik point body ki closing point per set krna hota hai. For example jab aap aik support level per zone draw krty hain, tu is main aapko zone ka aik point candlestick ki body ko select krna hota hai. Isk bad aap zone ko understand kar sakhty hain.

Candlestick's Wick

Candlestick ki wick ki complete recognition bhi zarori hoti hai. Dear member jab zone ko draw krty hain tu ismein aik point body per or dosra iska point wick kay end per krty hain. Us specific area per aap ko wick ki closing per aap ko is area per point out krna hota hai.

News Voltatality Ignorance

News ki waja sa kuch candlesticks ki wick bahut zyda ho jati hain. Jab aap wick ko focus kr kay mentioned krty hain, tu is main aapko news ki candlestick ko ignore krna hota hai. Kunk news kay time sometimes bahut zyda lambi wick ban jati hain, tu eisi situation main aap na zone ko wick tak extended nahin krna hota hai.

Trading in Zone Area

Dear forex members Jab aap successfully zone ko draw kar laty hain, tu ismein aapko hamesha bahut achi entries mil sakhti hain. Kunk jab aap support level aur resistance level per ya draw kar laty hain, tu ismein aapko us specific area main aapko aik achi reversal candlestick ya Reversal candlestick pattern per entry leni hoti hai or ismein aapko achi confirmation available ho sakhti hai. Zone Trade kay liye ya information important hoti hai.

Value of Zone

Zone area ki bahut jyada importance hoti hai. Definitely jab aap Technical Analysis ko completely understand krny kay liye zone ko properly utilised kar laty hain, tu aap effective trading kar sakhty hain. Kunk is main aapko bahut achi enteries mil sakhti hain.

Stop Loss Calculation

Zone area main stop loss ki calculation zarori hoti hai. Zone ko properly draw krny sa aapko hamesha aik achy point per stop loss ki value ko set krna hota hai. Is liye stop loss ki exactly calculation krny kay liye zone formation bahut zyda helpful ho sakhti hai.

Zone Area

Dear jab aap zone ki study krna chahty hain, tu Technical analysis ko complete krny kay liye aap aik zone ko draw krty hain, ya aik specific area hota hai, jis main aapko confirmation mil rahi hoti hai. Jab aap zone draw krty hain, tu ismein following points ko mentioned krna hota hai.

Candlestick's Body

Zone ko study krny kay liye Jab aap zone ko draw krty hain, tu is main aap na zone ka aik point body ki closing point per set krna hota hai. For example jab aap aik support level per zone draw krty hain, tu is main aapko zone ka aik point candlestick ki body ko select krna hota hai. Isk bad aap zone ko understand kar sakhty hain.

Candlestick's Wick

Candlestick ki wick ki complete recognition bhi zarori hoti hai. Dear member jab zone ko draw krty hain tu ismein aik point body per or dosra iska point wick kay end per krty hain. Us specific area per aap ko wick ki closing per aap ko is area per point out krna hota hai.

News Voltatality Ignorance

News ki waja sa kuch candlesticks ki wick bahut zyda ho jati hain. Jab aap wick ko focus kr kay mentioned krty hain, tu is main aapko news ki candlestick ko ignore krna hota hai. Kunk news kay time sometimes bahut zyda lambi wick ban jati hain, tu eisi situation main aap na zone ko wick tak extended nahin krna hota hai.

Trading in Zone Area

Dear forex members Jab aap successfully zone ko draw kar laty hain, tu ismein aapko hamesha bahut achi entries mil sakhti hain. Kunk jab aap support level aur resistance level per ya draw kar laty hain, tu ismein aapko us specific area main aapko aik achi reversal candlestick ya Reversal candlestick pattern per entry leni hoti hai or ismein aapko achi confirmation available ho sakhti hai. Zone Trade kay liye ya information important hoti hai.

Value of Zone

Zone area ki bahut jyada importance hoti hai. Definitely jab aap Technical Analysis ko completely understand krny kay liye zone ko properly utilised kar laty hain, tu aap effective trading kar sakhty hain. Kunk is main aapko bahut achi enteries mil sakhti hain.

Stop Loss Calculation

Zone area main stop loss ki calculation zarori hoti hai. Zone ko properly draw krny sa aapko hamesha aik achy point per stop loss ki value ko set krna hota hai. Is liye stop loss ki exactly calculation krny kay liye zone formation bahut zyda helpful ho sakhti hai.

تبصرہ

Расширенный режим Обычный режим