Forex account maintenance, yaani ke hisaab kitaab aur account ko chalane ka silsila hai jismein trading account ko smooth aur health maintain karna shamil hai. Yeh kai mukhtalif kamon aur ghor o fikr ko shamil karta hai taake trading account behtar taur par kaam kare. Yahan kuch account maintenance ke zaroori pehlu hain:

Balance Ka Monitoring:

- Regularly account balance check karna taake maloom ho ke kitna profit, loss, aur available margin hai.

Risk Management:

- Risk parameters, jaise ke stop-loss orders aur position sizes, ko adjust karna taake nuksan ko control mein rakha ja sake.

Position Ka Monitoring:

- Open positions ko nazar mein rakhna, unki performance ka andaza lagana, aur faislay karna ke kya position band karna chahiye, modify karna chahiye, ya naye positions add karni chahiye.

Market Analysis:

- Market analysis ko regular basis par karna taake trading opportunities ya threats ko pehchan saka ja sake. Isme technical aur fundamental analysis shaamil hai.

Transaction History Ka Review:

- Transaction history ko review karna taake past trades ki performance track ki ja sake aur patterns ya improvement ke liye areas ko identify kiya ja sake.

Withdrawals Aur Deposits:

- Funds ko zaroorat ke mutabiq withdraw ya deposit karna. Ye trading goals, risk tolerance, aur overall financial strategy par depend karta hai.

Trading Strategy Ko Adjust Karna:

- Trading strategy ko changing market conditions ya personal trading objectives ke mutabiq modify karna.

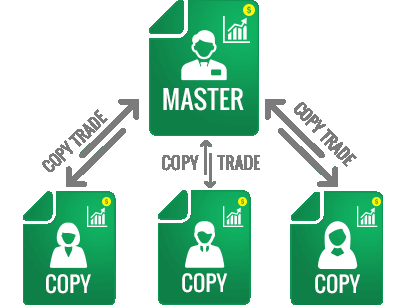

Copy Trading in Forex:

Copy trading, jo ke social trading ya mirror trading bhi kaha jata hai, woh ek feature hai jo kuch brokers aur platforms offer karte hain jisme traders experienced aur successful traders ke trades ko automatic taur par replicate kar sakte hain. Yahan copy trading ke kuch ahem pehlu hain:

Strategy Replication:

- Copy trading investors ko allow karta hai ke woh experienced traders ke strategies ko bina apne trades ko actively manage kiye replicate kar sakein.

Risk Diversification:

- Investors multiple traders ko copy karke apne risk ko diversify kar sakte hain, jo alag strategies, styles, aur risk profiles ke hote hain.

Automatic Execution:

- Trades automatically investor ke account par real-time mein execute hote hain, based on the actions of the selected trader.

Transparency:

- Copy trading platforms aksar traders ke performance, risk levels, aur trading history ko display karke transparency provide karte hain.

Flexibility:

- Investors ko flexibility milti hai ke woh kabhi bhi copy trading start ya stop kar sakein. Woh apne funds ko different traders mein allocate bhi kar sakte hain.

Educational Value:

- Copy trading less experienced traders ke liye ek educational tool ki tarah kaam karta hai, jo unhe more seasoned investors ke strategies se seekhne mein madad karta hai.

Monitoring Aur Analysis:

- Investors copied trades ki performance ko monitor kar sakte hain aur zaroorat par based adjustments ya copying ko stop kar sakte hain.

Ikhtisar mein, jabke account maintenance ek individual trading account ko rozana manage aur monitor karne ka kaam hai, copy trading ek automated approach provide karta hai jisme investors dusre successful traders ke trades ko replicate kar sakte hain. Dono tareeqay forex trading ke broad landscape mein ahem role ada karte hain aur alag preferences aur expertise levels ko cater karte hain.

Balance Ka Monitoring:

- Regularly account balance check karna taake maloom ho ke kitna profit, loss, aur available margin hai.

Risk Management:

- Risk parameters, jaise ke stop-loss orders aur position sizes, ko adjust karna taake nuksan ko control mein rakha ja sake.

Position Ka Monitoring:

- Open positions ko nazar mein rakhna, unki performance ka andaza lagana, aur faislay karna ke kya position band karna chahiye, modify karna chahiye, ya naye positions add karni chahiye.

Market Analysis:

- Market analysis ko regular basis par karna taake trading opportunities ya threats ko pehchan saka ja sake. Isme technical aur fundamental analysis shaamil hai.

Transaction History Ka Review:

- Transaction history ko review karna taake past trades ki performance track ki ja sake aur patterns ya improvement ke liye areas ko identify kiya ja sake.

Withdrawals Aur Deposits:

- Funds ko zaroorat ke mutabiq withdraw ya deposit karna. Ye trading goals, risk tolerance, aur overall financial strategy par depend karta hai.

Trading Strategy Ko Adjust Karna:

- Trading strategy ko changing market conditions ya personal trading objectives ke mutabiq modify karna.

Copy Trading in Forex:

Copy trading, jo ke social trading ya mirror trading bhi kaha jata hai, woh ek feature hai jo kuch brokers aur platforms offer karte hain jisme traders experienced aur successful traders ke trades ko automatic taur par replicate kar sakte hain. Yahan copy trading ke kuch ahem pehlu hain:

Strategy Replication:

- Copy trading investors ko allow karta hai ke woh experienced traders ke strategies ko bina apne trades ko actively manage kiye replicate kar sakein.

Risk Diversification:

- Investors multiple traders ko copy karke apne risk ko diversify kar sakte hain, jo alag strategies, styles, aur risk profiles ke hote hain.

Automatic Execution:

- Trades automatically investor ke account par real-time mein execute hote hain, based on the actions of the selected trader.

Transparency:

- Copy trading platforms aksar traders ke performance, risk levels, aur trading history ko display karke transparency provide karte hain.

Flexibility:

- Investors ko flexibility milti hai ke woh kabhi bhi copy trading start ya stop kar sakein. Woh apne funds ko different traders mein allocate bhi kar sakte hain.

Educational Value:

- Copy trading less experienced traders ke liye ek educational tool ki tarah kaam karta hai, jo unhe more seasoned investors ke strategies se seekhne mein madad karta hai.

Monitoring Aur Analysis:

- Investors copied trades ki performance ko monitor kar sakte hain aur zaroorat par based adjustments ya copying ko stop kar sakte hain.

Ikhtisar mein, jabke account maintenance ek individual trading account ko rozana manage aur monitor karne ka kaam hai, copy trading ek automated approach provide karta hai jisme investors dusre successful traders ke trades ko replicate kar sakte hain. Dono tareeqay forex trading ke broad landscape mein ahem role ada karte hain aur alag preferences aur expertise levels ko cater karte hain.

تبصرہ

Расширенный режим Обычный режим