What is Harami Candlestick Pattern?

Harami Candlestick pattern 1 Japanese candlestick pattern hai joo kaybmarket main bullish aur bearish short term signals produce karta hai. Harami Candlestick pattern price action kee directions ky hisaaab say bullish ya bearish consider hota hai. Harami candlestick pattern do candlesticks par mushtamil hottaa hai. 1 candlesticks bullish aur dosri bearish hoti hai aur es hisaab say market ke bullish ya bearish direction ka andaza lagaya jaata hai. Neechy dee gai tasveer main aap bullish aur bearish Harami patterns dekeh sakte hain.

Bullish Harami Candlestick Important Points

1. Yeh Downtrend Ka agahaz karta hai

2. Pehli candlestick bari aur bearish hoti hai

3. Bearish candlestick kay baad us sy qadry choti bullish candlestick banti hai

Bearish Harami Important Points

1. Uptrend ka aghaaz karti hai

2. Pehli candlestick bari aur bullish hotii hay

3. Dosri candlestick choti aur bearish hoti hai

How To Trade On Harami Pattern

Harami Candlestick patterns 2no bullish aur bearish signals muhaiyyah karta hain aur yeh signal candlestick pattern kay zariye pehchaany ja sakte hain kay bullish hain ya bearish. Neechy dono pattern ke tasaveer aur details main aap kay sath share karne jaa raha hun jis main ye pattern aap clearly dekh sakte hain.

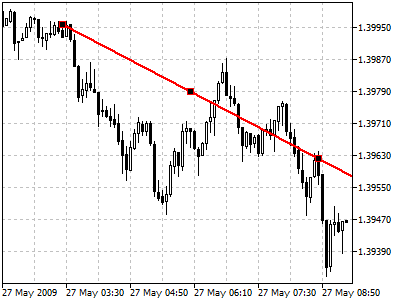

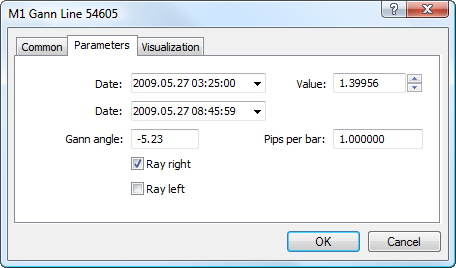

Example Of Bearish Harami

Oper dee hui tasveer main apne dekha kay bullish Harami pattern bany kay baad kis tarha market ny move kiya to same ussi tarha market nay bearish pattern banny kay baad bhe matket ke movement dekhai hai. Lekin aik baat aur jo zehan nasheen karne ke zaroorat hai kay trading karte huy trading ka time frame, classic chart pattern aur price action ko dekh kar decision lain.

Example Of Bullish Harami

Oper dee gai tasvier main mulahiza kiya jaa sakta hai kay EURUSD pair par bullish harami pattern bnnay kay baad uptrend dobara sy jaari hua hai. Lekin ess baat ko bhee madenazar rakhna chahey kay tamaam Harami pattern reversal ke taraf ishaara nahi karte.

Harami Candlestick pattern 1 Japanese candlestick pattern hai joo kaybmarket main bullish aur bearish short term signals produce karta hai. Harami Candlestick pattern price action kee directions ky hisaaab say bullish ya bearish consider hota hai. Harami candlestick pattern do candlesticks par mushtamil hottaa hai. 1 candlesticks bullish aur dosri bearish hoti hai aur es hisaab say market ke bullish ya bearish direction ka andaza lagaya jaata hai. Neechy dee gai tasveer main aap bullish aur bearish Harami patterns dekeh sakte hain.

Bullish Harami Candlestick Important Points

1. Yeh Downtrend Ka agahaz karta hai

2. Pehli candlestick bari aur bearish hoti hai

3. Bearish candlestick kay baad us sy qadry choti bullish candlestick banti hai

Bearish Harami Important Points

1. Uptrend ka aghaaz karti hai

2. Pehli candlestick bari aur bullish hotii hay

3. Dosri candlestick choti aur bearish hoti hai

How To Trade On Harami Pattern

Harami Candlestick patterns 2no bullish aur bearish signals muhaiyyah karta hain aur yeh signal candlestick pattern kay zariye pehchaany ja sakte hain kay bullish hain ya bearish. Neechy dono pattern ke tasaveer aur details main aap kay sath share karne jaa raha hun jis main ye pattern aap clearly dekh sakte hain.

Example Of Bearish Harami

Oper dee hui tasveer main apne dekha kay bullish Harami pattern bany kay baad kis tarha market ny move kiya to same ussi tarha market nay bearish pattern banny kay baad bhe matket ke movement dekhai hai. Lekin aik baat aur jo zehan nasheen karne ke zaroorat hai kay trading karte huy trading ka time frame, classic chart pattern aur price action ko dekh kar decision lain.

Example Of Bullish Harami

Oper dee gai tasvier main mulahiza kiya jaa sakta hai kay EURUSD pair par bullish harami pattern bnnay kay baad uptrend dobara sy jaari hua hai. Lekin ess baat ko bhee madenazar rakhna chahey kay tamaam Harami pattern reversal ke taraf ishaara nahi karte.

تبصرہ

Расширенный режим Обычный режим