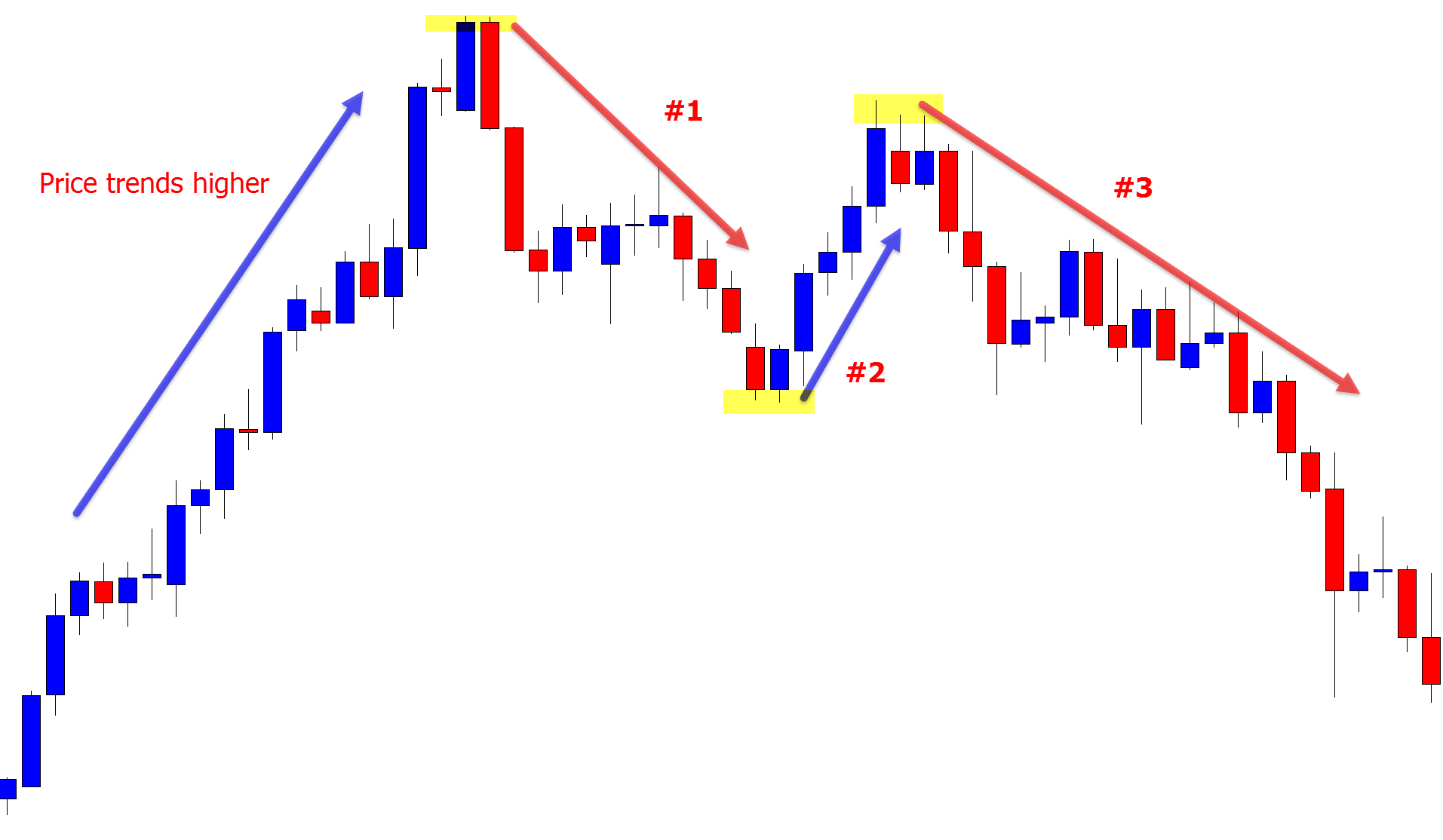

Dears members Assalamu Alaikum market mein jo candlestick ban rhi Hoti Hai usmein do different types ke patern ban Rahe hote hain Ek continue pattern aur ek reversal pattern reversal pattern. Continue patterns wo hota hai ki market ki next movement ab opposite direction Mein Hogi aur continue patterns Mein yah show ho raha Hota Hai ke market ki next movement same direction Mein Hone Wali Hai.

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Reversal and Continue Pattern -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Re: Reversal and Continue Pattern

Dear friend Apne bahut hi acchi information share Ki Hai Jab Bhi Hamen trading Karni hoti hai to hamare liye candle stick ki ki moment ko jaj karna bahut hi Jaruri Hota Hai what candlestick do different type ke pattern Bane Hote Hain 1 reversal pattern hota hai aur ek counter new pattern Hota Hai Hamesha Jab usko jaj Karte Hain To Jo candle ki ek stick Ki Maut hoti hai vah vah dusri ke opposite chal rahi Hoti Hai jisse Hamen main candlestick ki movement ko charge karne mein aasani Hoti Hai Jab Bhi aap trading karte hain to aapko Forex Ke chart ko Jarur follow karna chahie isko follow kar ki hi aap behtarin tarike Se markaj Ke 10 ko dekh sakte hain candlestick ki mobile ko charge kar sakte hain aur Hamesha koshish Kiya Karen ke Soch samajh gaye aur marksheet train Ko Yad karte hue trade Lagaya Karen kabhi bhi Bina soche samjhe kar kam na Kiya Karen tab yah aap successful ho sakte hainاصل پيغام ارسال کردہ از: Pips-Humter پيغام ديکھيےDears members Assalamu Alaikum market mein jo candlestick ban rhi Hoti Hai usmein do different types ke patern ban Rahe hote hain Ek continue pattern aur ek reversal pattern reversal pattern. Continue patterns wo hota hai ki market ki next movement ab opposite direction Mein Hogi aur continue patterns Mein yah show ho raha Hota Hai ke market ki next movement same direction Mein Hone Wali Hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Re: Reversal and Continue Pattern

G bhai forex market mein jab bhi ap koi trade oepn karyn tu apko pata hona chahiye k market hamesha trend mein movement karti hai aur patten bana kar movement karti hai agar ap trend k opposite trade open karyn gy tu apko loss hoga is liye trend ko follow karyn aur jab trend reversal ho raha ho tu us time ap wait karyn aur market pattern mein movement karti hai koi acha pattern banny dyn phir trade open karyn -

#4 Collapse

Re: Reversal and Continue Pattern

Forex ki market Mein candles Ka istemal Karna chahie Agar Ham market Mein candles Ko ignore kar dete Hain To Hamen nuksan ho jaega aur isko Samjhana asan nahin hai agar Ham kam karte hue mistake Karenge To Hamen Kuchh Bhi Hansi Nahin Hoga Hamen analyses ko indicators ko istemal karte hue market Mein Paisa invest Karke trading karna chahie -

#5 Collapse

"Reversal" اور "Continuation" پیٹرنز Ùاریکس اور دیگر مالی بازاروں میں استعمال Ûونے والے دو اÛÙ… ترنڈ پیٹرنز Ûیں جو ترنڈ Ú©ÛŒ تشخیص میں اÛÙ… Ûوتے Ûیں۔**Reversal Patterns (توڑن پیٹرنز):**Reversal پیٹرنز اس وقت پائے جاتے Ûیں جب مارکیٹ Ú©ÛŒ روانیات تبدیل Ûونے کا Ø§Ø´Ø§Ø±Û Ø¯ÛŒØªÛŒ Ûیں، اور قبل اس Ú©Û’ گزرتے Ûوئے ترنڈ Ú©ÛŒ تبدیلی کا امکان Ûوتا ÛÛ’Û” Ú©Ú†Ú¾ عام توڑن پیٹرنز درج ذیل Ûیں:- **Head and Shoulders (سر اور کندھے):** ایک توڑن پیٹرن جس میں مارکیٹ Ú©ÛŒ قیمتیں ایک "سر" اور دو "کندھوں" Ú©Û’ قریب آتی Ûیں، اور ترنڈ Ú©ÛŒ تبدیلی کا Ø§Ø´Ø§Ø±Û Ø¯ÛŒØªØ§ ÛÛ’Û”- **Double Tops and Double Bottoms (دوÛرے ٹاپ اور دوÛرے بوٹمز):** اس پیٹرن میں دو مختل٠وقتوں میں مارکیٹ Ú©ÛŒ قیمتیں ایک جیسی Ûوتی Ûیں، اور ترنڈ Ú©ÛŒ تبدیلی کا Ø§Ø´Ø§Ø±Û Ûوتا ÛÛ’Û”**Continuation Patterns (جاری رÛÙ†Û’ والے پیٹرنز):**Continuation پیٹرنز اس وقت پائے جاتے Ûیں جب مارکیٹ کا موج جاری رÛتا ÛÛ’ اور قبل اس Ú©Û’ ترنڈ Ú©ÛŒ جاری رÛÙ†Û’ کا امکان Ûوتا ÛÛ’Û” Ú©Ú†Ú¾ عام جاری رÛÙ†Û’ والے پیٹرنز درج ذیل Ûیں:- **Flag Patterns (جھنڈا پیٹرنز):** ایک جھنڈا پیٹرن Ú©ÛŒ Ø´Ú©Ù„ کھجور Ú©Û’ جھنڈے Ú©ÛŒ طرØ* Ûوتی ÛÛ’ اور ترنڈ Ú©ÛŒ جاری رÛÙ†Û’ کا Ø§Ø´Ø§Ø±Û Ûوتا ÛÛ’Û”- **Pennant Patterns (پینٹ پیٹرنز):** اس پیٹرن میں قیمتیں ایک مثلث Ú©ÛŒ Ø´Ú©Ù„ بناتی Ûیں اور ترنڈ Ú©ÛŒ جاری رÛÙ†Û’ کا Ø§Ø´Ø§Ø±Û Ûوتا ÛÛ’Û”ÛŒÛ Ù¾ÛŒÙ¹Ø±Ù†Ø² ترنڈ Ú©ÛŒ تشخیص میں کام آتے Ûیں، لیکن ان Ú©Ùˆ ØªØ¬Ø²ÛŒÛ Ú©Ø±Ù†Û’ سے قبل اور Ø¯ÙˆØ±Ø§Ù†ÛŒÛ Ú©ÛŒ معلومات جمع کرنا اÛÙ… Ûوتا ÛÛ’Û” ایسا کرتے وقت آپ Ú©Ùˆ اپنی تجارتی استریٹیجی Ú©Ùˆ مد نظر رکھ کر ÙÛŒØµÙ„Û Ú©Ø±Ù†Ø§ -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Trading, khud ek detailed aur complex field hai jahan har din nai strategies aur techniques istemal hoti hain taake profit maximize kiya ja sake aur loss minimize. Trading mein do bohot hi aham concepts hote hain: Reversal Patterns aur Continuation Patterns.

Reversal Patterns

Reversal pattern ka matlab hota hai ke market trend apni direction ko change karne wala hai. Agar market uptrend mein hai aur reversal pattern banta hai, to iska matlab hai ke market niche girne wala hai downtrend shuru hone wala hai. Isi tarah agar market downtrend mein hai aur reversal pattern banta hai, to iska matlab hai ke market upar jane wala hai uptrend shuru hone wala hai.

Common Reversal Patterns- Head and Shoulders:

- Description: Yeh pattern aksar uptrend ke baad banta hai aur iska matlab hota hai ke trend ulatne wala hai. Is pattern mein teen peaks banti hain; central peak (head) sabse badi hoti hai aur do side peaks (shoulders) usse choti hoti hain.

- Significance: Jab neckline break hoti hai (jo ke shoulders ke lowest points ko milakar banti hai), to yeh signal hota hai ke reversal shuru ho gaya hai.

- Inverse Head and Shoulders:

- Description: Yeh pattern downtrend ke baad banta hai aur iska matlab hota hai ke trend ulatne wala hai aur uptrend shuru hone wala hai. Is pattern mein bhi teen troughs (bottoms) bante hain; central trough (head) sabse deep hota hai aur do side troughs (shoulders) usse shallow hote hain.

- Significance: Jab neckline break hoti hai, to yeh signal hota hai ke reversal shuru ho gaya hai aur uptrend shuru hone wala hai.

- Double Top and Double Bottom:

- Double Top:

- Description: Yeh pattern uptrend ke baad banta hai jab price do baar ek level ko touch karta hai aur phir niche girta hai.

- Significance: Jab price neechay support level ko break karta hai, to yeh signal hota hai ke uptrend khatam ho gaya hai aur downtrend shuru ho raha hai.

- Double Bottom:

- Description: Yeh pattern downtrend ke baad banta hai jab price do baar ek level ko touch karta hai aur phir upar chalta hai.

- Significance: Jab price upar resistance level ko break karta hai, to yeh signal hota hai ke downtrend khatam ho gaya hai aur uptrend shuru ho raha hai.

- Double Top:

- Triple Top and Triple Bottom:

- Triple Top: Yeh pattern uptrend ke baad banta hai jab price teen baar ek high level ko touch karta hai aur phir niche girta hai.

- Triple Bottom: Yeh pattern downtrend ke baad banta hai jab price teen baar ek low level ko touch karta hai aur phir upar chalta hai.

- Rounding Bottom and Rounding Top:

- Rounding Bottom: Yeh pattern aksar downtrend ke baad banta hai aur yeh gradual reversal ka indication deta hai.

- Rounding Top: Yeh pattern aksar uptrend ke baad banta hai aur yeh gradual reversal ka indication deta hai.

Continuation Patterns

Continuation pattern ka matlab hota hai ke market apni current trend ko continue karega. Yeh patterns signal dete hain ke temporary pause ke baad, market apni pehli direction mein hi move karega.

Common Continuation Patterns- Flags and Pennants:

- Flags:

- Description: Yeh small rectangles hote hain jo steep trend ke baad bante hain aur consolidation period ka indication dete hain.

- Significance: Flag pattern ke breakout hone ke baad market apni pehli trend ko continue karta hai.

- Pennants:

- Description: Yeh small symmetrical triangles hote hain jo steep trend ke baad bante hain.

- Significance: Pennant pattern ke breakout hone ke baad market apni pehli trend ko continue karta hai.

- Flags:

- Triangles:

- Ascending Triangle: Yeh bullish continuation pattern hota hai jo higher lows aur constant highs se banta hai. Jab price resistance ko break karta hai, to uptrend continue hota hai.

- Descending Triangle: Yeh bearish continuation pattern hota hai jo lower highs aur constant lows se banta hai. Jab price support ko break karta hai, to downtrend continue hota hai.

- Symmetrical Triangle: Yeh pattern tab banta hai jab price higher lows aur lower highs banata hai. Yeh pattern continuation ke direction ka confirmation deta hai jab breakout hota hai.

- Rectangles:

- Description: Yeh pattern tab banta hai jab price horizontal movement show karta hai between two parallel lines (support aur resistance).

- Significance: Breakout hone par yeh pattern continuation trend ko confirm karta hai.

- Cup and Handle:

- Description: Yeh pattern bullish continuation pattern hota hai. Cup portion rounded bottom banata hai aur handle portion slight consolidation phase ko represent karta hai.

- Significance: Jab price handle se breakout karta hai, to uptrend continue hota hai.

Trading mein in patterns ki bohot importance hai kyunki yeh patterns traders ko market ke future movements ka andaza lagane mein madad karte hain. Patterns ke zariye traders apni strategies bana sakte hain aur apne entry aur exit points define kar sakte hain.- Reversal Patterns: In patterns ke through traders apne positions ko timely adjust kar sakte hain taake unhein loss se bacha ja sake. Jaise hi reversal pattern banta hai, traders apni long positions ko short positions mein convert kar sakte hain ya vice versa.

- Continuation Patterns: In patterns ke through traders apni current positions ko hold kar sakte hain aur market ke temporary pauses se ghabraaye baghair apne profits ko maximize kar sakte hain. Continuation pattern ke zariye traders ko yeh signal milta hai ke market kuch time ke liye consolidate kar raha hai lekin phir apni pehli trend ko continue karega.

Technical indicators jaise ke moving averages, relative strength index (RSI), aur MACD ke sath in patterns ka istemaal karke traders apne signals ko confirm kar sakte hain. Yeh indicators patterns ke zariye milne wale signals ko support karte hain aur trading decisions ko aur zyada robust banate hain.- Moving Averages: Moving averages trends ko smooth karte hain aur overall trend direction ko identify karne mein madadgar hote hain. Inhe patterns ke sath mila kar use karna signals ko confirm karta hai.

- RSI: Relative strength index momentum indicator hai jo overbought aur oversold conditions ko identify karta hai. Patterns ke sath RSI ka istemaal traders ko zyada accurate signals deta hai.

- MACD: Moving Average Convergence Divergence indicator trend-following aur momentum indicator hai jo moving averages ke beech ke relationships ko study karta hai. Patterns ke sath MACD ka istemaal signals ko aur zyada reliable banata hai.

Ek trader head and shoulders pattern ko identify karta hai. Uptrend ke baad market ne ek peak banaya left shoulder, phir thoda niche aya aur phir ek aur peak banaya jo pehli peak se zyada upar gaya head, aur phir market ne ek aur peak banaya jo head se neeche magar left shoulder ke barabar hai right shoulder. Ab jab neckline break hoti hai, trader apni long positions ko close karke short positions le sakta hai. Yeh strategy usse potential losses se bacha sakti hai aur nayi downtrend mein profit earn karne ka mauka de sakti hai. Isi tarah continuation patterns ka bhi istemaal hota hai. Agar market ek strong uptrend mein hai aur flag pattern form hota hai, to trader apni positions ko hold karke flag ke breakout ka wait kar sakta hai. Flag ke breakout hone par market apni pehli uptrend ko continue karega aur trader zyada profit earn kar sakega.

Trading mein reversal aur continuation patterns ka samajh aur unka sahi istemaal bohot aham hai. In patterns ke zariye traders market trends ko predict karke apne trading decisions ko aur zyada accurate aur profitable bana sakte hain. Har pattern ka apna ek unique significance hota hai aur technical indicators ke sath milakar inka istemaal trading strategies ko aur zyada robust aur reliable banata hai. Is liye, successful trading ke liye in patterns ko samajhna aur unka sahi istemaal karna bohot zaroori hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Head and Shoulders:

-

#7 Collapse

Forex Trading Overview

Forex, yaani foreign exchange market, duniya ka sabse bara aur sabse liquid financial market hai jahan currencies ka trade hota hai. Traders currencies khareedtay aur bechty hain profits kamaane ke liye. Forex trading do tareeqon se ki jati hai: reversal patterns aur continuation patterns ke zariye. Dono trading strategies apni apni dynamics rakhti hain aur traders inhe apne faida ke liye use kartay hain.

Reversal Patterns

Reversal patterns un signals ko represent kartay hain jo indicate kartay hain ke market ka trend badal raha hai. Jab market ek trend follow kar raha hota hai, aur phir ek specific pattern emerge hoti hai, to ye is baat ka ishara hota hai ke ab market ka trend ulatnay wala hai. Reversal patterns trading ke liye bohot ahmiyat rakhtay hain kyunki ye timely entry aur exit points provide kartay hain.

Head and Shoulders

Head and Shoulders pattern ek classic reversal pattern hai jo bearish reversal ka indication deta hai. Is pattern mein teen peaks hoti hain, jahan beech ki peak sabse zyada high hoti hai aur dono sides wali peaks comparatively kam hoti hain. Ye pattern signal deta hai ke trend ab bullish se bearish ho raha hai.

Double Top and Double Bottom

Double Top pattern do highs ka formation hota hai jo indicate karta hai ke bullish trend khatam hone wala hai aur market downtrend ki taraf ja raha hai. Iske baraks, Double Bottom pattern do lows ka formation hota hai jo batata hai ke bearish trend khatam ho raha hai aur market uptrend ki taraf ja raha hai. Ye dono patterns clear signals deti hain ke reversal hone wala hai.

Inverse Head and Shoulders

Inverse Head and Shoulders pattern, jaise naam se hi zahir hai, Head and Shoulders ka opposite hai. Ye ek bullish reversal pattern hai jo indicate karta hai ke bearish trend ab bullish trend mein convert hone wala hai. Ismein bhi teen troughs hoti hain, jahan beech ki trough sabse zyada low hoti hai aur dono sides wali comparatively kam hoti hain.

Continuation Patterns

Continuation patterns indicate kartay hain ke current trend continue rahega. Jab market ek trend follow kar raha hota hai aur specific patterns emerge hoti hain, to ye patterns is baat ka ishara karti hain ke trend abhi aur continue karega. Continuation patterns traders ko opportunities provide kartay hain ke wo current trend ke saath trade kar ke profits kamaa saken.

Flags and Pennants

Flags aur Pennants common continuation patterns hain. Flag pattern ek short-term consolidation phase ko indicate karta hai jo ek strong trend ke baad hota hai. Ye pattern ek rectangle ya parallelogram shape mein hota hai. Pennant pattern bhi similar hai lekin ye ek symmetrical triangle shape mein hota hai. Dono patterns strong trends ke continuation ka signal deti hain.

Triangles

Triangles teen tareekon ke hotay hain: Ascending, Descending, aur Symmetrical. Ascending triangle ek bullish continuation pattern hai jo higher lows aur horizontal resistance line ka formation hota hai. Descending triangle bearish continuation pattern hai jo lower highs aur horizontal support line ka formation hota hai. Symmetrical triangle neutral pattern hai jo indicate karta hai ke trend kisi bhi direction mein continue kar sakta hai.

Rectangles

Rectangle pattern horizontal consolidation phase ko indicate karta hai jo ek strong trend ke baad hota hai. Is pattern mein price action ek specific range mein move karta hai, support aur resistance levels ke beech mein. Jab price rectangle ke upper boundary ko break karta hai, to bullish trend continue hota hai. Aur agar price lower boundary ko break karta hai, to bearish trend continue hota hai.

Practical Application

Forex trading mein reversal aur continuation patterns ka understanding zaroori hai kyunki ye traders ko precise entry aur exit points provide karti hain. Reversal patterns ko identify kar ke traders trend ke reversal pe trade kar sakte hain aur continuation patterns ko identify kar ke current trend ke saath stay kar sakte hain. In patterns ko identify karne ke liye charts aur technical analysis tools ka use kiya jata hai.

Combining Patterns with Indicators

Indicators jaise Moving Averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) ko use kar ke reversal aur continuation patterns ko confirm karna helpful hota hai. Indicators aur patterns ka combination traders ko robust trading strategy banane mein madad karta hai. Indicators market ki momentum aur trend strength ko measure karte hain, jo patterns ko validate karte hain.

Risk Management

Forex trading mein risk management ka bohot bara role hota hai. Patterns aur indicators ke sath sath, traders ko stop-loss aur take-profit levels define karne chahiye. Reversal patterns pe trade karte waqt stop-loss ko nearest support ya resistance level pe set karna zaroori hai. Continuation patterns pe trade karte waqt trend ke opposite direction mein stop-loss ko place karna chahiye. Risk management se traders apne losses ko minimize aur profits ko maximize kar sakte hain.

Note

Forex trading mein reversal aur continuation patterns ka understanding aur unka practical application bohot ahmiyat rakhta hai. Ye patterns traders ko market ke trend ko identify aur predict karne mein madad karte hain. Reversal patterns market ke trend ke reversal ko indicate karte hain, jabke continuation patterns current trend ke continuation ko signal karte hain. Patterns ko indicators ke sath combine kar ke aur proper risk management ko follow kar ke, traders apne trading strategies ko enhance kar sakte hain aur consistent profits kama sakte hain. -

#8 Collapse

Reversal and Continue Pattern

Reversal aur Continue Patterns ka forex aur stock trading mein bohot bara ahamiyat hota hai. Ye patterns market ke price movements ke bare mein hints dete hain aur traders ko achi decision making mein madad karte hain. Reversal patterns market ke direction mein tabdili ko indicate karte hain, jabke continuation patterns market ke current trend ke barqarar rehne ka ishara dete hain.

Reversal Patterns

Head and Shoulders:

Head and Shoulders pattern ek reversal pattern hota hai jo ke bull market ko bear market mein convert hone ka signal deta hai. Is pattern mein pehle left shoulder banta hai, phir ek ucha head banta hai aur phir right shoulder banta hai. Jab price neckline ko break karti hai, toh ye confirmation hota hai ke trend reversal hone wala hai.

Inverse Head and Shoulders:

Inverse Head and Shoulders pattern ek bullish reversal pattern hota hai jo bear market ko bull market mein tabdeel hone ka ishara deta hai. Is pattern mein pehle left shoulder, phir ek low head aur phir right shoulder banta hai. Jab price neckline ko break karti hai, toh ye confirmation hota hai ke trend reversal ho raha hai aur price ooper jane wali hai.

Double Top aur Double Bottom:

Double Top ek bearish reversal pattern hota hai jo ke do highs banata hai aur phir price niche girti hai. Ye indicate karta hai ke bulls market ko control nahi kar pa rahe hain aur trend reversal hone wala hai.

Double Bottom ek bullish reversal pattern hota hai jo ke do lows banata hai aur phir price ooper jati hai. Ye indicate karta hai ke bears market ko control nahi kar pa rahe hain aur trend reversal hone wala hai.

Triple Top aur Triple Bottom:

Triple Top ek bearish reversal pattern hota hai jo ke teen highs banata hai aur phir price niche girti hai. Ye indicate karta hai ke bulls weak ho rahe hain aur market niche girne wali hai.

Triple Bottom ek bullish reversal pattern hota hai jo ke teen lows banata hai aur phir price ooper jati hai. Ye indicate karta hai ke bears weak ho rahe hain aur market ooper jane wali hai.

Continuation Patterns

Flags aur Pennants:

Flags aur Pennants continuation patterns hain jo ke trend ke continuation ko indicate karte hain. Flag pattern ek short-term consolidation phase hota hai jo ke parallel lines mein banta hai. Jab price flag ke boundary ko break karti hai, toh trend continuation ka signal milta hai.

Pennant pattern ek short-term consolidation phase hota hai jo ke converging trendlines mein banta hai. Jab price pennant ke boundary ko break karti hai, toh trend continuation ka signal milta hai.

Triangles:

Triangles do types ke hote hain: ascending triangle aur descending triangle. Ascending triangle ek bullish continuation pattern hota hai jo ke ek horizontal resistance line aur ek rising support line se banta hai. Jab price resistance line ko break karti hai, toh trend continuation ka signal milta hai.

Descending triangle ek bearish continuation pattern hota hai jo ke ek horizontal support line aur ek falling resistance line se banta hai. Jab price support line ko break karti hai, toh trend continuation ka signal milta hai.

Rectangles:

Rectangle pattern ek continuation pattern hota hai jo ke parallel support aur resistance lines se banta hai. Is pattern mein price range-bound rehti hai jab tak support ya resistance line break nahi hoti. Jab price rectangle ke boundary ko break karti hai, toh trend continuation ka signal milta hai.

Wedges:

Wedges do types ke hote hain: rising wedge aur falling wedge. Rising wedge ek bearish continuation pattern hota hai jo ke converging trendlines mein banta hai aur price gradually ooper move karti hai. Jab price lower trendline ko break karti hai, toh trend continuation ka signal milta hai.

Falling wedge ek bullish continuation pattern hota hai jo ke converging trendlines mein banta hai aur price gradually niche move karti hai. Jab price upper trendline ko break karti hai, toh trend continuation ka signal milta hai.

Conclusion

Reversal aur continuation patterns trading mein bohot zaroori hain kyunki ye market ke future movements ko predict karne mein madad karte hain. In patterns ko samajhna aur sahi tarah se interpret karna traders ke liye faida mand ho sakta hai. Agar aap in patterns ka sahi istimaal karte hain, toh aap market ke trends ko samajh sakte hain aur achi trading decisions le sakte hain. Isse aapko profit earn karne mein madad mil sakti hai aur aap loss se bach sakte hain.

Yeh patterns market ke dynamics ko samajhne ke liye ek achi tool hain, lekin hamesha yaad rakhein ke koi bhi pattern 100% accurate nahi hota. Market mein bohot sare factors hote hain jo price movements ko influence karte hain. Isliye trading karte waqt hamesha risk management strategies ka istimaal karein aur apni analysis ko diversify karein.

Agar aap in patterns ke bare mein zyada janana chahte hain, toh trading books aur online resources se madad le sakte hain. Practice aur experience se aap in patterns ko samajhne mein maharat hasil kar sakte hain. Happy trading!

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Reversal and Continue Pattern Kya ?HOTA hai

"Reversal and Continue Pattern" ka matlab hai ki kisi sequence ya series ko ulta-pulta karke aur fir continue karke pattern banane ka tareeka. Iska use typically programming, mathematics, ya puzzles mein hota hai.

For example, agar hum ek number sequence lete hain jaise 1, 2, 3, 4, ... toh reversal and continue pattern mein yeh aise dikhega:- Original sequence: 1, 2, 3, 4, ...

- Reversal: 4, 3, 2, 1, ...

- Reversal and continue pattern: 1, 2, 3, 4, 4, 3, 2, 1, 1, 2, 3, 4, 4, 3, 2, 1, ...

Is pattern mein pehle original sequence hoti hai, phir uska ulta sequence aata hai, aur fir se original sequence repeat hota hai. Yeh pattern solve karne mein logic aur sequence understanding ka use hota hai.

Reversal and Continue Pattern Ki mazeed wazahat

Reversal and Continue Pattern ek sequence ko ulta-pulta karke aur fir usi sequence ko repeat karke ek naya pattern banane ka tareeka hai. Isko samajhne ke liye ek example dekhate hain:

Maan lijiye humare paas ek number sequence hai: 1, 2, 3, 4, 5.

Ab hum is sequence ko ulta karte hain:- Original sequence: 1, 2, 3, 4, 5

- Reversed sequence: 5, 4, 3, 2, 1

Reversal and Continue Pattern mein hum pehle original sequence ko likhte hain, fir uska ulta sequence likhte hain, aur phir se original sequence ko repeat karte hain. Is example mein yeh pattern hoga:

1, 2, 3, 4, 5, 5, 4, 3, 2, 1, 1, 2, 3, 4, 5, 5, 4, 3, 2, 1, ...

Yahan pehle 1 se 5 tak original sequence hai, phir 5 se 1 tak reversed sequence aata hai, aur fir se original sequence repeat hota hai.

Is tarah ke patterns programming mein logic solve karne mein aur puzzles mein use hote hain. Inka use sequence manipulation aur pattern recognition ko samajhne ke liye kiya jata hai.

Reversal and Continue Pattern Ki Aqsam

Reversal and Continue Pattern ki kuch aam aqsaam hain jo alag-alag scenarios mein istemal ki ja sakti hain. Yahan kuch mukhtasar aqsaam di gayi hain:- Number Sequence Pattern:

- Ismein ek number sequence ko pehle original form mein likha jata hai.

- Fir usi sequence ko ulta (reverse) kiya jata hai.

- Uske baad original sequence ko dubara repeat kiya jata hai.

- Example: Original sequence: 1, 2, 3

- Reversal: 3, 2, 1

- Reversal and Continue Pattern: 1, 2, 3, 3, 2, 1, 1, 2, 3

- String Pattern:

- Ismein ek string ko pehle original form mein likha jata hai.

- Fir us string ko ulta (reverse) kiya jata hai.

- Uske baad original string ko dubara repeat kiya jata hai.

- Example: Original string: "abc"

- Reversal: "cba"

- Reversal and Continue Pattern: "abc", "cba", "abc"

- Character Pattern:

- Ismein ek set of characters ko pehle original form mein likha jata hai.

- Fir usi set ko ulta (reverse) kiya jata hai.

- Uske baad original set ko dubara repeat kiya jata hai.

- Example: Original set: {A, B, C}

- Reversal: {C, B, A}

- Reversal and Continue Pattern: {A, B, C}, {C, B, A}, {A, B, C}

- Geometric Pattern:

- Ismein ek geometric shape ya pattern ko pehle original form mein likha jata hai.

- Fir us shape ko ulta (mirror image) kiya jata hai.

- Uske baad original shape ko dubara repeat kiya jata hai.

- Example: Original shape: Triangle

- Reversal (mirrored triangle): Inverted Triangle

- Reversal and Continue Pattern: Original Triangle, Inverted Triangle, Original Triangle

In aqsaam ko solve karne ke liye logic aur pattern recognition ka istemal hota hai. Ye patterns programming, puzzles, aur sequence generation mein use hote hain, jahan sequence manipulation aur logic ko samajhne ke liye important hote hain.

Shukria

-

#10 Collapse

Reversal and Continue Pattern forex mein kya hota hai

Forex trading mein Reversal aur Continue pattern dono hi important hote hain. Inko samajhna forex traders ke liye bahut zaruri hota hai. Reversal pattern ek aisa pattern hota hai jisme market ki direction change hoti hai. Jab market ki direction change hoti hai to ise reversal pattern kaha jata hai. Is pattern ko samajhne ke liye aapko technical analysis ki knowledge honi chahiye. Reversal pattern ko samajhne ke liye aapko charts aur price action ko observe karna hota hai.in dno pattern ko sath ly kr chlna prhta h q k dno ki direction ksi time b change ho skti h is lie dno k bary me full knowledge hna chaye.

Directions knowledge

Continue pattern ek aisa pattern hota hai jisme market ki direction continue hoti hai. Jab market ki direction continue hoti hai to ise continue pattern kaha jata hai. Is pattern ko samajhne ke liye bhi aapko technical analysis ki knowledge honi chahiye. Continue pattern ko samajhne ke liye aapko trend lines aur price action ko observe karna hota hai.ye pattern continue direction change krta rehta h is lie apko is k Bary me full knowledge hna chaye.

Conclusion

Reversal aur continue pattern ko samajhne ke baad forex traders apne trades ko better way mein manage kar sakte hain. Ye patterns aapko market ke movements ko samajhne aur trade ko better way mein plan karne mein help karte hain. In patterns ko samajhne ke liye aapko market analysis aur technical analysis ki knowledge honi chahiye.

-

#11 Collapse

**Reversal Aur Continuation Patterns: Forex Trading Mein Inki Ahmiyat**

Forex trading mein, technical analysis ka key aspect chart patterns ko samajhna aur unka use karna hai. Do fundamental types ke patterns hain jo traders ko market ke potential movements ko predict karne mein madad karte hain: Reversal aur Continuation patterns. In patterns ki pehchaan aur samajh trading decisions ko behtar aur informed banane mein crucial role play karti hai. Is post mein, hum Reversal aur Continuation patterns ko detail se samjhenge aur dekhenge ke inki forex trading mein kya ahmiyat hai.

**Reversal Patterns:**

Reversal patterns market ke trend ke direction ko reverse karne ka signal dete hain. Jab market ek established trend ke dauran hota hai aur reversal pattern emerge hota hai, to ye trend reversal ka indication hota hai. Here are some popular reversal patterns:

1. **Head and Shoulders:** Yeh pattern market ke bullish trend ke baad bearish reversal ko indicate karta hai. Ismein ek head (central peak) aur do shoulders (side peaks) hote hain. Inverse Head and Shoulders pattern bearish trend ke baad bullish reversal ko signal karta hai.

2. **Double Top/Bottom:** Double Top pattern ek bullish trend ke baad bearish reversal ko indicate karta hai, jabke Double Bottom pattern bearish trend ke baad bullish reversal ko signal karta hai. Double Top do high peaks aur Double Bottom do low troughs ko represent karta hai.

**Continuation Patterns:**

Continuation patterns market ke existing trend ko continue karne ka signal dete hain. Jab market ek trend ke dauran hota hai aur continuation pattern form hota hai, to ye trend continuation ka indication hota hai. Here are some common continuation patterns:

1. **Flags aur Pennants:** Ye patterns short-term consolidation periods ko indicate karte hain jo trend ke continuation ka signal dete hain. Flags rectangular shape mein hote hain, Jabke Pennants triangular shape mein hoti hain.

2. **Cup and Handle:** Yeh pattern market ke uptrend ko indicate karta hai. Cup rounded shape hoti hai aur Handle consolidation phase ko represent karta hai. Breakout ke baad bullish continuation ka signal milta hai.

**Trading Mein Use Aur Application:**

1. **Entry Aur Exit Points:** Reversal aur Continuation patterns ko identify karke traders precise entry aur exit points decide kar sakte hain. Reversal patterns trend changes ke signals provide karte hain, jabke Continuation patterns trend ke continuation ke signals dete hain.

2. **Risk Management:** Patterns ke signals ko use karke traders stop-loss orders set kar sakte hain aur risk management strategies apply kar sakte hain. Isse potential losses ko minimize kiya ja sakta hai aur profits ko maximize kiya ja sakta hai.

**Conclusion:**

Reversal aur Continuation patterns forex trading mein market ke trends aur price movements ko accurately predict karne ke liye essential tools hain. In patterns ko sahi tarah se samajhkar aur apni trading strategies mein incorporate karke, traders apne trading performance ko enhance kar sakte hain aur market conditions ke mutabiq better decisions le sakte hain. In patterns ki pehchaan aur unka effective use trading success ko barhane mein madadgar hota hai.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Reversal Pattern

Reversal patterns technical analysis ka ek aham hissa hain jo traders ko market ke trend ke palatne ka andaza lagane mein madad deti hain. Ye patterns tab bante hain jab ek market trend apne momentum ko kho deti hai aur ek naye trend ki taraf modh le leti hai. Aam tor par, reversal patterns ke do qisam hote hain: bullish reversal aur bearish reversal.

Bullish Reversal Pattern

Bullish reversal patterns tab bante hain jab market ka downtrend khatam hota hai aur upar ki taraf movement shuru hoti hai. Iske mashhoor examples mein 'Double Bottom' aur 'Head and Shoulders' (inverse) patterns shamil hain. Double Bottom pattern tab banta hai jab market do bar neeche jati hai aur beech mein ek chhoti si rebound hoti hai, jo ke naye upward trend ka signal hota hai. Head and Shoulders (inverse) pattern bhi bullish reversal ka indicator hota hai jahan market ek neechay ki shape banati hai, jo ke potential upward movement ka ishara hota hai.

Bearish Reversal Pattern

Bearish reversal patterns tab bante hain jab market ka uptrend khatam hota hai aur neeche ki taraf movement shuru hoti hai. Iske mashhoor examples mein 'Double Top' aur 'Head and Shoulders' patterns shamil hain. Double Top pattern tab banta hai jab market do bar upar jati hai aur beech mein ek chhoti si downward movement hoti hai, jo ke naye downward trend ka signal hota hai. Head and Shoulders pattern bhi bearish reversal ka indicator hota hai jahan market ek ooncha shape banati hai, jo ke potential downward movement ka ishara hota hai.

Continue Pattern

Continue patterns bhi technical analysis ka ek zaroori hissa hain jo market ke trend ko banaye rakhte hain. Ye patterns tab bante hain jab market ek short-term consolidation period se guzarti hai aur phir apne previous trend ko continue karti hai. Continue patterns ke mashhoor examples mein 'Flags', 'Pennants', aur 'Triangles' shamil hain.

Flags

Flags ek chhoti si consolidation period ko dikhati hain jo ek trend ke baad aati hai. Ye generally parallel lines ki form mein hoti hain, jahan price ek flagpole ki tarah dikhti hai aur consolidation ke baad trend continue karti hai. Flags ko bullish aur bearish dono form mein dekha ja sakta hai, jahan bullish flag uptrend ke baad aata hai aur bearish flag downtrend ke baad.

Pennants

Pennants bhi consolidation patterns hain jo ek symmetrical triangle ki form mein hote hain. Ye pattern price ke consolidation ko dikhata hai jahan market ek tight range mein trade karti hai aur phir apne previous trend ko continue karti hai. Bullish aur bearish pennants dono market trends ko continue karne mein madad karte hain.

Triangles

Triangles ek aur common continue pattern hain jo market ke consolidation ko dikhate hain. Isme ascending, descending, aur symmetrical triangles shamil hain. Ye patterns market ke consolidation ko dikhate hain aur jab breakouts hoti hain, to market apne previous trend ko continue karti hai.

-

#13 Collapse

Jab hum trading aur technical analysis ki baat karte hain, to do important patterns hain jo investors aur traders ko market ki movement samajhne mein madad dete hain: reversal aur continuation patterns. Ye dono patterns market ki direction aur future price movements ke baare mein hints dete hain.

Reversal patterns wo hote hain jo market ki current trend ko reverse karne ka indication dete hain. Ye patterns market ko bullish se bearish ya bearish se bullish direction mein le ja sakte hain. Ek mashhoor reversal pattern hai "Head and Shoulders". Is pattern mein, ek peak ke baad do chhote peaks aate hain, aur is pattern ko reversal ka signal maana jata hai. Head and Shoulders ke mirror image ko "Inverse Head and Shoulders" kehte hain, jo ke bearish trend ke reversal ka indication hota hai.

Doosra important reversal pattern "Double Top" aur "Double Bottom" hain. Double Top pattern tab banta hai jab market do baar ek hi price level pe peak banata hai, aur iske baad price girti hai. Ye pattern bearish reversal ka signal hai. Iske opposite, Double Bottom pattern tab banta hai jab market do baar ek hi price level pe dip karta hai aur phir price upar chali jati hai. Ye bullish reversal ka signal hota hai.

Continuation patterns wo hote hain jo market ke current trend ko continue karne ka indication dete hain. Ye patterns market ke temporary pauses ko dikhate hain aur ye confirm karte hain ke current trend barqarar rahega. Ek aam continuation pattern "Flags" aur "Pennants" hain. Flags tab bante hain jab ek sharp price movement ke baad market thoda consolidate karti hai, aur fir trend continue hota hai. Flags ka shape ek rectangle jaisa hota hai aur price consolidation ke baad trend continue karti hai.

Pennants bhi similar hain, lekin ye triangle shape ke hote hain. Pennants ke do types hain: bullish aur bearish. Bullish pennants tab bante hain jab market upward trend ke dauran consolidation karti hai aur fir price continue hoti hai. Bearish pennants tab bante hain jab downward trend ke dauran consolidation hoti hai aur phir price continue hoti hai.

Ek aur common continuation pattern "Triangles" hain. Triangles ka shape ek symmetrical, ascending, ya descending triangle ke form mein hota hai. Symmetrical triangles mein market price dono directions mein move karti hai aur ek point pe converge karti hai. Ascending triangles bullish trend ko indicate karte hain, jabke descending triangles bearish trend ko indicate karte hain.

In patterns ko samajhna aur inka analysis karna trading decisions ko behtar banane mein madadgar hota hai. Reversal patterns aapko market ke trend change ke signals dete hain, jabke continuation patterns market ke current trend ko confirm karte hain aur aapko trading decisions mein madad karte hain. Har pattern ka apna unique signal aur importance hota hai aur inhe sahi tarike se samajhna aur interpret karna trading success ke liye zaroori hai.

-

#14 Collapse

Reversal aur continuation patterns technical analysis mein aik ahem role ada kartay hain. In patterns ki madad se traders aur investors market ke future trends ka andaza lagate hain. Ye patterns price charts par nazar aate hain aur ye signals dete hain ke market ka trend reverse ho sakta hai ya phir continue rahega.

Reversal patterns wo hain jo market ke trend ko ulta dete hain. Jab aik trend apne aakhri marahil par hota hai, to reversal patterns indicate karte hain ke ye trend khatam ho sakta hai aur naye trend ka shuru hona mumkin hai. In patterns ki pehchan karna zaroori hai taake timely decisions liye ja saken. Ek mashhoor reversal pattern head and shoulders hai. Is pattern mein, price chart par teen peaks nazar aati hain—do chhoti aur aik badi peak, jo ke head ki trah lagti hai. Jab ye pattern complete hota hai, to market ka trend reverse hone ka imkaan hota hai. Doosra common pattern double top aur double bottom hai. Double top pattern tab hota hai jab price do martaba ek hi level par pohnchti hai aur uske baad girti hai, jabke double bottom pattern tab hota hai jab price do martaba ek hi level par girti hai aur phir barhti hai. Ye patterns market ke trend reversal ka indication dete hain.

Continuation patterns wo hain jo current trend ko continue rakhte hain. Ye patterns tab develop hote hain jab market temporarily consolidate hoti hai aur phir se usi trend ko continue karti hai. Aik popular continuation pattern flag aur pennant hai. Flag pattern aik sharp price movement ke baad hota hai, jahan price consolidation phase mein chali jati hai aur phir se usi direction mein movement karti hai. Pennant pattern bhi aik consolidation pattern hai jo flag pattern ki trah hota hai lekin ismein price ke triangles ban jaate hain. Dono patterns indicate karte hain ke trend continue rahega.

Reversal aur continuation patterns ka istemal karna trading strategies ko enhance kar sakta hai. In patterns ko samajhna aur identify karna zaroori hai taake market trends aur price movements ko accurately predict kiya ja sake. Technical analysis mein in patterns ka role trading decisions ko improve karne mein madadgar hota hai aur risk management ko behtar banata hai.

Yeh patterns hamesha 100% accurate nahi hote, isliye unhein complementary tools ke sath use karna behtar hota hai. Indicators aur other technical tools ke sath milkar ye patterns trading strategies ko support aur validate karte hain. Proper analysis aur risk management ki madad se, traders aur investors in patterns ko apni trading strategies mein shamil kar sakte hain aur market ke trends ko behtar samajh sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Reversal aur continuation patterns financial markets ka aik ahem hissa hoti hain, jo traders ko market trends samajhne mein madad deti hain. In patterns ko pehchan karna market ki direction ko predict karne ka aik tareeqa hota hai. Jab market aik particular trend mein hoti hai, to reversal pattern humein yeh batata hai ke ab market ka direction badal sakta hai. Jabke continuation pattern yeh indicate karta hai ke current trend apna rukh barqarar rakhegi.

Reversal pattern ka matlab yeh hota hai ke market apne pehle wale trend ko ulta karne wali hai. Agar market pehle upward trend mein thi, to reversal pattern yeh suggest karta hai ke market ab downward trend mein janay wali hai, ya agar market downtrend mein thi, to yeh indicate karta hai ke market ab upward ho sakti hai. Yeh patterns aksar jab market overbought ya oversold zone mein hoti hai, tab zyada clearly dekhne ko milte hain. Reversal patterns ke examples mein head and shoulders, double tops, double bottoms, aur triple tops bottoms shamil hain.

Head and shoulders pattern aksar bullish market ke khatme aur bearish market ke shuru hone ka signal hota hai. Is pattern mein pehle aik peak banta hai, phir us se ooncha aik aur peak, aur phir pehla wala peak wapas repeat hota hai. Yeh signify karta hai ke buying pressure ab kam ho raha hai, aur market downward ja sakti hai. Isi tarah, double top ya bottom pattern jab market do dafa apni previous high ya low ko test karti hai, lekin us se aagay nahi jaa pati, tab yeh signal milta hai ke ab trend reversal hone wala hai.

Continuation patterns humein batate hain ke market apne current trend ko continue karne wali hai. Yeh patterns aksar market mein temporary pauses ya consolidation phases ke dauran bante hain, lekin overall trend apni direction barqarar rakhta hai. Continuation patterns ke examples mein flags, pennants, aur triangles shamil hain. Agar market aik bullish trend mein hai, aur flag ya pennant pattern banta hai, to yeh indicate karta hai ke market mein temporary consolidation ke baad bullish trend wapas aayegi.

Flags aur pennants aksar short-term continuation patterns hote hain. Flag pattern mein price action chhoti si consolidation ya pullback phase ke baad apni previous direction mein wapas jaata hai. Pennants bhi similar hotay hain, lekin inmein price action triangular shape mein consolidate karta hai. Dono patterns yeh suggest karte hain ke market ke investors abhi bhi current trend ko support kar rahe hain, aur market ke break hone ke chances zyada hain.

Triangles bhi aik widely used continuation pattern hain, aur inke teen types hote hain: ascending, descending, aur symmetrical. Ascending triangle bullish continuation ka signal hota hai, jab price action aik horizontal resistance level ko baar baar test kar raha hota hai, jab ke lows har dafa higher hote hain. Descending triangle bearish continuation ka signal deta hai, jab price action aik horizontal support ko test kar raha hota hai, jab ke highs har dafa lower hote hain. Symmetrical triangle mein price action do converging trendlines ke beech mein consolidate karta hai, aur jab breakout hota hai, to market ussi direction mein continue karti hai jo previous trend mein hoti thi.

In patterns ko samajhna market mein profitable decisions lene ke liye zaroori hota hai, lekin inka hamesha correct hona lazmi nahi hota. Market ka behavior kai factors par depend karta hai, aur kabhi kabhi patterns fail bhi karte hain. Is liye, inko use karte waqt risk management aur stop loss strategies ka istemal bhi bohot zaroori hota hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:56 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим