Kia Indicators signals use karna best hay?

"Best" indicators ka chunav vyaktigat taur par alag hota hai aur ye depend karta hai ki aapke trading style, market conditions, aur risk tolerance kya hai. Har ek indicator apne taur par unique hota hai aur kisi bhi ek indicator ko sabhi traders ke liye suitable ya best kehna mushkil hai. Lekin, yahaan kuch popular indicators hain jo traders commonly use karte hain:

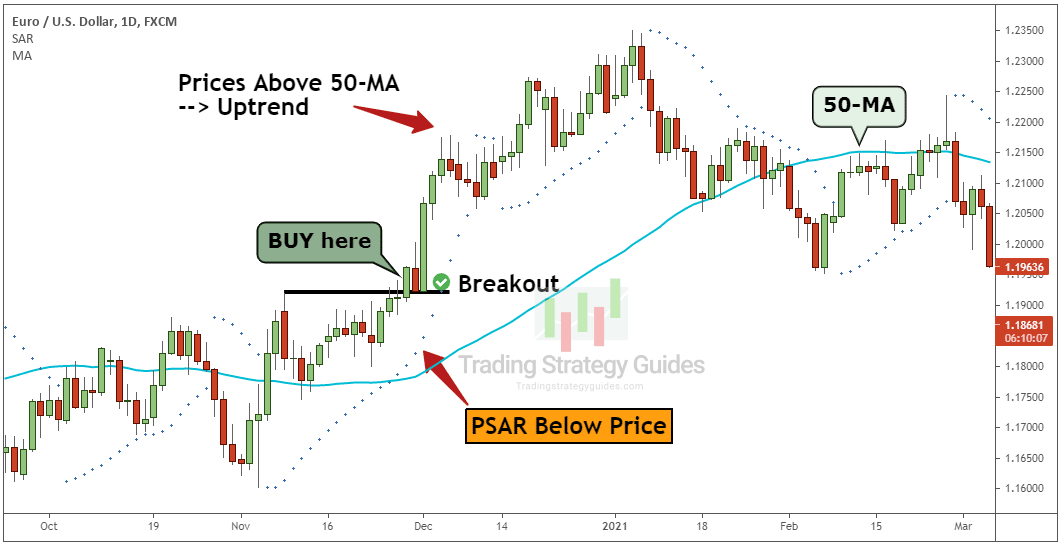

- Moving Averages (MA):

- Simple Moving Average (SMA) aur Exponential Moving Average (EMA) traders ke beech mein prachlit hain. Ye trend ka pata lagane mein aur entry/exit points tay karne mein madad karte hain.

- Relative Strength Index (RSI):

- RSI overbought aur oversold conditions ko identify karta hai. Ye momentum aur trend reversal ko gauge karne mein upyogi hai.

- Moving Average Convergence Divergence (MACD):

- MACD trend direction aur momentum ko measure karta hai. Signal line aur histogram ke saath use kiya jata hai.

- Bollinger Bands:

- Bollinger Bands volatility ko measure karte hain. Price ke upper aur lower bands ko dekhte hue traders price volatility ko samajh sakte hain.

- Stochastic Oscillator:

- Stochastic Oscillator overbought aur oversold conditions ko indicate karta hai. Ye momentum ke shifts ko identify karne mein help karta hai.

- Fibonacci Retracements:

- Fibonacci retracement levels trend reversals aur pullbacks ko identify karne mein use hote hain. Ye technical analysis mein common hai.

- Ichimoku Cloud:

- Ichimoku Cloud multiple lines aur a shaded area ka combination hai jo trend direction, support, aur resistance ko represent karta hai.

- Average True Range (ATR):

- ATR volatility ko measure karta hai, jisse traders stop-loss levels aur position sizes tay kar sakte hain.

- Parabolic SAR:

- Parabolic SAR trend reversals ko indicate karta hai. Uptrend ke dauran ye dots price ke neeche, aur downtrend ke dauran dots price ke upar aate hain.

- Volume:

- Trading volume bhi ek important indicator hai. High volume trend continuation aur reversal ko confirm karta hai.

Yeh sirf kuch indicators hain, lekin har ek indicator ke apne advantages aur limitations hote hain. Traders ko apne trading strategy ke hisab se indicators ka chayan karna chahiye aur unhe sahi taur par interpret karne ka tarika sikhein. Kabhi-kabhi, multiple indicators ka istemal ek saath bhi kiya jata hai taki confirmatory signals mil sakein.

تبصرہ

Расширенный режим Обычный режим