INTRODUCTION :

Aslam u Alaikum! Dear members i hope ap sab kehriyat sy hon gay, or market main achi earning kar rhy hon gy. Dear agr ap market main kamyabi Hasil karna chahty hain to aapko Hamesha experience k satg kam karna hota hai aur apni learning ko perfect banana hota hai. Tab hi ap kamyabi hasil kar sakte hain.Forex trading mein agar aap successful trading karna chahte hain. To ap ko different factor par study karty hain to ap ko bhot zyda advantages available hoty hain aj main ap ko Reversal And Retracement k related important information share karna chahti hun umeed hai ap es ko achi tara samjhy gay.

WHAT IS CORRELATIONS IN FOREX TRADING:

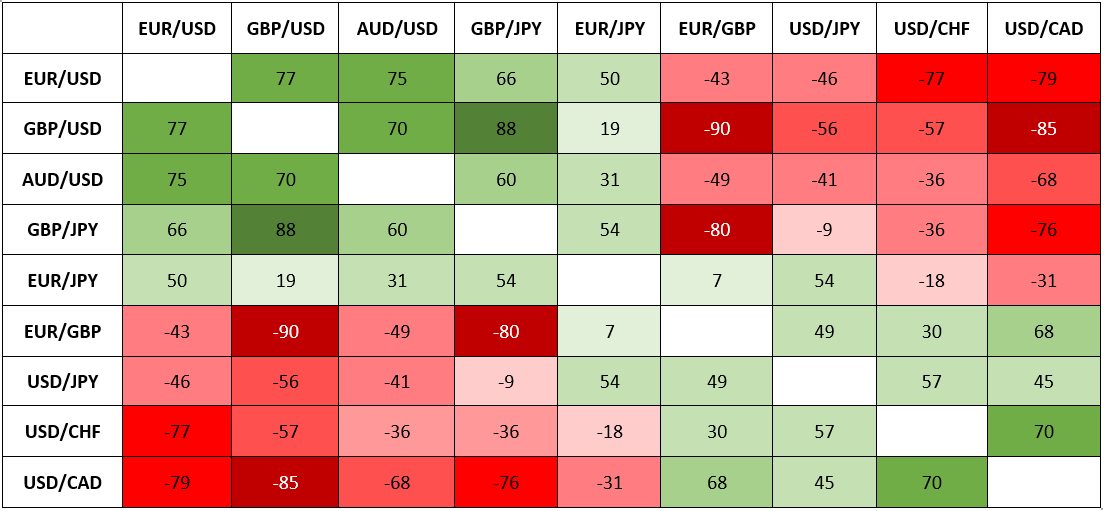

Dear, mairay knowledge k mutabik jab forex market k chart main 2 curriencies ka aik dusray k sath correlation hota hai, jab chart pay 2 pairs same directions main run kartay hain to usay ham positive correlation kehtay hain, aur jab wahi pairs aik dusray k opposit run kartay hain tab ham unko negative correlation kehtay hain.

HOW TO TRADE CURRENCY CORRELATION :

Dear, mairay knowledge k mutabik world ki curriencies ka correlation bilkul normal hai, for example ham candial doller (CAD) ki baat kartay hain jiska correlation oil prices say hai, Astralian doller (AUD) ka correlation Newzeland (NZD) say hai aur usk sath sath gold aur cruide bhi is say related hain. Ab yeh sab aik traders pay depend karta hai k us nay kasiay in correlations ko apnay mined main rkahtay hwauy market k chart main trading kartay hwuay losses say bachna hai aur kaisay profit ko hasil karna hai.

INTERPRETATION PROCESSES:

Dear, mairay knowledge k mutabik agar ham trading correlation ka acha knowledge hasil kartay hain to hamain market main kaam kartay hwauy double faida hasil ho skata hai qk jahan pay curriencies ka correlation hai wahi pay ham unko hedging kartay hwuay apnay orders ko long term k liye wait aur hold say acha faida hasil kar saktay hain, qk jab market main supply aur demand k time pay ham hedging k douraan cut kartay hain to next hamara order profit hasil karna start kar daiga jis say ham hedging positions say acha benefit hasil kar skatay hain.

Aslam u Alaikum! Dear members i hope ap sab kehriyat sy hon gay, or market main achi earning kar rhy hon gy. Dear agr ap market main kamyabi Hasil karna chahty hain to aapko Hamesha experience k satg kam karna hota hai aur apni learning ko perfect banana hota hai. Tab hi ap kamyabi hasil kar sakte hain.Forex trading mein agar aap successful trading karna chahte hain. To ap ko different factor par study karty hain to ap ko bhot zyda advantages available hoty hain aj main ap ko Reversal And Retracement k related important information share karna chahti hun umeed hai ap es ko achi tara samjhy gay.

WHAT IS CORRELATIONS IN FOREX TRADING:

Dear, mairay knowledge k mutabik jab forex market k chart main 2 curriencies ka aik dusray k sath correlation hota hai, jab chart pay 2 pairs same directions main run kartay hain to usay ham positive correlation kehtay hain, aur jab wahi pairs aik dusray k opposit run kartay hain tab ham unko negative correlation kehtay hain.

HOW TO TRADE CURRENCY CORRELATION :

Dear, mairay knowledge k mutabik world ki curriencies ka correlation bilkul normal hai, for example ham candial doller (CAD) ki baat kartay hain jiska correlation oil prices say hai, Astralian doller (AUD) ka correlation Newzeland (NZD) say hai aur usk sath sath gold aur cruide bhi is say related hain. Ab yeh sab aik traders pay depend karta hai k us nay kasiay in correlations ko apnay mined main rkahtay hwauy market k chart main trading kartay hwuay losses say bachna hai aur kaisay profit ko hasil karna hai.

INTERPRETATION PROCESSES:

Dear, mairay knowledge k mutabik agar ham trading correlation ka acha knowledge hasil kartay hain to hamain market main kaam kartay hwauy double faida hasil ho skata hai qk jahan pay curriencies ka correlation hai wahi pay ham unko hedging kartay hwuay apnay orders ko long term k liye wait aur hold say acha faida hasil kar saktay hain, qk jab market main supply aur demand k time pay ham hedging k douraan cut kartay hain to next hamara order profit hasil karna start kar daiga jis say ham hedging positions say acha benefit hasil kar skatay hain.

Currency correlation ko samajhne ke liye kuch mukhtalif types hoti hain: Positive Correlation Positive correlation mein 2 currencies ek dusre ke sath aapas mein mukhtalif times par badhte hain. Yeh taluqat am taur par un currencies ke darmiyan hoti hain jin ki economy halat ya economy policies mein samanta hoti hai. Misal ke taur par, agar Euro (EUR) aur British Pound (GBP) ki positive correlation hai, toh jab Euro ki keemat badhti hai, toh British Pound ki keemat bhi badhti hai. Aisa tab ho sakta hai kyunke dono currencies ka economy takh ek dusre se mutassir hota hai. Negative Correlation Negative correlation mein 2 currencies ulte harkat karte hain, yaani jab pehli currency badhti hai, toh dusri currency ghatti hai. Yeh taluqat am taur par un currencies ke darmiyan hoti hain jin ki economy policies ya tarrar ki keemat mein ulat pher hoti hai. Misal ke taur par, agar US Dollar (USD) aur Japanese Yen (JPY) ki negative correlation hai, toh jab USD ki keemat badhti hai, toh JPY ki keemat ghatti hai. Aisa tab ho sakta hai kyunke dono currencies ke beech safe-haven ki khasiyat hoti hai. Zero Correlation Zero correlation mein do currencies ka koi correlation nahin hota, jab ek currency badhti hai, toh dusri currency par koi asar nahin padta. Aisa tab ho sakta hai jab dono currencies ke darmiyan koi economy ya siasati taluq nahin hota hai. Misal ke taur par, agar Australian Dollar (AUD) aur Canadian Dollar (CAD) ki zero correlation hai, toh jab AUD ki keemat badhti hai, toh CAD ki keemat par koi asar nahin parta hai.

Currency correlation ko samajhne ke liye kuch mukhtalif types hoti hain: Positive Correlation Positive correlation mein 2 currencies ek dusre ke sath aapas mein mukhtalif times par badhte hain. Yeh taluqat am taur par un currencies ke darmiyan hoti hain jin ki economy halat ya economy policies mein samanta hoti hai. Misal ke taur par, agar Euro (EUR) aur British Pound (GBP) ki positive correlation hai, toh jab Euro ki keemat badhti hai, toh British Pound ki keemat bhi badhti hai. Aisa tab ho sakta hai kyunke dono currencies ka economy takh ek dusre se mutassir hota hai. Negative Correlation Negative correlation mein 2 currencies ulte harkat karte hain, yaani jab pehli currency badhti hai, toh dusri currency ghatti hai. Yeh taluqat am taur par un currencies ke darmiyan hoti hain jin ki economy policies ya tarrar ki keemat mein ulat pher hoti hai. Misal ke taur par, agar US Dollar (USD) aur Japanese Yen (JPY) ki negative correlation hai, toh jab USD ki keemat badhti hai, toh JPY ki keemat ghatti hai. Aisa tab ho sakta hai kyunke dono currencies ke beech safe-haven ki khasiyat hoti hai. Zero Correlation Zero correlation mein do currencies ka koi correlation nahin hota, jab ek currency badhti hai, toh dusri currency par koi asar nahin padta. Aisa tab ho sakta hai jab dono currencies ke darmiyan koi economy ya siasati taluq nahin hota hai. Misal ke taur par, agar Australian Dollar (AUD) aur Canadian Dollar (CAD) ki zero correlation hai, toh jab AUD ki keemat badhti hai, toh CAD ki keemat par koi asar nahin parta hai.  Currency correlation ko samajhna aur istemal karna forex traders ke liye behad zaroori hai, kyunke yeh unhein market ke mazboot aur kamzor mudraon ke beech rishton ko samajhne mein madad deta hai. Agar ek trader do currencies ki correlation ko theek se samajhta hai, toh woh sahi samay par position le sakte hain aur risk ko kam kar sakte hain. Misal ke taur par, agar ek trader positive correlation ko samajhta hai aur usse pata hota hai ke Euro (EUR) aur Swiss Franc (CHF) ki positive correlation hai, toh jab Euro ki keemat badhegi, woh Swiss Franc mein bhi izafa ki ummeed rakhsakta hai. Is tarah se, woh dono currencies ke beech taluqat ka faida utha sakta hai.

Currency correlation ko samajhna aur istemal karna forex traders ke liye behad zaroori hai, kyunke yeh unhein market ke mazboot aur kamzor mudraon ke beech rishton ko samajhne mein madad deta hai. Agar ek trader do currencies ki correlation ko theek se samajhta hai, toh woh sahi samay par position le sakte hain aur risk ko kam kar sakte hain. Misal ke taur par, agar ek trader positive correlation ko samajhta hai aur usse pata hota hai ke Euro (EUR) aur Swiss Franc (CHF) ki positive correlation hai, toh jab Euro ki keemat badhegi, woh Swiss Franc mein bhi izafa ki ummeed rakhsakta hai. Is tarah se, woh dono currencies ke beech taluqat ka faida utha sakta hai.

تبصرہ

Расширенный режим Обычный режим