Brief Description.

Crab candlestick chart pattern pattern ki khasiyat yeh hai ke yeh ek deep retracement aur extension points par focus karta hai, jahan price ek major reversal ya significant move kar sakta hai. Is pattern ka structure char points X, A, B, C aur D par mabni hota hai, jahan D point ek precise reversal area hota hai.Crab candlestick chart pattern ek advanced harmonic pattern hai jo trading mein price movement ko samajhne ke liye use hota hai. Yeh pattern zyada tar high volatility aur reversal zones ko identify karne ke liye banaya jata hai.

Crab Pattern Structure.

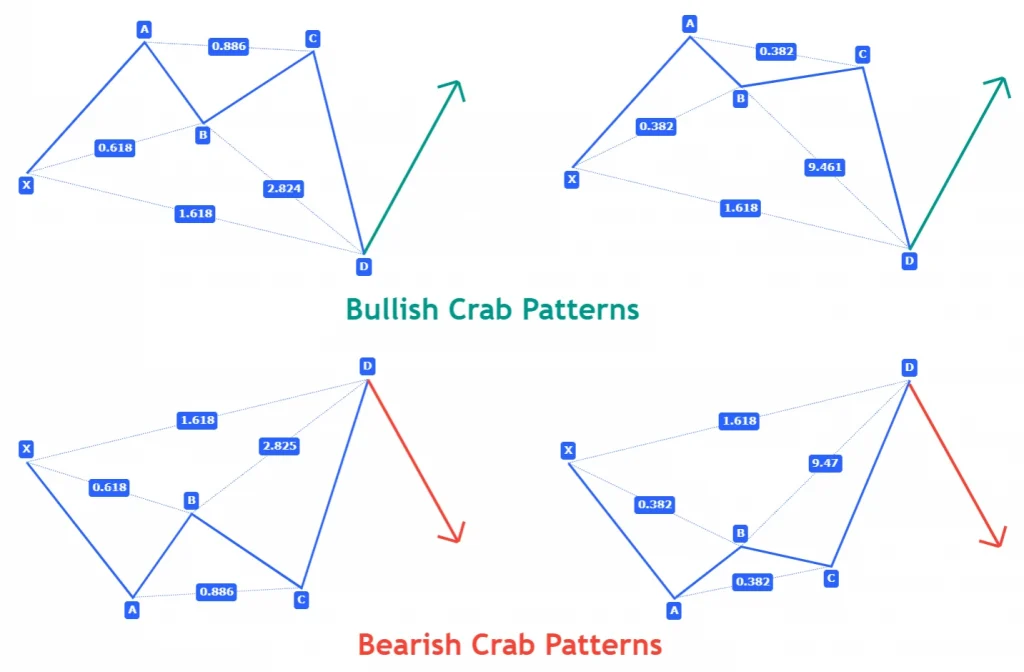

Is pattern ko samajhne ke liye practice aur harmonic analysis ka basic knowledge hona chahiye, warna beginners ke liye yeh complex lag sakta hai.ar trade mein profit aur loss ke darmiyan ek balance hona chahiye.Crab pattern ke structure mein X to A move ek impulsive leg hoti hai, jo market ka primary trend dikhata hai. Phir A to B ek retracement hoti hai, jo 38.2% se 61.8% Fibonacci level ke darmiyan hoti hai. B to C move ek extension hoti hai jo 38.2% se 88.6% ke beech hoti hai. Sabse important D point hota hai jo 161.8% Fibonacci extension hota hai jo XA leg ka hota hai. Jab price D point par pohanchta hai, to yeh ek strong reversal zone hota hai, jahan se price ulta chalne ka imkaan hota hai.

Crab Pattern Ko Kaise Trade Karein?

Crab pattern ko trade karte waqt risk management par focus bohot zaroori hai. Kyun ke yeh pattern zyada volatility ke areas mein hota hai, galat analysis ya false breakout ka risk hota hai. Is liye stop-loss lagana aur position size ka sahi taayun karna zaroori hai.Crab pattern ko trade karne ke liye sabse pehle aapko iska structure identify karna zaroori hai. Jab price D point tak pohanch jaye aur wahan ek reversal signal de, tab entry lene ka waqt hota hai. Stop-loss ka taayun D point ke thoda neeche (buy trade ke liye) ya upar (sell trade ke liye) lagana chahiye. Target points ko Fibonacci retracement levels ke mutabiq set kiya jata hai, jaise ke 38.2%, 50% aur 61.8%. Is pattern mein patience aur accuracy bohot zaroori hai kyun ke yeh ek precise trading opportunity deta hai.

Crab candlestick chart pattern pattern ki khasiyat yeh hai ke yeh ek deep retracement aur extension points par focus karta hai, jahan price ek major reversal ya significant move kar sakta hai. Is pattern ka structure char points X, A, B, C aur D par mabni hota hai, jahan D point ek precise reversal area hota hai.Crab candlestick chart pattern ek advanced harmonic pattern hai jo trading mein price movement ko samajhne ke liye use hota hai. Yeh pattern zyada tar high volatility aur reversal zones ko identify karne ke liye banaya jata hai.

Crab Pattern Structure.

Is pattern ko samajhne ke liye practice aur harmonic analysis ka basic knowledge hona chahiye, warna beginners ke liye yeh complex lag sakta hai.ar trade mein profit aur loss ke darmiyan ek balance hona chahiye.Crab pattern ke structure mein X to A move ek impulsive leg hoti hai, jo market ka primary trend dikhata hai. Phir A to B ek retracement hoti hai, jo 38.2% se 61.8% Fibonacci level ke darmiyan hoti hai. B to C move ek extension hoti hai jo 38.2% se 88.6% ke beech hoti hai. Sabse important D point hota hai jo 161.8% Fibonacci extension hota hai jo XA leg ka hota hai. Jab price D point par pohanchta hai, to yeh ek strong reversal zone hota hai, jahan se price ulta chalne ka imkaan hota hai.

Crab Pattern Ko Kaise Trade Karein?

Crab pattern ko trade karte waqt risk management par focus bohot zaroori hai. Kyun ke yeh pattern zyada volatility ke areas mein hota hai, galat analysis ya false breakout ka risk hota hai. Is liye stop-loss lagana aur position size ka sahi taayun karna zaroori hai.Crab pattern ko trade karne ke liye sabse pehle aapko iska structure identify karna zaroori hai. Jab price D point tak pohanch jaye aur wahan ek reversal signal de, tab entry lene ka waqt hota hai. Stop-loss ka taayun D point ke thoda neeche (buy trade ke liye) ya upar (sell trade ke liye) lagana chahiye. Target points ko Fibonacci retracement levels ke mutabiq set kiya jata hai, jaise ke 38.2%, 50% aur 61.8%. Is pattern mein patience aur accuracy bohot zaroori hai kyun ke yeh ek precise trading opportunity deta hai.

تبصرہ

Расширенный режим Обычный режим