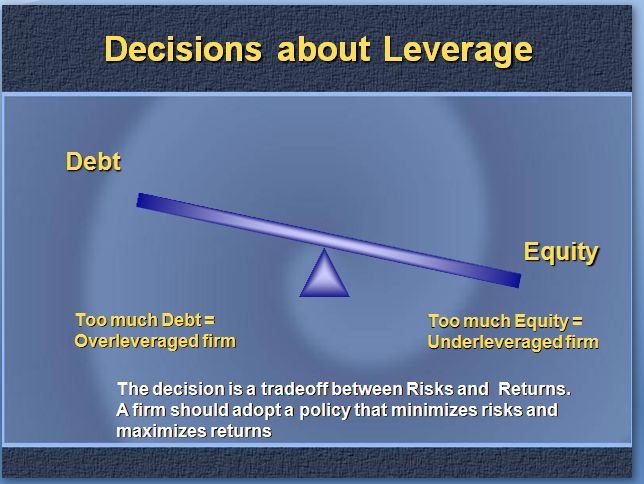

ab main apko btanay ja raha hu k Leverage kaya cheez hai.Agar koi ap ko judge karny k lye k ap forex main kitny mahar ho ap se savalat kar raha ho to us ka 2nd ya 3rd question yehe hoga k what is leverage?

Wo kyun?Wo insan yehe question kyun kary ga?

Kyun k my dear friends leverage ki defination mushkal hai likhny mai,parhny mai,magar ye bohat he aasan ha samjhny main.

Wo kyun?Wo insan yehe question kyun kary ga?

Kyun k my dear friends leverage ki defination mushkal hai likhny mai,parhny mai,magar ye bohat he aasan ha samjhny main.

تبصرہ

Расширенный режим Обычный режим