Brief Description.

Harmonic patterns main commonly bataye jaane walay designs hain jaise Gartley, Bat, Crab aur Butterfly. In patterns ko samajhne ke liye trader ko technical analysis aur Fibonacci retracement levels ka knowledge hona zaroori hai.Harmonic price chart patterns trading ki ek advanced technique hai jo price ki movements aur unke specific ratios ke zariye market ki aglay trends ko predict karti hai. Yeh patterns Fibonacci ratios ka istamaal karte hain, jo ek mathematical sequence par mabni hain. Yeh patterns price ke specific points par reversal ya continuation ka pata dete hain.

Harmonic Patterns Working ?

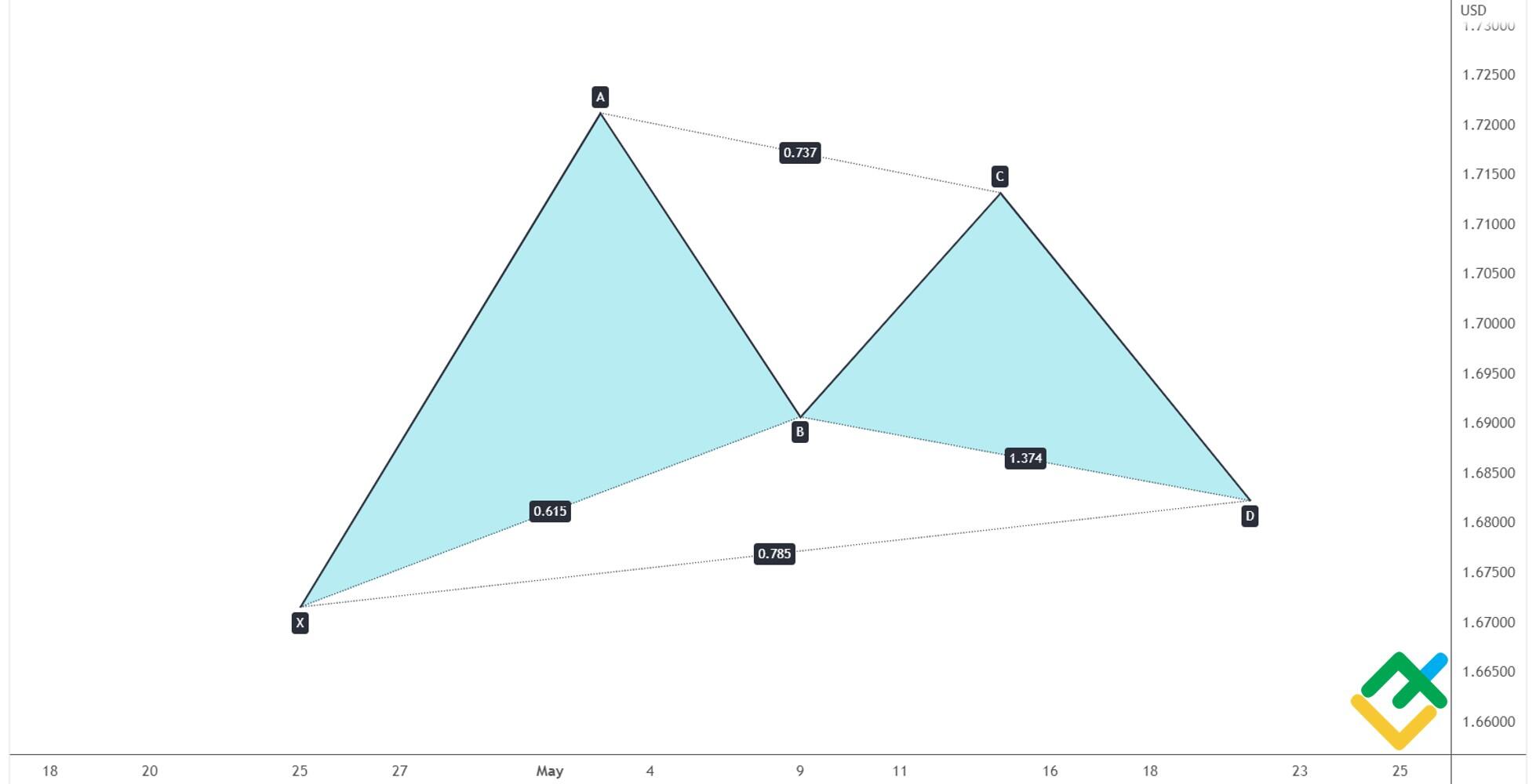

Harmonic patterns price ke four major points (X, A, B, C aur D) ke darmiyan banaye jate hain. Yeh points Fibonacci retracement aur extension ratios ke mutabiq hotay hain. Misal ke taur par, Gartley pattern main price X se A tak move karta hai, phir A se B tak retrace karta hai, aur phir C aur

D tak apni journey mukammal karta hai. D point ka asar hota hai ki price ya to reversal karega ya apne trend ko continue karega. In patterns ko identify karne ke liye accurate measurement aur chart reading ki practice zaroori hai, warna galat signal mil sakta hai.

Harmonic Patterns Challenges.

Hormonic Price Chart Pattern ka sabse bara challenge hai patterns ko accurately identify karna, kyunki inka analysis technical aur time-consuming hota hai. Dusra challenge market ka dynamic nature hai jo kabhi kabhi in patterns ko fail kar deta hai. Harmonic patterns ko samajhne aur use karne ke liye consistent practice aur patience zaroori hai. armonic price patterns ka sabse bara faida yeh hai ke yeh high probability trade setups dete hain. Agar sahi identify kiya jaye, to yeh patterns aapko entry aur exit points ka acha idea dete hain. Lekin iske saath kuch challenges bhi hain.

Harmonic patterns main commonly bataye jaane walay designs hain jaise Gartley, Bat, Crab aur Butterfly. In patterns ko samajhne ke liye trader ko technical analysis aur Fibonacci retracement levels ka knowledge hona zaroori hai.Harmonic price chart patterns trading ki ek advanced technique hai jo price ki movements aur unke specific ratios ke zariye market ki aglay trends ko predict karti hai. Yeh patterns Fibonacci ratios ka istamaal karte hain, jo ek mathematical sequence par mabni hain. Yeh patterns price ke specific points par reversal ya continuation ka pata dete hain.

Harmonic Patterns Working ?

Harmonic patterns price ke four major points (X, A, B, C aur D) ke darmiyan banaye jate hain. Yeh points Fibonacci retracement aur extension ratios ke mutabiq hotay hain. Misal ke taur par, Gartley pattern main price X se A tak move karta hai, phir A se B tak retrace karta hai, aur phir C aur

D tak apni journey mukammal karta hai. D point ka asar hota hai ki price ya to reversal karega ya apne trend ko continue karega. In patterns ko identify karne ke liye accurate measurement aur chart reading ki practice zaroori hai, warna galat signal mil sakta hai.

Harmonic Patterns Challenges.

Hormonic Price Chart Pattern ka sabse bara challenge hai patterns ko accurately identify karna, kyunki inka analysis technical aur time-consuming hota hai. Dusra challenge market ka dynamic nature hai jo kabhi kabhi in patterns ko fail kar deta hai. Harmonic patterns ko samajhne aur use karne ke liye consistent practice aur patience zaroori hai. armonic price patterns ka sabse bara faida yeh hai ke yeh high probability trade setups dete hain. Agar sahi identify kiya jaye, to yeh patterns aapko entry aur exit points ka acha idea dete hain. Lekin iske saath kuch challenges bhi hain.

تبصرہ

Расширенный режим Обычный режим