GBP/USD: Shuruati Karobariyon ke Liye Sadeh Tajaweez

6 February (US Session)

Shops aur Trading Ka Jaiza

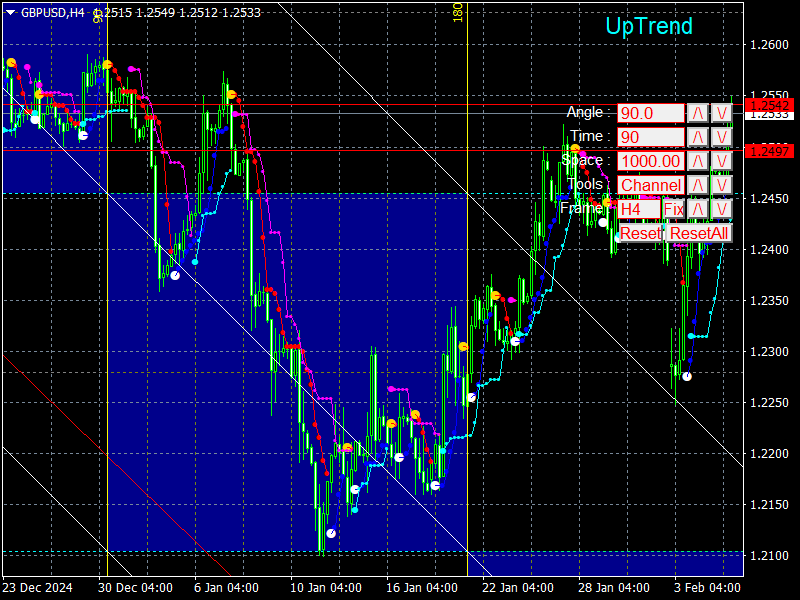

GBP/USD ka daam 1.2473 par pahuncha jab MacD indicator zero se neeche aagaya, jis se neeche ki taraf chalne ka potential kam ho gaya. Is wajah se, maine GBP/USD bechnay ka mauqa kho diya aur poori neeche ki movement se faida nahi utha saka.

Britain ke building sector PMI ka kamzor data ne kal ki bechne ki umeed ko jaldi se khatam kar diya. Investors ki uncertainty ne halat ko kharab kar diya, khaaskar Bank of England (BOE) ke meeting se pehle, jahan interest rates ki umeed hai. Is se GBP/USD ki aur kamzori ho sakti hai.

BOE ka faisla aur US labor market ka data aaj kafi ahmiyat rakhta hai. Ye payable weekly report hai initial jobless claims par, lekin agar ye numbers economists ke andazay se kaafi hat kar aaye, to traders zyada react nahi kar sakte. Magar, FOMC ke members Christopher Waller aur Mary Daly ko nazar andaz nahi karna chahiye, kyunki ye Federal Reserve ki monetary policy ke mustaqbil ke direction par roshni dal sakte hain.

Meri Intraday Strategy

Main apni trading ke liye do scenarios par tawajjo doonga.

Signal

Scenario No. 1:

GBP/USD ko 1.2430 par kharidna mumkin hai (chart par haree line) jiska target 1.2470 hai. 1.2470 par main long positions ko band karne aur ulta bechne ki soch raha hoon, jiska target 30-35 points neeche hoga. Aaj GBP kharidna kamzor US economic data ke baad theek hai.

Important! Kharidne se pehle ensure karein ke MacD indicator zero mark se upar ho aur bas upar ki taraf aane lage.

Scenario No. 2:

Main GBP/USD ko bhi kharidne ka irada rakhta hoon agar daam 1.2406 ko do baar test kare jab MacD indicator pre-overbought area mein ho. Is se neeche ka potential kam hoga aur market ka upar ki taraf palatne ka imkaan hoga. Target levels: 1.2430 aur 1.2470.

Bechne ka Plan

Scenario No. 1:

GBP/USD ko bechna mumkin hai agar 1.2406 ka level break hota hai (chart par laal line) jiska target 1.2366 hai. 1.2366 par main short positions ko band karne aur foran ulta kharidne ka plan bana raha hoon, jiska target 20-25 points upar hoga. Agar US ka data mazboot raha, to sellers dominate karenge.

Important! Bechne se pehle ensure karein ke MacD indicator zero mark se neeche ho aur bas neeche ki taraf aane lage.

Scenario No. 2:

Main GBP/USD ko bechne ka plan bhi rakhta hoon agar daam 1.2430 ko do baar test kare jab MacD indicator overbought area mein ho. Is se upar ki taraf ka potential kam hoga aur market ka neeche ki taraf palatne ka imkaan hoga. Target levels: 1.2406 aur 1.2366.

Shukriya!

6 February (US Session)

Shops aur Trading Ka Jaiza

GBP/USD ka daam 1.2473 par pahuncha jab MacD indicator zero se neeche aagaya, jis se neeche ki taraf chalne ka potential kam ho gaya. Is wajah se, maine GBP/USD bechnay ka mauqa kho diya aur poori neeche ki movement se faida nahi utha saka.

Britain ke building sector PMI ka kamzor data ne kal ki bechne ki umeed ko jaldi se khatam kar diya. Investors ki uncertainty ne halat ko kharab kar diya, khaaskar Bank of England (BOE) ke meeting se pehle, jahan interest rates ki umeed hai. Is se GBP/USD ki aur kamzori ho sakti hai.

BOE ka faisla aur US labor market ka data aaj kafi ahmiyat rakhta hai. Ye payable weekly report hai initial jobless claims par, lekin agar ye numbers economists ke andazay se kaafi hat kar aaye, to traders zyada react nahi kar sakte. Magar, FOMC ke members Christopher Waller aur Mary Daly ko nazar andaz nahi karna chahiye, kyunki ye Federal Reserve ki monetary policy ke mustaqbil ke direction par roshni dal sakte hain.

Meri Intraday Strategy

Main apni trading ke liye do scenarios par tawajjo doonga.

Signal

Scenario No. 1:

GBP/USD ko 1.2430 par kharidna mumkin hai (chart par haree line) jiska target 1.2470 hai. 1.2470 par main long positions ko band karne aur ulta bechne ki soch raha hoon, jiska target 30-35 points neeche hoga. Aaj GBP kharidna kamzor US economic data ke baad theek hai.

Important! Kharidne se pehle ensure karein ke MacD indicator zero mark se upar ho aur bas upar ki taraf aane lage.

Scenario No. 2:

Main GBP/USD ko bhi kharidne ka irada rakhta hoon agar daam 1.2406 ko do baar test kare jab MacD indicator pre-overbought area mein ho. Is se neeche ka potential kam hoga aur market ka upar ki taraf palatne ka imkaan hoga. Target levels: 1.2430 aur 1.2470.

Bechne ka Plan

Scenario No. 1:

GBP/USD ko bechna mumkin hai agar 1.2406 ka level break hota hai (chart par laal line) jiska target 1.2366 hai. 1.2366 par main short positions ko band karne aur foran ulta kharidne ka plan bana raha hoon, jiska target 20-25 points upar hoga. Agar US ka data mazboot raha, to sellers dominate karenge.

Important! Bechne se pehle ensure karein ke MacD indicator zero mark se neeche ho aur bas neeche ki taraf aane lage.

Scenario No. 2:

Main GBP/USD ko bechne ka plan bhi rakhta hoon agar daam 1.2430 ko do baar test kare jab MacD indicator overbought area mein ho. Is se upar ki taraf ka potential kam hoga aur market ka neeche ki taraf palatne ka imkaan hoga. Target levels: 1.2406 aur 1.2366.

Shukriya!

تبصرہ

Расширенный режим Обычный режим