:::Trade Lgane Ka Sahi Time:::

Stock trading ka sahi time market conditions, economic indicators, aur aapke personal financial goals par depend karta hai.

:::Trade Lgane Ka Sahi Halaat:::

Yeh kuch factors hain jo aapko trading karne se pehle consider karna chahiye:

Iske alawa, aapko apne financial goals, risk tolerance, aur market conditions ko dhyan mein rakhkar decide karna chahiye ki kaunsa time aapke liye sahi hai. Yaad rahe ki market mein koi fixed formula nahi hoti, aur har trader ka approach alag hota hai.

Stock trading ka sahi time market conditions, economic indicators, aur aapke personal financial goals par depend karta hai.

:::Trade Lgane Ka Sahi Halaat:::

Yeh kuch factors hain jo aapko trading karne se pehle consider karna chahiye:

- Liquidity:

- Market ke opening aur closing times mein generally zyada liquidity hoti hai. Opening bell ke time par market mein volatility hoti hai, jo traders ke liye opportunities create kar sakti hai. Lekin, yeh time risky bhi ho sakta hai. Closing time par bhi market mein activity hoti hai.

- Economic Indicators:

- Market movements mein economic indicators ka bada asar hota hai. Important economic reports, jaise ki employment data, GDP growth, aur interest rate decisions, ke time par market mein volatility badh sakti hai.

- News Events:

- Koi bhi significant news event, jaise ki geopolitical developments ya corporate earnings reports, market mein sudden changes la sakte hain. Aise events ke time par trading karna riskier ho sakta hai.

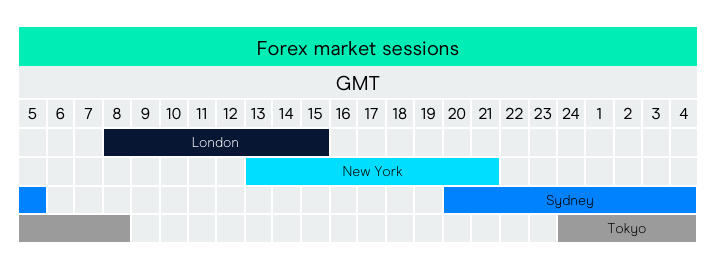

- Time Zone:

- Aapki geographical location bhi ek important factor ho sakta hai. Agar aap kisi specific market ke stocks trade karte hain, toh woh market ke time zone ke hisab se trading hours decide karna important hai.

- Risk Tolerance:

- Aapki risk tolerance level ko bhi consider karna important hai. Kuch log volatile market conditions mein comfortable feel karte hain, jabki kuch log prefer karte hain ki market stable ho.

- Trading Strategy:

- Aapki trading strategy bhi decide karegi ki aap kaunsa time prefer karte hain. Scalping traders short-term price movements par focus karte hain, jabki long-term investors market fluctuations se kam concerned hote hain.

Iske alawa, aapko apne financial goals, risk tolerance, aur market conditions ko dhyan mein rakhkar decide karna chahiye ki kaunsa time aapke liye sahi hai. Yaad rahe ki market mein koi fixed formula nahi hoti, aur har trader ka approach alag hota hai.

تبصرہ

Расширенный режим Обычный режим