Agar koi successful trader hai tu maire khyal mai osko dosray traders ka be help karna chaheye osko apni successful strategy share karni chaheye takay dosre traders ko be kuch na kuch faida ho buhot say traders aise hai jo forex mai trading tu kar rahe hai lekan oski profitability losses say kam hai so aise traders koshish mai hai kay akhir konsi strategy apnae jaye jeski waja say osko kuch na kuch faida ho es leye maira ye sub successful traders ko request hai kay apni apni strategies zaror share karni chaheye

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Re: Successful traders ko apni strategy share karni chaheye?

g han dear ap ny bilkul sahi bat kahi hai forex main jitny bhi mambers achi trading stratgey ka use kar rahy hain sub ko chahye k wo forex main sub k sath apni trading k experience ko share karen jis main hum achi trading kar k kamyab ho skaen boht se mambers boht achi trading kar ray hain or kamyab ho rahy hain es liye aghr hum forex main kamyab hna chahty hain tu hmain sinors ki help se apni trading ko abhter krna hoga jis se hum bhi achi trading kar skty hain -

#3 Collapse

Re: Successful traders ko apni strategy share karni chaheye?

hamain apni stretgy ko use kar k hi hum achi earning ho saky gi aur hamain is k bary main pahly learn karna ho ga tba hi hum achi trade karni ho gi aur haamain demo main practice karni ho gi aur hamain is k bary main knowldge k bary main learning karni ho gi aur hamain is forum main planing kar k hi hum achy say trade karni ho gi aur hamain is say earn ho -

#4 Collapse

Re: Successful traders ko apni strategy share karni chaheye?

dear agar aap apni successful trade strategy apne sath kha sakte hain agar yah is kisi aur ko nahin dete to iska Koi fayda nahin sirf aapko hi fayda hai aur Baki agar aapko kisi aur ko bhi yah strategy de rahe hain to vah se fayda uthega usse aapko Koi nuksan nahin hoga hi koi aisa bhi nahin hai ki agar are wasted digialm kar denge to form wale apna tarika change kar denge yah to automatically candles banti hai movement hoti hai iski vajah se vah khud bahut hamen moment rate jagah rahti hai aur steadicam strategy hamari kamyab hoti hai isliye hamen chahie ki ham har kisi ke saath apne experience share Karen aur apne sath sath dusron ko bhi fayda panchaen.اصل پيغام ارسال کردہ از: Zuhaib9988 پيغام ديکھيےAgar koi successful trader hai tu maire khyal mai osko dosray traders ka be help karna chaheye osko apni successful strategy share karni chaheye takay dosre traders ko be kuch na kuch faida ho buhot say traders aise hai jo forex mai trading tu kar rahe hai lekan oski profitability losses say kam hai so aise traders koshish mai hai kay akhir konsi strategy apnae jaye jeski waja say osko kuch na kuch faida ho es leye maira ye sub successful traders ko request hai kay apni apni strategies zaror share karni chaheye -

#5 Collapse

Re: Successful traders ko apni strategy share karni chaheye?

Ji Hamen chahie Jab Bhi apni trade open karen to sabse pahle market ka analysis Karen aur latest tenth ko study Karen aur latest and ko study karne ke bad Hamen chahie apni Ek strategy develop Karen aur yah strategy demo per implement Karke Uske result Dekhen Iske result acche Hain To fir Hamen is strategy ko Aage Lekar Chalna chahie aur sab ke sath share karne chahie -

#6 Collapse

Re: Successful traders ko apni strategy share karni chaheye?

Dost aapki baat bilkul theek hai frocks online business mein work Karne Wale Kamyab trader ko chahie ki vah apni kamyabi vali strategy ko more frocks online business Mein share karna chahie Aane Wale new memberon Ko Pata Chal sake ki Ham Forex trading mein kis Math ke sath varg Karenge To Hamen kamyabi Milegi profit Milega Agar vah method Yojana Karen To Hamen ismein are coming bhi ho sakti hai aisi chij fresh online business Mein share karna bahut jaruri hai Kyunki fresh Mein Jo Baat new knowledge hota hai vah frocks online business Mein kamyabi ko Aasan kar sakta hai -

#7 Collapse

Re: Successful traders ko apni strategy share karni chaheye?

yes ek successful trader ko kisi aur ki help krni chahye aur usko apni strategy share karni chahye ta ky us ki strategy share krny sy kisi aur ko himat aur hosla mily ga aur us ko successful trader bannay ka tajarba hota jaye ga aur wo mustakbil men ek succesful trader ban skta hy aur wo jitni ziada invest kry ga us ka us ko trading men ziada profit mila tha is liye a successful trader ko chahye ky wo trading ka treeka dosroo ko bhi bataye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

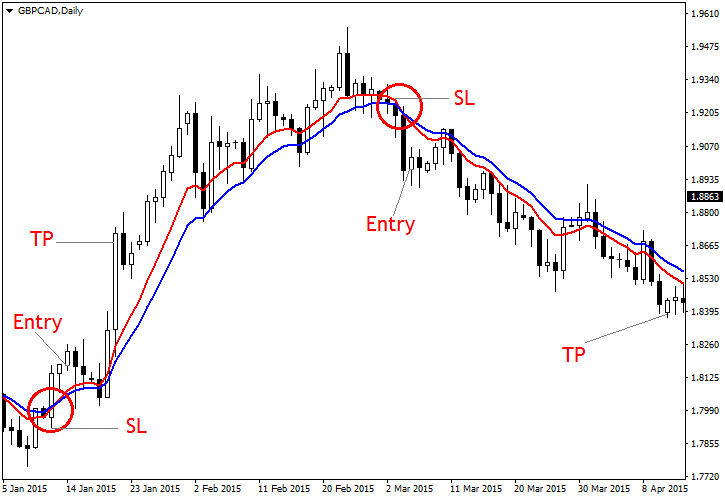

Forex trading mein profitable trading strategy chunana, ek zaroori tareeqa hai jo traders ko consistent profits tak pahuncha sakta hai. Yeh ek systematic aur well-researched approach hota hai jisme traders apne trading decisions ko base karte hain. Ek achi forex trading strategy ke liye, traders ko kuch zaroori cheezon par tawajjo deni hoti hai. Sabse pehle, traders ko market ko samjhna zaroori hota hai. Market ki trends, price action, technical indicators, aur fundamental factors ko samjhna trading strategy ke liye zaroori hai. Traders ko market ki liquidity, volatility, aur timing ko bhi samajhna chahiye, jisse unko trading opportunities aur risks ka pata chal sake. Dusra zaroori aspect ek trading strategy ke liye risk management hai. Risk management traders ko apne trading capital ko effectively manage karne mein madad karta hai. Achi risk management strategy ke saath, traders apne trades ko manage kar sakte hain, apne losses ko control kar sakte hain, aur apne trading account ko protect kar sakte hain. Ek achi trading strategy risk-reward ratio, stop-loss levels, aur position sizing ke saath integrate hoti hai. Ab hum ek potential profitable forex trading strategy ke example par baat karte hain. Ek common aur effective trading strategy hai Moving Average Crossover strategy. Is strategy mein, traders moving averages (MA) ko use karke entry aur exit points ko determine karte hain. Moving averages price trends aur momentum ko analyze karne mein madad karte hain. Is strategy mein, traders typically 2 alag alag timeframes ke moving averages ka use karte hain. Ek shorter timeframe ka moving average (20-day MA) aur ek longer timeframe ka moving average (50-day MA). Jab shorter timeframe ka moving average longer timeframe ka moving average ko upar se cross kar jata hai, toh ye ek buy signal hota hai, aur jab shorter timeframe ka moving average longer timeframe ka moving average ko neeche se cross kar jata hai, toh ye ek sell signal hota hai. Traders ko is strategy ko samjhaney aur implement karney ke liye kuch steps follow karne hote hain: Market Selection: Traders ko pehle ek currency pair ya kisi specific market ko select karna hota hai, jahan wo strategy ko apply karna chahte hain. Iske liye market ki liquidity, volatility, aur trading hours ko samjhna zaroori hota hai. Timeframe Selection: Traders ko do alag alag timeframes ko select karna hota hai, jaise ek shorter timeframe (daily chart) aur ek longer timeframe (weekly chart). Shorter timeframe par jaldi se changing prices hoti hain, jabki longer timeframe par trends aur price movements ko clear aur accurate tarah se dekha ja sakta hai. Moving Average Settings: Traders ko apne selected timeframes ke liye moving averages ke settings ko configure karna hota hai. Moving averages ke settings par traders ki personal preference aur market conditions par depend karti hai. Jaise ki 20-day MA aur 50-day MA. Entry aur Exit Rules: Traders ko entry aur exit rules ko clearly define karna hota hai. Jab shorter timeframe ka moving average longer timeframe ka moving average ko upar se cross karta hai, toh traders ko buy signal milta hai, aur wo trade enter kar sakte hain. Jab shorter timeframe ka moving average longer timeframe ka moving average ko neeche se cross karta hai, toh traders ko sell signal milta hai, aur wo trade exit kar sakte hain. Stop-Loss aur Take-Profit Levels: Traders ko apne trades ke liye stop-loss aur take-profit levels ko define karna hota hai. Stop-loss level traders ke liye maximum acceptable loss level hota hai, jahan wo trade ko close kar denge agar market against jaati hai. Take-profit level traders ke liye expected profit level hota hai, jahan wo trade ko close kar denge agar market in their favor jaati hai. Risk Management: Traders ko apni risk management strategy ko implement karna hota hai. Traders apne trades ko position sizing aur risk-reward ratio ke hisab se manage karte hain, taki ek losing trade bhi unko large losses na de. Backtesting aur Demo Trading: Kisi bhi strategy ko live trading mein apply karne se pehle, traders ko usko backtest karna aur demo trading mein test karna chahiye. Backtesting, historical data par strategy ko test karne ko kehta hai, jisse traders ko strategy ka performance, win rate, aur drawdown ko samajhne mein madad milti hai. Demo trading, virtual money par real market conditions mein strategy ko test karne ko kehta hai, jisse traders ko actual trading experience aur strategy ke results ko dekhne mein madad milti hai. Trading Journal: Ek trading journal maintain karna bhi zaroori hai, jahan traders apne trades, entry aur exit points, stop-loss aur take-profit levels, aur overall performance ko record kar sakte hain. Yeh traders ko apne trades ko evaluate karne aur strategy ko improve karne mein madad karta hai.

Traders ko is strategy ko samjhaney aur implement karney ke liye kuch steps follow karne hote hain: Market Selection: Traders ko pehle ek currency pair ya kisi specific market ko select karna hota hai, jahan wo strategy ko apply karna chahte hain. Iske liye market ki liquidity, volatility, aur trading hours ko samjhna zaroori hota hai. Timeframe Selection: Traders ko do alag alag timeframes ko select karna hota hai, jaise ek shorter timeframe (daily chart) aur ek longer timeframe (weekly chart). Shorter timeframe par jaldi se changing prices hoti hain, jabki longer timeframe par trends aur price movements ko clear aur accurate tarah se dekha ja sakta hai. Moving Average Settings: Traders ko apne selected timeframes ke liye moving averages ke settings ko configure karna hota hai. Moving averages ke settings par traders ki personal preference aur market conditions par depend karti hai. Jaise ki 20-day MA aur 50-day MA. Entry aur Exit Rules: Traders ko entry aur exit rules ko clearly define karna hota hai. Jab shorter timeframe ka moving average longer timeframe ka moving average ko upar se cross karta hai, toh traders ko buy signal milta hai, aur wo trade enter kar sakte hain. Jab shorter timeframe ka moving average longer timeframe ka moving average ko neeche se cross karta hai, toh traders ko sell signal milta hai, aur wo trade exit kar sakte hain. Stop-Loss aur Take-Profit Levels: Traders ko apne trades ke liye stop-loss aur take-profit levels ko define karna hota hai. Stop-loss level traders ke liye maximum acceptable loss level hota hai, jahan wo trade ko close kar denge agar market against jaati hai. Take-profit level traders ke liye expected profit level hota hai, jahan wo trade ko close kar denge agar market in their favor jaati hai. Risk Management: Traders ko apni risk management strategy ko implement karna hota hai. Traders apne trades ko position sizing aur risk-reward ratio ke hisab se manage karte hain, taki ek losing trade bhi unko large losses na de. Backtesting aur Demo Trading: Kisi bhi strategy ko live trading mein apply karne se pehle, traders ko usko backtest karna aur demo trading mein test karna chahiye. Backtesting, historical data par strategy ko test karne ko kehta hai, jisse traders ko strategy ka performance, win rate, aur drawdown ko samajhne mein madad milti hai. Demo trading, virtual money par real market conditions mein strategy ko test karne ko kehta hai, jisse traders ko actual trading experience aur strategy ke results ko dekhne mein madad milti hai. Trading Journal: Ek trading journal maintain karna bhi zaroori hai, jahan traders apne trades, entry aur exit points, stop-loss aur take-profit levels, aur overall performance ko record kar sakte hain. Yeh traders ko apne trades ko evaluate karne aur strategy ko improve karne mein madad karta hai.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:34 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим