Description.

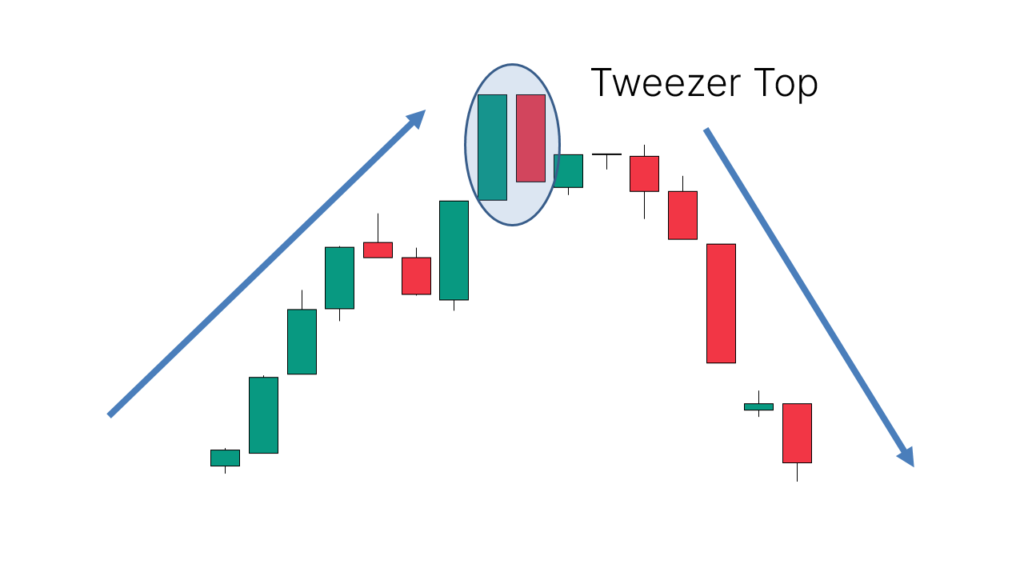

Tweezer Top ek candlestick pattern hai jo aksar market ke reversal points par nazar aata hai. Ye pattern do candlesticks se mil kar banta hai jahan pehla candlestick bullish hota hai aur doosra bearish hota hai aur in Dono candlestick patterns candlesticks ki high price barabar hoti hai jo is baat ki nishani hoti hai ke market mein resistance hai yeh pattern aksar high price levels par banta hai aur yeh signal deta hai ke price neeche gir sakti hai tweezer top par bharosa karne ke bajaye doosre technical indicators jaise ke RSI aur MACD ke saath analysis karna zaroori hai. Is pattern ka istimaal karte waqt proper risk management aur discipline zaroori hai warna aap ko loss ho sakta hai.

Pattern identification.

Tweezer Top pattern ka maqsad yeh hota hai ke traders ko warn karein ke market mein buying pressure kam ho raha hai aur selling pressure barh raha hai. Jab pehla candlestick strong bullish hota hai aur doosra candlestick bearish ban jata hai toh iska matlab yeh hota hai ke buyers apne momentum ko maintain nahi kar pa rahe. Tweezer Top pattern reliable hota hai magar har waqt kaam nahi karta. Yeh pattern tabhi kaam karega jab market mein already overbought condition hoIs pattern ko samajhne ke liye aapko candlestick ki shapes aur unke position par focus karna hota hai.

Trading Strategy.

Tweezer Top ke basis par trading karte waqt aapko sabse pehle confirmation signals ka intezar karna chahiye, jaise ke volume ka girna ya support level ka todna jab yeh pattern banta hai, aksar yeh indicate karta hai ke price neeche girne wali hai is liye traders short selling ya sell positions enter karte hain. Stop-loss ko high price ke upar set karna chahiye, aur profit target ko nearest support levels par rakhna chahiye.

Tweezer Top ek candlestick pattern hai jo aksar market ke reversal points par nazar aata hai. Ye pattern do candlesticks se mil kar banta hai jahan pehla candlestick bullish hota hai aur doosra bearish hota hai aur in Dono candlestick patterns candlesticks ki high price barabar hoti hai jo is baat ki nishani hoti hai ke market mein resistance hai yeh pattern aksar high price levels par banta hai aur yeh signal deta hai ke price neeche gir sakti hai tweezer top par bharosa karne ke bajaye doosre technical indicators jaise ke RSI aur MACD ke saath analysis karna zaroori hai. Is pattern ka istimaal karte waqt proper risk management aur discipline zaroori hai warna aap ko loss ho sakta hai.

Pattern identification.

Tweezer Top pattern ka maqsad yeh hota hai ke traders ko warn karein ke market mein buying pressure kam ho raha hai aur selling pressure barh raha hai. Jab pehla candlestick strong bullish hota hai aur doosra candlestick bearish ban jata hai toh iska matlab yeh hota hai ke buyers apne momentum ko maintain nahi kar pa rahe. Tweezer Top pattern reliable hota hai magar har waqt kaam nahi karta. Yeh pattern tabhi kaam karega jab market mein already overbought condition hoIs pattern ko samajhne ke liye aapko candlestick ki shapes aur unke position par focus karna hota hai.

Trading Strategy.

Tweezer Top ke basis par trading karte waqt aapko sabse pehle confirmation signals ka intezar karna chahiye, jaise ke volume ka girna ya support level ka todna jab yeh pattern banta hai, aksar yeh indicate karta hai ke price neeche girne wali hai is liye traders short selling ya sell positions enter karte hain. Stop-loss ko high price ke upar set karna chahiye, aur profit target ko nearest support levels par rakhna chahiye.

تبصرہ

Расширенный режим Обычный режим