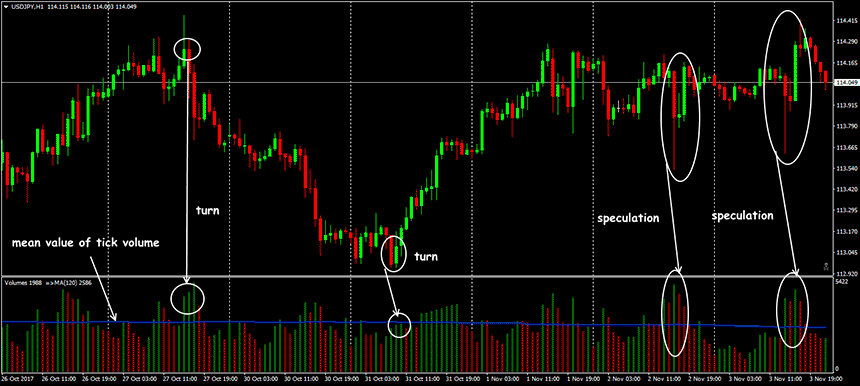

Hi every one .Hope u all are doing well. Volume indicator trading ma bht important ha. Tading ma dept lany ka liye us ko ap use karain means ap

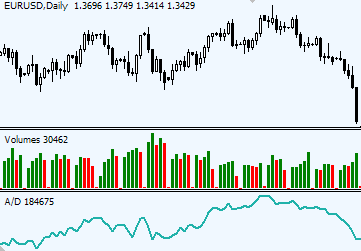

us sa zaida sa zaida trading jeet sakty hain aur ap ka loss b nai ho ga then. agar ap forex volume indicator ma key trading levels and

price action ko sath ly kr chalein gy to easily ap win krain gy.

us sa zaida sa zaida trading jeet sakty hain aur ap ka loss b nai ho ga then. agar ap forex volume indicator ma key trading levels and

price action ko sath ly kr chalein gy to easily ap win krain gy.

تبصرہ

Расширенный режим Обычный режим