Candlestick pattern kya hote Hain

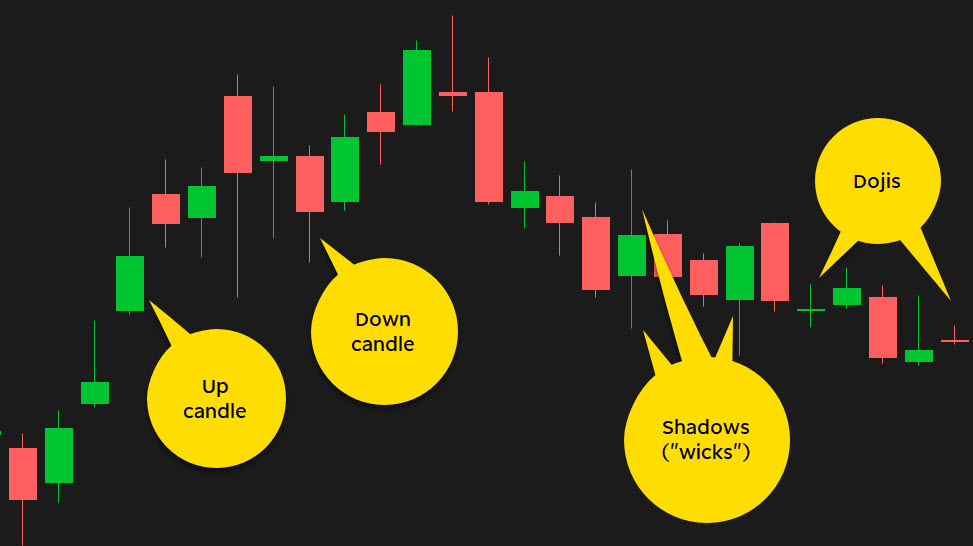

Candlestick patterns, financial markets mein istemal hone wale visual indicators hote hain jo trading aur technical analysis mein istemal hote hain. Ye patterns market ki price movements ko represent karte hain aur traders ko market ka future direction predict karne mein madad karte hain. Har candlestick pattern ek ya multiple candles se bana hota hai, aur har ek candle specific information provide karta hai.

mein, candlestick patterns ko is tarah se bayan kiya ja sakta hai:

"Candlestick patterns, jo ke market analysis mein istemal hotay hain, ye visual indicators hain jo price movements ko darust karne mein madad dete hain. Har candlestick pattern ek ya zyada candles se bana hota hai, aur har ek candle khas malumat farahem karta hai."

Candlestick patterns ka istemal market trends, reversals, aur potential entry/exit points ko samajhne ke liye hota hai. Kuch mashhoor candlestick patterns mein include hoti hain Doji, Hammer, Shooting Star, Engulfing, aur Head and Shoulders. Har ek pattern ka apna apna matlub aur interpretation hota hai, aur traders in patterns ko apni trading strategies mein shamil karte hain.

tool hai jo financial markets mein istemal hota hai. Ye patterns price movements ko represent karte hain aur traders ko market ka mood samajhne mein madad karte hain. Har candlestick ek specific time period ko represent karta hai, jise time frame kehte hain (jaise ki 1 minute, 1 hour, 1 day, etc.).

Yeh kuch common candlestick patterns hain:

- Doji: Ye ek candlestick hai jiska opening price aur closing price barabar hoti hai. Iska matlab hai ki market mein indecision hai aur buyers aur sellers mein equal strength hai.

- Hammer: Hammer pattern ek bullish reversal pattern hai, jo downtrend ke baad aata hai. Isme ek choti si body hoti hai aur lambi lower shadow hoti hai, jo indicate karta hai ki sellers ne try kiya price ko neeche le jaane ki, lekin buyers ne ise recover kar liya hai.

- Shooting Star: Shooting star pattern ek bearish reversal pattern hai, jo uptrend ke baad aata hai. Isme ek choti si body hoti hai aur lambi upper shadow hoti hai, jo indicate karta hai ki buyers ne try kiya price ko upar le jaane ki, lekin sellers ne ise recover kar liya hai.

- Engulfing Pattern: Engulfing pattern ek reversal pattern hai, jo ek trend ke opposite direction mein hota hai. Bullish engulfing ek downtrend ke baad aata hai aur bearish engulfing ek uptrend ke baad aata hai.

- Morning Star aur Evening Star: Ye trend reversal patterns hain. Morning star ek downtrend ke baad aata hai aur bullish reversal ko indicate karta hai, jabki evening star ek uptrend ke baad aata hai aur bearish reversal ko indicate karta hai.

In patterns ki madad se traders market mein hone wale potential reversals ya trend changes ko predict karne ki koshish karte hain. Hamesha yaad rahe ki ek hi pattern par poora bharosa na karein aur dusre technical indicators aur analysis tools ka bhi istemal karein market direction ko confirm karne ke liye.

تبصرہ

Расширенный режим Обычный режим