Brief Description.

Evening Star ek mashhoor candlestick pattern hai jo aksar market ke reversal ko signify karta hai, khaaskar jab market mein bullish trend chal raha ho. Ye pattern teen candlesticks se mil kar banta hai Evening Star Candlestick Pattern Trading mein hamesha risk management ka khayal rakhna bohot zaroori hai, khaaskar jab Evening Star jaise reversal patterns ko follow karein. Aap apni trade size ko apne portfolio ke se zyada nahi rakhna chahiye. Iske ilawa, overtrading aur emotions ko control karna bhi zaroori hai kyun ke ye cheezen aksar losses ka sabab banti hain. Market ko har waqt monitor karna aur apne trading plan ke mutabiq chalna professional trading ke liye bohot zaroori hai.

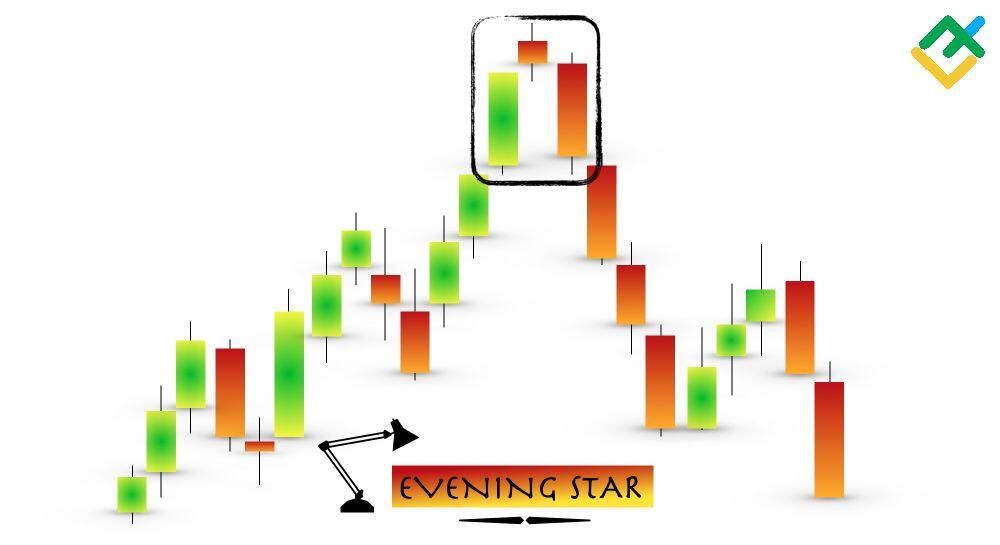

Candlestick Structure of Evening Star Candlestick Pattern.

Pehli Candle: Ye ek lambi bullish (green) candle hoti hai jo market ke strong buying pressure ko dikhati hai.

Doosri Candle: Ye ek chhoti candle hoti hai, jo spinning top ya doji ki shakal mein hoti hai, aur ye confusion ya market ki momentum mein kami ko show karti hai.

Teesri Candle: Ye ek lambi bearish (red) candle hoti hai jo price ko pehle candle ke aadhe ya us se neeche le aati hai. Ye pattern tab banta hai jab price resistance level ko chhoo kar neeche girne lage.

Trading Strategy.

Evening Star pattern ko trade karte waqt sabse zaroori cheez confirmation hai. Jab ye pattern bane, tab aapko teesri bearish candle ke close hone ka intezar karna chahiye. Iske baad, aap support levels, RSI, aur moving averages jaise indicators ka istamaal kar ke apni entry confirm kar sakte hain. Entry ke liye, teesri candle ke low ke neeche sell karna aur stop-loss ko pehli bullish candle ke high ke upar lagana recommended hota hai. Profit ke liye risk-reward ratio ko one ratio two ya us se zyada rakhna chahiye.

Evening Star ek mashhoor candlestick pattern hai jo aksar market ke reversal ko signify karta hai, khaaskar jab market mein bullish trend chal raha ho. Ye pattern teen candlesticks se mil kar banta hai Evening Star Candlestick Pattern Trading mein hamesha risk management ka khayal rakhna bohot zaroori hai, khaaskar jab Evening Star jaise reversal patterns ko follow karein. Aap apni trade size ko apne portfolio ke se zyada nahi rakhna chahiye. Iske ilawa, overtrading aur emotions ko control karna bhi zaroori hai kyun ke ye cheezen aksar losses ka sabab banti hain. Market ko har waqt monitor karna aur apne trading plan ke mutabiq chalna professional trading ke liye bohot zaroori hai.

Candlestick Structure of Evening Star Candlestick Pattern.

Pehli Candle: Ye ek lambi bullish (green) candle hoti hai jo market ke strong buying pressure ko dikhati hai.

Doosri Candle: Ye ek chhoti candle hoti hai, jo spinning top ya doji ki shakal mein hoti hai, aur ye confusion ya market ki momentum mein kami ko show karti hai.

Teesri Candle: Ye ek lambi bearish (red) candle hoti hai jo price ko pehle candle ke aadhe ya us se neeche le aati hai. Ye pattern tab banta hai jab price resistance level ko chhoo kar neeche girne lage.

Trading Strategy.

Evening Star pattern ko trade karte waqt sabse zaroori cheez confirmation hai. Jab ye pattern bane, tab aapko teesri bearish candle ke close hone ka intezar karna chahiye. Iske baad, aap support levels, RSI, aur moving averages jaise indicators ka istamaal kar ke apni entry confirm kar sakte hain. Entry ke liye, teesri candle ke low ke neeche sell karna aur stop-loss ko pehli bullish candle ke high ke upar lagana recommended hota hai. Profit ke liye risk-reward ratio ko one ratio two ya us se zyada rakhna chahiye.

تبصرہ

Расширенный режим Обычный режим