IMPOTANAT CANDLESITCK IN FOREX MARKET

Forex exchanging man merchant exchange kerna pehla value graph ko read kerta ha. Value Chart value k pattern, momemtum aur designs man tabdeeli ko exactness k sath distinguish kerta ha. Candle Pattern money sets aur wares k value diagram man value ki development ko track kerna k liye hona wala generally significant ""Technical Tool"" ha. Forex Market man kisi b money pair ya product ko purchase/sell kerna k liye candle design per depend kerta ha.

HARAMI CANDLESICK PATTERN

Harami candle design ak "" Trend Reversal"" design ha jo long bullish aur negative pattern k end per banta ha. Japanese language man ""Harami"" word ka matalb "" Phragnant"" ha. Is design man b first light long bullish/negative flame banti ha aur second candle first candle ki genuine body man sa open hoti ha aur genuine body k ander he apna close deti ha. Is liye asa lagta ha k first candle phragnent ho is liye is design ka nam b Harami Candlestick Pattern rukha gya ha.

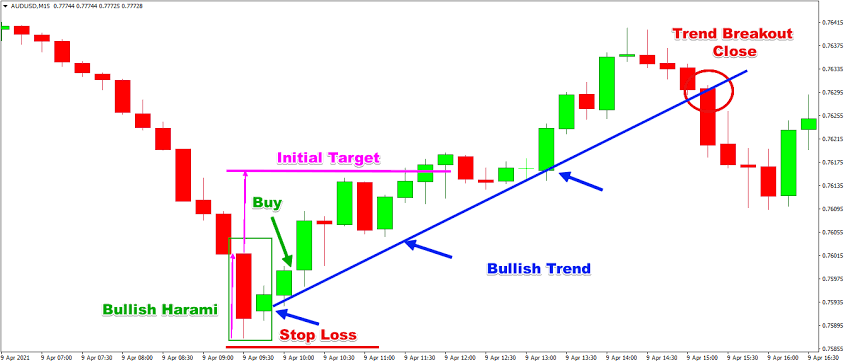

BULLISH HARAMI CANDLESICK PATTERN

Bullish Harami Candlestick Pattern ak negative pattern inversion design ha. Ye cash sets aur products k value outline man negative pattern k base per support level per normally nazer ana wala design ha.

IDENTIFICATION OF BULLISH HARANI CANDLESITCK PATTERN

Bullish Harami Candlestick Pattern two candles sa mil ker banta ha. Is design man first candle long genuine body ki Black candle banti ha. Jo market man venders k solid hold ko batati ha. Lakin second light ""Gap-up"" k sath first candle ki genuine body man sa open hoti ha aur thora sa value change de ker first flame ki genuine body man he close deti ha. Aur asa lagta ha k dark flame phragnant ho

Second flame ki genuine body first light ki genuine body k 25% sa zayada nahe honi chaheye werna design Bullish Harami nahe raha ga. Aur exchange signal b legitimate nahe hoga.

TRADING & BULLISH HARAMI CANDLESITCK PATTERN

Bullish Harami Candlestick Pattern k banna k terrible new light k open k sath broker ko ""Buy ki Trade"" dynamic kerni chaheye. Stoploss ko first dark candle ki low sa nicha place karen aur Take Profit ko next obstruction level per place karen.

Bullish Harami Candlestick Pattern k sath ager merchant kisi specialized pointer ko b use kara to exchange ki mazeed affirmation ho jae gi. Ager broker ""Relative Strength Index (RSI) Indicator"" ko use ker raha ha to is design ki development k doran RSI oversold (30 level sa nicha) region man honi chaheye aur exchange section k waqt RSI 30 level ko cross above ker rahe

DEAR FRIEND'S I AM NEW HERE PLEASE THANX MY POST

Forex exchanging man merchant exchange kerna pehla value graph ko read kerta ha. Value Chart value k pattern, momemtum aur designs man tabdeeli ko exactness k sath distinguish kerta ha. Candle Pattern money sets aur wares k value diagram man value ki development ko track kerna k liye hona wala generally significant ""Technical Tool"" ha. Forex Market man kisi b money pair ya product ko purchase/sell kerna k liye candle design per depend kerta ha.

HARAMI CANDLESICK PATTERN

Harami candle design ak "" Trend Reversal"" design ha jo long bullish aur negative pattern k end per banta ha. Japanese language man ""Harami"" word ka matalb "" Phragnant"" ha. Is design man b first light long bullish/negative flame banti ha aur second candle first candle ki genuine body man sa open hoti ha aur genuine body k ander he apna close deti ha. Is liye asa lagta ha k first candle phragnent ho is liye is design ka nam b Harami Candlestick Pattern rukha gya ha.

BULLISH HARAMI CANDLESICK PATTERN

Bullish Harami Candlestick Pattern ak negative pattern inversion design ha. Ye cash sets aur products k value outline man negative pattern k base per support level per normally nazer ana wala design ha.

IDENTIFICATION OF BULLISH HARANI CANDLESITCK PATTERN

Bullish Harami Candlestick Pattern two candles sa mil ker banta ha. Is design man first candle long genuine body ki Black candle banti ha. Jo market man venders k solid hold ko batati ha. Lakin second light ""Gap-up"" k sath first candle ki genuine body man sa open hoti ha aur thora sa value change de ker first flame ki genuine body man he close deti ha. Aur asa lagta ha k dark flame phragnant ho

Second flame ki genuine body first light ki genuine body k 25% sa zayada nahe honi chaheye werna design Bullish Harami nahe raha ga. Aur exchange signal b legitimate nahe hoga.

TRADING & BULLISH HARAMI CANDLESITCK PATTERN

Bullish Harami Candlestick Pattern k banna k terrible new light k open k sath broker ko ""Buy ki Trade"" dynamic kerni chaheye. Stoploss ko first dark candle ki low sa nicha place karen aur Take Profit ko next obstruction level per place karen.

Bullish Harami Candlestick Pattern k sath ager merchant kisi specialized pointer ko b use kara to exchange ki mazeed affirmation ho jae gi. Ager broker ""Relative Strength Index (RSI) Indicator"" ko use ker raha ha to is design ki development k doran RSI oversold (30 level sa nicha) region man honi chaheye aur exchange section k waqt RSI 30 level ko cross above ker rahe

DEAR FRIEND'S I AM NEW HERE PLEASE THANX MY POST

تبصرہ

Расширенный режим Обычный режим