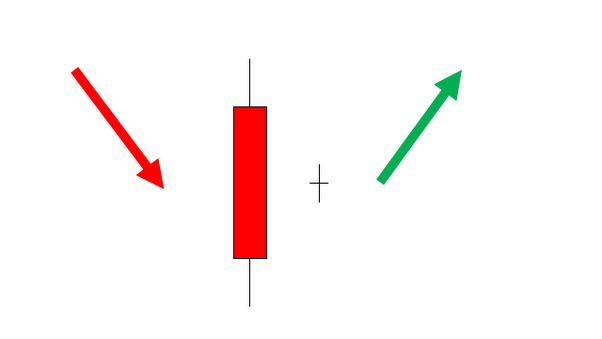

candlestick pattern ha ya market ka chart ma banta ha ir market ka trend ko reversal karna ka kam karta ha. Ya pattern market ma do candlestick sa mil kar banta ha is pattern ke first candle ak long real body bearish ke candle hote ha or dosre candle ak small doji candle hote ha. Ya pattern market ka chart ma downtrend ka bottom ma banay ga or ya market ka reversal ka batay ga is pattern ma reversal downtrend sa ho ga or market uptrend ke traf jay ge. Is pattern ke jo second doji candle ho ge wo full contain ho ge is pattern ke previous candle ka. Ya harami cross pattern market ka chart ma zada effective ho ga simple bullish harami pattern sa. Ya pattern jab market ma trend ka end par banay ga to ya market ma strong reversal kara ga or market reversal kar ka bearish to bullish ke traf jay ge. Ya bullish harami cross pattern market ka low ma support level ka near ma ho ga or market ko upward ke traf push kara ga. Ya bullish harami pattern bearish Harami pattern ka opposite ho ga ya pattern market ka chart ma uptrend par bany ga or ya market ko bullish sa bearish ke traf reversal karna ka kam kara ga ya pattern bhi do candle sa banay ga ak bullish or dosre candle doji ho ge.  Candlestick Pattern Design ki second doji light k high aur trad hi depressed spot mukamal shadow dark flame k genuine body se baher nahi hona chaheye. Bullish Harami Cross example bhi same bullish harami design jaisa hai, lekin dosri light bullish sharpen ki bajaye aik doji flame hoti hai. Ye design ziada tar low cost region ya all time trading say hi negative pattern k baad banta hai, is waja se ye aik pattern inversion design hai, jis me do candles shamil hoti hai. first light hy...market high sa low ke traf push ho ge or is candle ma strong bear ka pressure ho ga is ka bad market ma reversal start ho jay ga ya reversal market ma strong gap ke sorat ma ho ga is ma second candle doji banay ge jes ma market ka bear or bull ka pressure same ho ga jo huma market ka indecision ko show kara ga is liya is pattern ma traders trade ko enter karna ka liya traders is pattern ke conformation sab sa phalay kara ga. Jab is pattern ke dono candle close ho jay ge to is time ya pattern traders ko indecision ko show kar raha ho ga or traders is pattern ka uptrend ke traf reversal ko find karna ka liya is pattern ke conformation kara ga ya conformation is pattern ke next movement kara ge agar is pattern second doji candle ka bad agar market ke movement high ke traf jay ge yani agr is pattern me next candle bullish ma close ho ge

Candlestick Pattern Design ki second doji light k high aur trad hi depressed spot mukamal shadow dark flame k genuine body se baher nahi hona chaheye. Bullish Harami Cross example bhi same bullish harami design jaisa hai, lekin dosri light bullish sharpen ki bajaye aik doji flame hoti hai. Ye design ziada tar low cost region ya all time trading say hi negative pattern k baad banta hai, is waja se ye aik pattern inversion design hai, jis me do candles shamil hoti hai. first light hy...market high sa low ke traf push ho ge or is candle ma strong bear ka pressure ho ga is ka bad market ma reversal start ho jay ga ya reversal market ma strong gap ke sorat ma ho ga is ma second candle doji banay ge jes ma market ka bear or bull ka pressure same ho ga jo huma market ka indecision ko show kara ga is liya is pattern ma traders trade ko enter karna ka liya traders is pattern ke conformation sab sa phalay kara ga. Jab is pattern ke dono candle close ho jay ge to is time ya pattern traders ko indecision ko show kar raha ho ga or traders is pattern ka uptrend ke traf reversal ko find karna ka liya is pattern ke conformation kara ga ya conformation is pattern ke next movement kara ge agar is pattern second doji candle ka bad agar market ke movement high ke traf jay ge yani agr is pattern me next candle bullish ma close ho ge  â*Indication of bullish Harami cross candlestick: Dear forex members bullish Harami cross candlestick normally aik simple doji candlestick ki Tarah ki hoti Hy is candle ka real body nahi hota q k is k opening or closing point same hote hain market Jis point se Banna start Hoti hai same usi point py a k candle close krti Hy bullish Harami cross candlestick aik plus k sign ki Tarah ki hoti Hy or yh hmesha bearish trend k last py banti Hy or market ka previous trend change ho k upper trend Yani k bullish trend ban jata Hy is Tarah sy yh candle aik trend reversal candlestick kehlay gi q k Is sy market ka trend apni direction change kr deta Hy.

â*Indication of bullish Harami cross candlestick: Dear forex members bullish Harami cross candlestick normally aik simple doji candlestick ki Tarah ki hoti Hy is candle ka real body nahi hota q k is k opening or closing point same hote hain market Jis point se Banna start Hoti hai same usi point py a k candle close krti Hy bullish Harami cross candlestick aik plus k sign ki Tarah ki hoti Hy or yh hmesha bearish trend k last py banti Hy or market ka previous trend change ho k upper trend Yani k bullish trend ban jata Hy is Tarah sy yh candle aik trend reversal candlestick kehlay gi q k Is sy market ka trend apni direction change kr deta Hy.

Candlestick Pattern Design ki second doji light k high aur trad hi depressed spot mukamal shadow dark flame k genuine body se baher nahi hona chaheye. Bullish Harami Cross example bhi same bullish harami design jaisa hai, lekin dosri light bullish sharpen ki bajaye aik doji flame hoti hai. Ye design ziada tar low cost region ya all time trading say hi negative pattern k baad banta hai, is waja se ye aik pattern inversion design hai, jis me do candles shamil hoti hai. first light hy...market high sa low ke traf push ho ge or is candle ma strong bear ka pressure ho ga is ka bad market ma reversal start ho jay ga ya reversal market ma strong gap ke sorat ma ho ga is ma second candle doji banay ge jes ma market ka bear or bull ka pressure same ho ga jo huma market ka indecision ko show kara ga is liya is pattern ma traders trade ko enter karna ka liya traders is pattern ke conformation sab sa phalay kara ga. Jab is pattern ke dono candle close ho jay ge to is time ya pattern traders ko indecision ko show kar raha ho ga or traders is pattern ka uptrend ke traf reversal ko find karna ka liya is pattern ke conformation kara ga ya conformation is pattern ke next movement kara ge agar is pattern second doji candle ka bad agar market ke movement high ke traf jay ge yani agr is pattern me next candle bullish ma close ho ge

Candlestick Pattern Design ki second doji light k high aur trad hi depressed spot mukamal shadow dark flame k genuine body se baher nahi hona chaheye. Bullish Harami Cross example bhi same bullish harami design jaisa hai, lekin dosri light bullish sharpen ki bajaye aik doji flame hoti hai. Ye design ziada tar low cost region ya all time trading say hi negative pattern k baad banta hai, is waja se ye aik pattern inversion design hai, jis me do candles shamil hoti hai. first light hy...market high sa low ke traf push ho ge or is candle ma strong bear ka pressure ho ga is ka bad market ma reversal start ho jay ga ya reversal market ma strong gap ke sorat ma ho ga is ma second candle doji banay ge jes ma market ka bear or bull ka pressure same ho ga jo huma market ka indecision ko show kara ga is liya is pattern ma traders trade ko enter karna ka liya traders is pattern ke conformation sab sa phalay kara ga. Jab is pattern ke dono candle close ho jay ge to is time ya pattern traders ko indecision ko show kar raha ho ga or traders is pattern ka uptrend ke traf reversal ko find karna ka liya is pattern ke conformation kara ga ya conformation is pattern ke next movement kara ge agar is pattern second doji candle ka bad agar market ke movement high ke traf jay ge yani agr is pattern me next candle bullish ma close ho ge

تبصرہ

Расширенный режим Обычный режим