what is volatile currency pair;

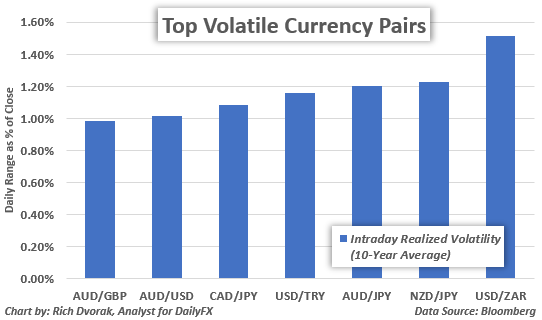

sab say zyada volaile currency pair yeh hein

AUD/JPY

NZD/JPY

AUD/USD

CAD/JPY

AUD/GBP

dosray major currency pair jaisa keh EUR/USD, USD/JPY, GBP/USD or USD/CHF yeh currency pair aam tor par zyada liquid or kam volatile hein obharty hove market mein currency pair jaisay USD/ZAR,USD/TRY OR USD/MXN yeh kuch pairs boland tareen volatile ko bhe clock kar saktay hein

most volatile currency pair;

Major; AUD/JPY, NZD/JPY, AUD/USD, GBP/AUD, CAD/JPY

Emerging market; USD/ZAR, USD/TRY, USD/MXN

nesbatan kam liquidity kay elawa emerging market currency trend khas tor par emerging trend economy kay ley marose risk ke wajah say entahai volatile ka shekar hotay hein nechay deya geya chart es bat ke mesal dayta hey keh emerging market ke currencies kitne un stable ho sakte hein USD/SAR, USD/ZAR ko serf aik mah kay arsay mein takreban 25% higher dekhaya geya hey emerging market kay currency joron ke pore market es tarah taize say swing karnay ke ki dosre mesal nahe hey

Kam volatile kay currency pairs;

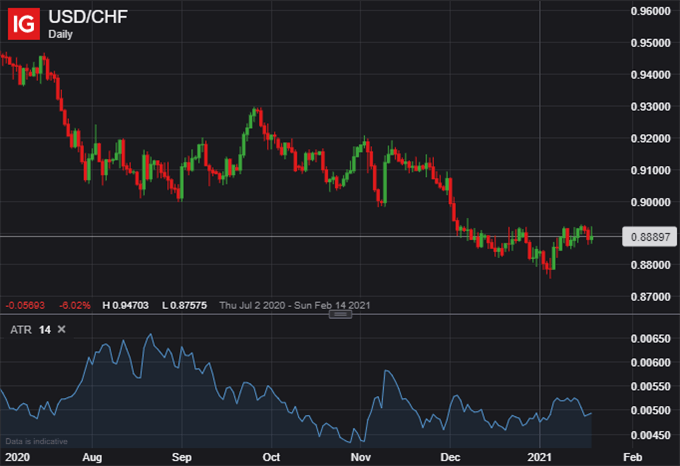

kam volatile currency pair major currency pair hotay hein jo sab say zyada liquidity hotay hein naiz yeh economy bare or zyada tarqe yafta mein hotay hein yeh zyada trading volume ko apni taraf motowajah kartay hein or badlay mein zyada stable hotay hein es maksad kay ley USD/CHF, EUR/USD, EUR/GBP Trade ke liquidity kay zyada volume kay sath yeh mamole taojob ke baat hey keh woh kam volatile wallay currency pairs mein shamel hein

zail mein yeh bat wazah ke gai hey keh average sahe range (ATR)45 pips or 65 kay darmean hey jo dosray currency pairs kay mokabalay mein kam average hey currency ke average limit currency kay volatile ko mapnay ka behtaren tarekon mein say aik hey Bollinger Band ke volatile ka aik bohut he acha technical indicator hey

sab say zyada volaile currency pair yeh hein

AUD/JPY

NZD/JPY

AUD/USD

CAD/JPY

AUD/GBP

dosray major currency pair jaisa keh EUR/USD, USD/JPY, GBP/USD or USD/CHF yeh currency pair aam tor par zyada liquid or kam volatile hein obharty hove market mein currency pair jaisay USD/ZAR,USD/TRY OR USD/MXN yeh kuch pairs boland tareen volatile ko bhe clock kar saktay hein

most volatile currency pair;

Major; AUD/JPY, NZD/JPY, AUD/USD, GBP/AUD, CAD/JPY

Emerging market; USD/ZAR, USD/TRY, USD/MXN

nesbatan kam liquidity kay elawa emerging market currency trend khas tor par emerging trend economy kay ley marose risk ke wajah say entahai volatile ka shekar hotay hein nechay deya geya chart es bat ke mesal dayta hey keh emerging market ke currencies kitne un stable ho sakte hein USD/SAR, USD/ZAR ko serf aik mah kay arsay mein takreban 25% higher dekhaya geya hey emerging market kay currency joron ke pore market es tarah taize say swing karnay ke ki dosre mesal nahe hey

Kam volatile kay currency pairs;

kam volatile currency pair major currency pair hotay hein jo sab say zyada liquidity hotay hein naiz yeh economy bare or zyada tarqe yafta mein hotay hein yeh zyada trading volume ko apni taraf motowajah kartay hein or badlay mein zyada stable hotay hein es maksad kay ley USD/CHF, EUR/USD, EUR/GBP Trade ke liquidity kay zyada volume kay sath yeh mamole taojob ke baat hey keh woh kam volatile wallay currency pairs mein shamel hein

zail mein yeh bat wazah ke gai hey keh average sahe range (ATR)45 pips or 65 kay darmean hey jo dosray currency pairs kay mokabalay mein kam average hey currency ke average limit currency kay volatile ko mapnay ka behtaren tarekon mein say aik hey Bollinger Band ke volatile ka aik bohut he acha technical indicator hey

تبصرہ

Расширенный режим Обычный режим