Financial markets par news ka asar ahem hota hai aur iska maayne trading aur investments mein bohot bada hota hai. News, economic indicators, geopolitical events, aur anya factors market sentiment ko directly influence karte hain.

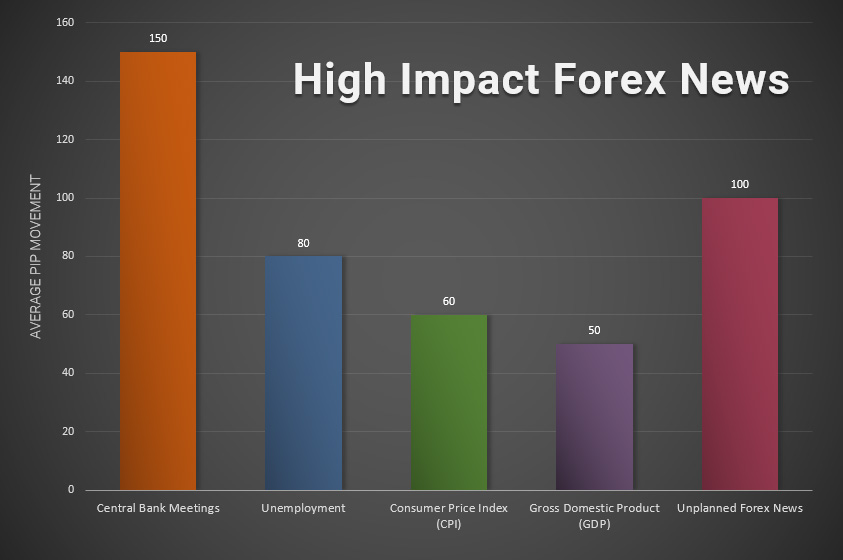

Economic Indicators:

Economic indicators jaise ke GDP growth rate, employment figures, aur inflation rate market par asar dalte hain. Jab economic indicators expected se behtar hote hain ya phir kharab hote hain, to isse currency values aur stock prices par asar hota hai.

Central Bank Policies:

Central banks ki monetary policies bhi market par asar daal sakti hain. Interest rate changes, monetary stimulus programs, ya phir forward guidance ke statements market mein volatility create kar sakte hain.

Geopolitical Events:

Kisi bhi desh mein hone wale geopolitical events, jaise ke elections, conflicts, ya trade disputes, market par asar daal sakte hain. Aise events se currency values, stock prices, aur commodities mein fluctuations ho sakti hain.

Corporate Earnings:

Company ke quarterly earnings reports bhi market par direct asar daalte hain. Agar ek company achhe results report karti hai to uske shares ke prices mein tezi dekhi ja sakti hai, jabki kharab results negetive impact daal sakte hain.

Market Sentiment:

News ka market sentiment par bhi asar hota hai. Positive news se traders aur investors optimistic ho sakte hain, jo market ko buland kar sakti hai. Wahi negative news market ko negetively affect kar sakti hai.

Kaise Traders News Ka Asar Manage Kar Sakte Hain:

News Calendar Ka Istemal:

Traders ko news ka asar manage karne ke liye economic calendar ka istemal karna chahiye. Isse wo future mein hone wale important economic events aur announcements ka pata laga sakte hain.

Risk Management:

News ka asar unpredictable hota hai, is liye risk management ek ahem hissa hai. Stop-loss orders ka istemal karke traders apne trades ko protect kar sakte hain.

Market Analysis:

News ka asar samajhne ke liye market analysis karna zaroori hai. Technical aur fundamental analysis ka istemal karke traders news ke asar ko predict kar sakte hain.

Diversification:

Portfolio ko diversify karna bhi ek tareeqa hai news ke asar se bachne ka. Alag alag asset classes mein invest karke traders apne investments ko hedge kar sakte hain.

News market par asar daal sakti hai, is liye traders aur investors ko chahiye ke wo market news ko dhyan se monitor karein aur apne trading strategies ko is asar ke mutabiq adjust karein. News ka asar samajhna, risk management ko prioritize karna, aur market trends ko analyze karna trading journey mein ahem hota hai.

تبصرہ

Расширенный режим Обычный режим