Brief Description.

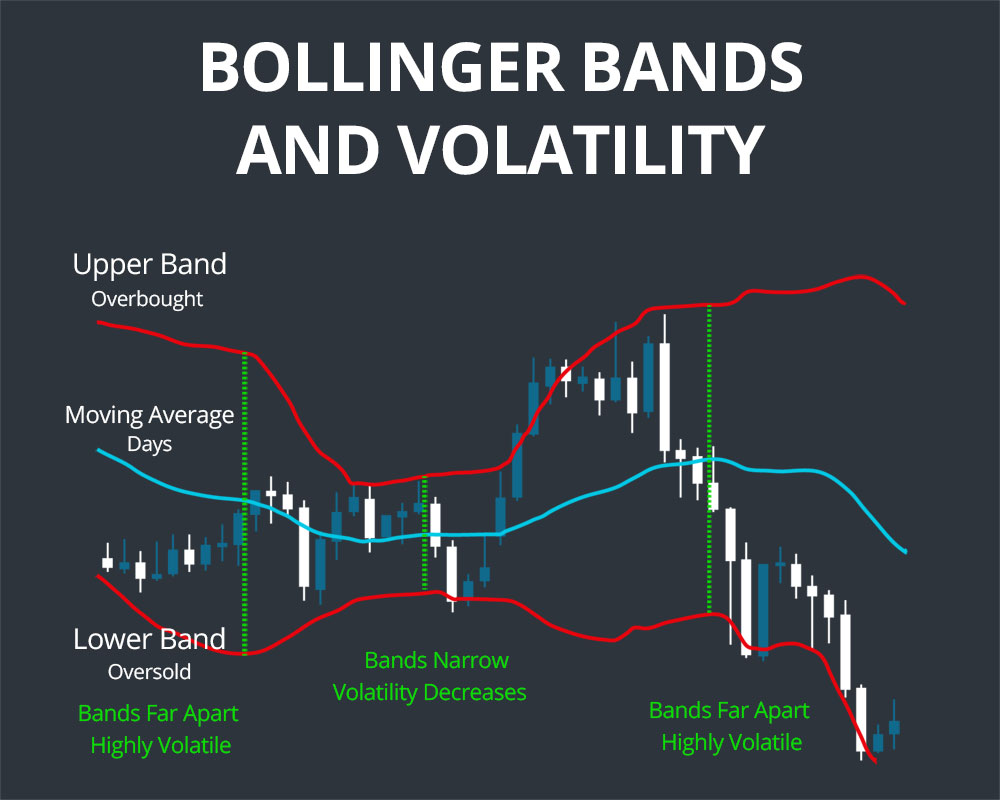

Dear friends aap ko btata chaloon kay Bollinger Bands trading Indecator market kee volatility ko zabir karta hai aur is main outer bands door ho jaate hain aur jab volatility kam hoti hai toh bands paas aa jaate hain. Middle line jo kay simple moving average hoti hai wo price ka average level dikhati hai jo market ka trend samajhne mein madad gar hoti hai agar price upper band ke kareeb ho toh yeh overbought condition ka signal deta hai aur neeche lower band ke kareeb ho toh yeh oversold situation ko dikhata hai.

Trading on Bollinger Bands.

Dear friends Bollinger Bands ko alag alag trading strategies mein istemaal kiya ja sakta hai aik common strategy aur is maqasad kay liye aik strategy ka istemal kia jata hai jis ko bounce trading kha jata hai is main traders upper aur lower bands ko support aur resistance levels ke tor par treat karte hain aur jab price lower band tak pauhanchti hai toh buy signal generate hota hai aur jab upper band tak pauhanchti hai to sell signal milta hai.

Use of other indicators with Bollinger Bands.

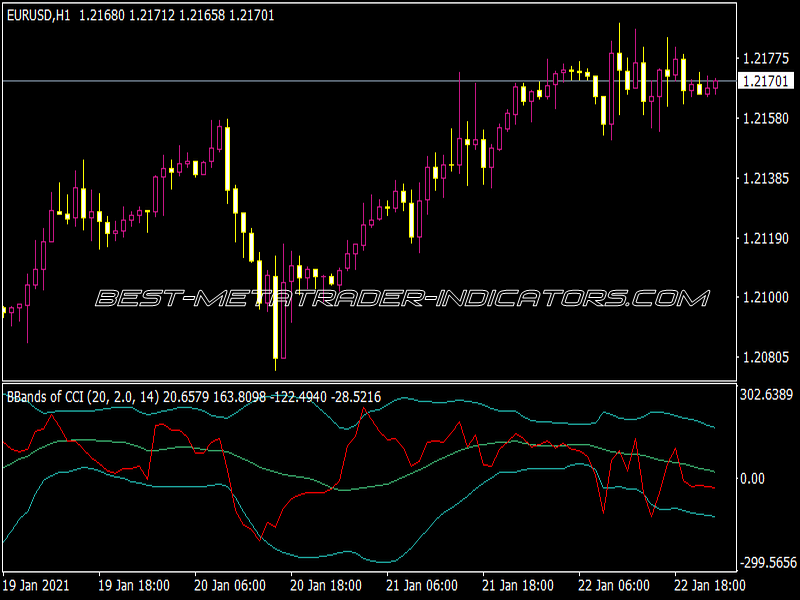

Dear friends Bollinger Bands trading mein kaafi useful hain lekin in ka sahi tarike se istemal zaroori hai yeh overbought aur oversold conditions ko samajhne mein madad dete hain jo reversal points ka idea dete hain. Saath hi, yeh volatility aur trend ki strength ka bhi indication dete hain. Lekin, inka signal kabhi kabhi galat ho sakta hai especially jab market sideways move karta hai is wajah se Bollinger Bands ko doosre technical indicators ke saath mila kay istemal kar chahye jaisa kay RSI ya MACD waghaira.

Dear friends aap ko btata chaloon kay Bollinger Bands trading Indecator market kee volatility ko zabir karta hai aur is main outer bands door ho jaate hain aur jab volatility kam hoti hai toh bands paas aa jaate hain. Middle line jo kay simple moving average hoti hai wo price ka average level dikhati hai jo market ka trend samajhne mein madad gar hoti hai agar price upper band ke kareeb ho toh yeh overbought condition ka signal deta hai aur neeche lower band ke kareeb ho toh yeh oversold situation ko dikhata hai.

Trading on Bollinger Bands.

Dear friends Bollinger Bands ko alag alag trading strategies mein istemaal kiya ja sakta hai aik common strategy aur is maqasad kay liye aik strategy ka istemal kia jata hai jis ko bounce trading kha jata hai is main traders upper aur lower bands ko support aur resistance levels ke tor par treat karte hain aur jab price lower band tak pauhanchti hai toh buy signal generate hota hai aur jab upper band tak pauhanchti hai to sell signal milta hai.

Use of other indicators with Bollinger Bands.

Dear friends Bollinger Bands trading mein kaafi useful hain lekin in ka sahi tarike se istemal zaroori hai yeh overbought aur oversold conditions ko samajhne mein madad dete hain jo reversal points ka idea dete hain. Saath hi, yeh volatility aur trend ki strength ka bhi indication dete hain. Lekin, inka signal kabhi kabhi galat ho sakta hai especially jab market sideways move karta hai is wajah se Bollinger Bands ko doosre technical indicators ke saath mila kay istemal kar chahye jaisa kay RSI ya MACD waghaira.

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Using_Bollinger_Bands_to_Gauge_Trends_Oct_2020-03-11daeb096d8045e395432b57de6bfa06.jpg)

تبصرہ

Расширенный режим Обычный режим