Importance of Relative Index Indicator (RSI) in Forex Trading:

Dear forex members umeed krta hu k ap kheriyat sy hun gy.Or forex Trading sy ak acha profit earn kr rahy hu gy.

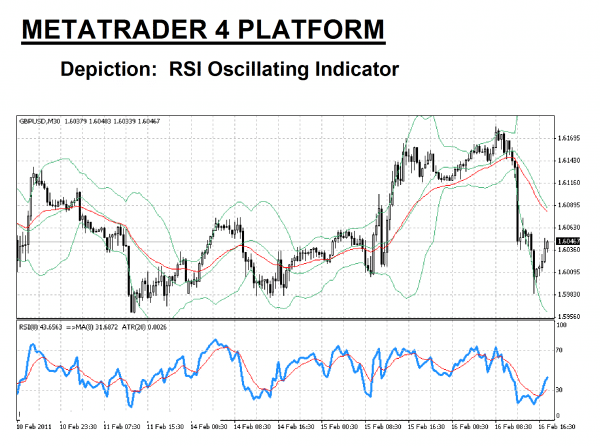

Relative Strength Index Indicator (RSI)

Dear forex members forex trading mai relative strength index RSI indicator sab say zayada use hony wala indicator hai.Ye bht useful or important indicator hai.Jis ko use kr k hum ak successful trading kr skty hain.Is lye short ma hum isy RSI kehty hain.

Ye aik asa indicator hai jo hamen market mai ak successful trading krny k lye overbought or over sold situation ki detail sy identify krta hai.Trading mai overbought or oversold ki situation ko samjty hwy is indicator sy trading krni chahye.

1). RSI Indicator trading mai buy or sell k signals generate krta hai.

2). RSI indicator trading mai currency pairs ki prices k overbought or oversell ka batata hai.

3). RSI indicator trading mai currency pairs ki prices k sath sath is ki movement ko kisi bi time frame k mutabik accurate batata hai.

4). RSI indicator trading mai leading indicator k tor pr use hota hai. Or ye pehly sy he market price k trend reversal signal deta hai.

RSI indicator ko hum different situation mai use kr sakty hen.

1. Overbought Situation :

Dear forex members forex trading mai RSI indicator ki is situation ko hum level 70 bi kehty hen. Or overbought situation ko hum level 70 sy bi indicate kr sakty hen. Trading mai ye ak aisi position hoti hai. Jis mai hum market prices ko uptrend mai dekhty hen. Is situation mai different type ki candlestick patterns ko dekhty huwy hum is mai buy or sell ki trade ki entry ly sakty hen. RSI indicator k overbought hoty he hum candlestick pattern ko dekh sakty hen. Or is k indication pr hum trade laga sakty hen.

2. Oversold Situation :

Dear forex members forex trading mai RSI indicator ki is situation ko hum level 30 bi kehty hen. Jb market ki prices down fall kr rahe hon. To hum market ko observe krty huwy is mai humen ak strong seller pressure mil raha hota hai. Or isi seller pressure ki waja sy market down fall krty huwy bottom tk aa jati hai. Market k us level pr aany k bad market mai uptrend expected ho jata hai. Is situation ko oversold situation kehty hen. Is indicator ki help sy hum trading chart mai apni buy ki trade ki entry ly sakty hen.

Trading with RSI Indicator :

Dear forex members agr hum forex trading mai RSI indicator k basis pr hum trading krna chahty hen. To hamen trade different time frame ki basis pr is ki classification krni ho ge. Q k choty time frame or bary time frame mai calculation different hoti hai. Or RSI indicator ki value mai changing bi hamen confuse kr sakti hai. Is time frame ki classification k bad hum trading kr sakty hen.

RSI Indicator on Small Time Frame :

Jb hum RSI indicator ko kisi bi Small time frame or apply krty hen. To hamen level 5 sy level level 90 ko draw krna chaheye. Small time frame py market ki calculation or RSI indicator ki value bohot tezi sy km or zyada hoti hai. Small time frame mai hamen trading krny k leye entry point level 15 sy lena chaheye. Trade ko down hony pr hum mazeed level 10 or level 5 pr bi hum apni trade ki enrty ly sakty hen. Or is tarha sy sell ki trade lagany k leye apna enrty point level 85 sy pehly lena ho ga. Or phr level 90 or 95 pr bi hum mazeed enrty ly sakty hen.

RSI Indicator on Big Time Frame :

Jb bi hum RSI indicator ko kisi bi big time frame pr lety hen. To level 70 sy seller or level 30 sy buyer ki conformation milti hai. Kisi bi big time frame ko for example H4 ya daily time frame mai dekh rahy hoty hen. To is ki identification or situation pr level 70 pr sell or level 30 pr buy ki confirmation hoti hai. Isi waja,sy hum level 70 pr sell ki or level 30 buy ki trade ki entry ly sakty hen.

Benifits of RSI Indicator :

Dear members RSI indicator ak bohot famous important or bohot strong indicator hai. Ye hamen ak positive guide line deta hai. RSI indicator sy market ko smjhna bohot asan hota hai.

<font size="4"><font size="2">

Dear forex members umeed krta hu k ap kheriyat sy hun gy.Or forex Trading sy ak acha profit earn kr rahy hu gy.

Relative Strength Index Indicator (RSI)

Dear forex members forex trading mai relative strength index RSI indicator sab say zayada use hony wala indicator hai.Ye bht useful or important indicator hai.Jis ko use kr k hum ak successful trading kr skty hain.Is lye short ma hum isy RSI kehty hain.

Ye aik asa indicator hai jo hamen market mai ak successful trading krny k lye overbought or over sold situation ki detail sy identify krta hai.Trading mai overbought or oversold ki situation ko samjty hwy is indicator sy trading krni chahye.

1). RSI Indicator trading mai buy or sell k signals generate krta hai.

2). RSI indicator trading mai currency pairs ki prices k overbought or oversell ka batata hai.

3). RSI indicator trading mai currency pairs ki prices k sath sath is ki movement ko kisi bi time frame k mutabik accurate batata hai.

4). RSI indicator trading mai leading indicator k tor pr use hota hai. Or ye pehly sy he market price k trend reversal signal deta hai.

RSI indicator ko hum different situation mai use kr sakty hen.

1. Overbought Situation :

Dear forex members forex trading mai RSI indicator ki is situation ko hum level 70 bi kehty hen. Or overbought situation ko hum level 70 sy bi indicate kr sakty hen. Trading mai ye ak aisi position hoti hai. Jis mai hum market prices ko uptrend mai dekhty hen. Is situation mai different type ki candlestick patterns ko dekhty huwy hum is mai buy or sell ki trade ki entry ly sakty hen. RSI indicator k overbought hoty he hum candlestick pattern ko dekh sakty hen. Or is k indication pr hum trade laga sakty hen.

2. Oversold Situation :

Dear forex members forex trading mai RSI indicator ki is situation ko hum level 30 bi kehty hen. Jb market ki prices down fall kr rahe hon. To hum market ko observe krty huwy is mai humen ak strong seller pressure mil raha hota hai. Or isi seller pressure ki waja sy market down fall krty huwy bottom tk aa jati hai. Market k us level pr aany k bad market mai uptrend expected ho jata hai. Is situation ko oversold situation kehty hen. Is indicator ki help sy hum trading chart mai apni buy ki trade ki entry ly sakty hen.

Trading with RSI Indicator :

Dear forex members agr hum forex trading mai RSI indicator k basis pr hum trading krna chahty hen. To hamen trade different time frame ki basis pr is ki classification krni ho ge. Q k choty time frame or bary time frame mai calculation different hoti hai. Or RSI indicator ki value mai changing bi hamen confuse kr sakti hai. Is time frame ki classification k bad hum trading kr sakty hen.

RSI Indicator on Small Time Frame :

Jb hum RSI indicator ko kisi bi Small time frame or apply krty hen. To hamen level 5 sy level level 90 ko draw krna chaheye. Small time frame py market ki calculation or RSI indicator ki value bohot tezi sy km or zyada hoti hai. Small time frame mai hamen trading krny k leye entry point level 15 sy lena chaheye. Trade ko down hony pr hum mazeed level 10 or level 5 pr bi hum apni trade ki enrty ly sakty hen. Or is tarha sy sell ki trade lagany k leye apna enrty point level 85 sy pehly lena ho ga. Or phr level 90 or 95 pr bi hum mazeed enrty ly sakty hen.

RSI Indicator on Big Time Frame :

Jb bi hum RSI indicator ko kisi bi big time frame pr lety hen. To level 70 sy seller or level 30 sy buyer ki conformation milti hai. Kisi bi big time frame ko for example H4 ya daily time frame mai dekh rahy hoty hen. To is ki identification or situation pr level 70 pr sell or level 30 pr buy ki confirmation hoti hai. Isi waja,sy hum level 70 pr sell ki or level 30 buy ki trade ki entry ly sakty hen.

Benifits of RSI Indicator :

Dear members RSI indicator ak bohot famous important or bohot strong indicator hai. Ye hamen ak positive guide line deta hai. RSI indicator sy market ko smjhna bohot asan hota hai.

<font size="4"><font size="2">

تبصرہ

Расширенный режим Обычный режим