Brief Description.

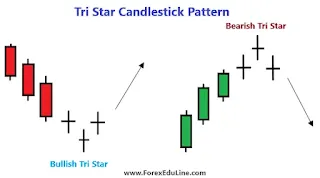

Tri Star candlestick pattern aik unique aur rare pattern hai jo aksar market ke trend reversal ko signal karta hai. Ye pattern tab banta hai jab teen doji candles lagataar aati hain, jo market ki uncertainty aur balance ko zahir karti hain. pattern aksar high volatility aur news-driven markets mein zyada accurate hota hai.Tri Star candlestick pattern pattern ka asar unhe markets mein behtareen hota hai jo technical analysis ke liye zyada sensitive hain. Risk management ke liye trade size ko control karna aur zarurat par profit book karna bhi zaroori hai.Doji candle ka matlab hai ke open aur close price takreeban barabar hoti hain, jo is baat ki nishani hai ke buyers aur sellers mein koi faisla nahi ho raha. Tri Star pattern ko aksar strong support ya resistance zones par dekha jata hai, jo ek naya trend shuru hone ka pata deta hai.

Tri Star Pattern candlesticks Structure.

Tri Star candlestick patternpattern ke liye pehli condition ye hai ke teen lagataar doji candles hon jo ya to bullish ya bearish ho sakti hain. Bullish Tri Star mein market ka trend neeche ja raha hota hai, lekin pattern banne ke baad upar ki taraf move karta hai. Iske baraks bearish Tri Star mein market pehle upar ki taraf hota hai, lekin pattern ke baad neeche ki taraf girta hai. Ye pattern aksar chhoti bodies aur lambi shadows rakhta hai, jo market ke indecision ko aur zyada mazbooti se dikhata hai.

Trading Strategy aur Entry Points

Tri Star pattern ke zariye trading karte waqt sabse pehla step hai is pattern ki tasdeeq karna. Jab bullish pattern nazar aaye to agle din ki candle bullish honi chahiye jo trend reversal ka pakka signal de. Entry point aksar teesri candle ke baad hota hai jab market naya trend dikhana shuru karta hai. Risk management ke liye stop loss ko last doji candle ke neeche set karna chahiye. Isi tarah bearish Tri Star ke liye, teesri candle ke baad sell position lena chahiye aur stop loss ko last doji ke upar lagana chahiye.Tri Star pattern hamesha akela kaafi nahi hota, isliye market ka overall context samajhna zaroori hai. Ye Is pattern ka use karte waqt patience aur proper analysis kaafi ahmiyat rakhta hai, taake aap galat signals se bach saken.

Tri Star candlestick pattern aik unique aur rare pattern hai jo aksar market ke trend reversal ko signal karta hai. Ye pattern tab banta hai jab teen doji candles lagataar aati hain, jo market ki uncertainty aur balance ko zahir karti hain. pattern aksar high volatility aur news-driven markets mein zyada accurate hota hai.Tri Star candlestick pattern pattern ka asar unhe markets mein behtareen hota hai jo technical analysis ke liye zyada sensitive hain. Risk management ke liye trade size ko control karna aur zarurat par profit book karna bhi zaroori hai.Doji candle ka matlab hai ke open aur close price takreeban barabar hoti hain, jo is baat ki nishani hai ke buyers aur sellers mein koi faisla nahi ho raha. Tri Star pattern ko aksar strong support ya resistance zones par dekha jata hai, jo ek naya trend shuru hone ka pata deta hai.

Tri Star Pattern candlesticks Structure.

Tri Star candlestick patternpattern ke liye pehli condition ye hai ke teen lagataar doji candles hon jo ya to bullish ya bearish ho sakti hain. Bullish Tri Star mein market ka trend neeche ja raha hota hai, lekin pattern banne ke baad upar ki taraf move karta hai. Iske baraks bearish Tri Star mein market pehle upar ki taraf hota hai, lekin pattern ke baad neeche ki taraf girta hai. Ye pattern aksar chhoti bodies aur lambi shadows rakhta hai, jo market ke indecision ko aur zyada mazbooti se dikhata hai.

Trading Strategy aur Entry Points

Tri Star pattern ke zariye trading karte waqt sabse pehla step hai is pattern ki tasdeeq karna. Jab bullish pattern nazar aaye to agle din ki candle bullish honi chahiye jo trend reversal ka pakka signal de. Entry point aksar teesri candle ke baad hota hai jab market naya trend dikhana shuru karta hai. Risk management ke liye stop loss ko last doji candle ke neeche set karna chahiye. Isi tarah bearish Tri Star ke liye, teesri candle ke baad sell position lena chahiye aur stop loss ko last doji ke upar lagana chahiye.Tri Star pattern hamesha akela kaafi nahi hota, isliye market ka overall context samajhna zaroori hai. Ye Is pattern ka use karte waqt patience aur proper analysis kaafi ahmiyat rakhta hai, taake aap galat signals se bach saken.

تبصرہ

Расширенный режим Обычный режим