Brief Description.

Dear traders abhi hum continuation trading patterns ko discuss Karen ge yea bahut hi important role play karte hain trading ko moasar aur profitable banane mein aur khas kar agar aik beginner trader hai to us ke liye bahut hi zaruri hai ki woh is ki important ko samjhen aur in patterns ke bare mein knowledge aur experience hasil kar ke trading ko continue karen kyun ki yah continuation pattern jab develop hote hain trading chart per to is ka matlab hota hai ki current trend jo hai vah continue rahe ga aur is mein koi bhi tabdili hone ke chance bahut hi kam hain aur kuch resistance ke baad ya phir Kuch consolidation ke baad trend wapas continue kray ga aur apni previous direction ko follow karte hue trend ko continue rakhay ga in patterns ko trend continuation patterns Kaha jata hai dear friends jab bhi aap continuation pattern dekhain toh volume ko zaroor analyze karein agar breakout ke waqt volume zyada ho, toh iska matlab trend mazboot hai. Doosra, risk management ko madde nazar rakhein aur stop-loss lagana na bhoolain, jab ek trend chal raha hota hai (upar ya neeche), toh yeh patterns is trend ki continuation ko dikhatay hain aur traders ko entry aur exit points identify karne mein madad detay hain.

Bullish / Bearish Continuation Patterns.

Dear traders ab ham yah jana ne ki koshish karte hain kay trend continuation pattern Kitni types ke hote hain aur Kis tarah say trading per in ka asar padta hai aur kis tarah say trader in ko apni judgement ke zarie judge kar ke acchi trading result shasan kar sakta hai Trend continuation patterns 2 tarha ke hotay hain bullish aur bearish.

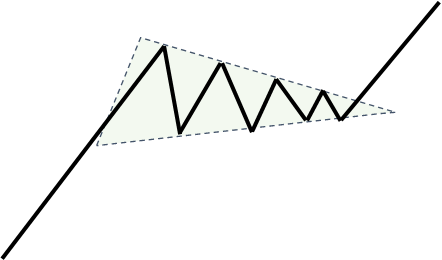

Bullish continuation patterns tab hotay hain jab market ka trend upar ki taraf ho aur usi direction mein continue karay. Is mein common patterns symmetrical triangles, flags aur pennants hotay hain.

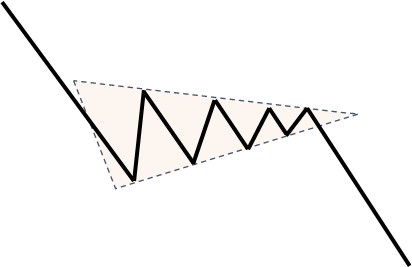

Bearish continuation patterns tab banti hain jab market neeche ki taraf ja raha ho aur yeh neeche hi continue kare. Yeh patterns zyada tar descending triangles aur bearish flags ki shakal mein hotay hain. Inka samajhna zaroori hai kyun ke yeh patterns timing aur strategy banane mein kaam aatay hain.

Some other Common Countinoution Patterns.

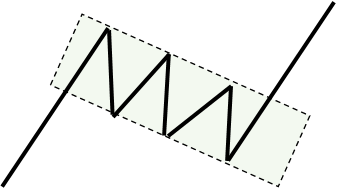

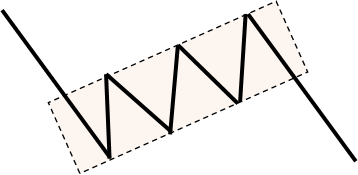

Dear friends aap ko btata chaloon kay Jo oopar hum ne zikr kiya woh Bulish aur Bearish continuation pattern the abhi ham Kuchh common types of Countinoution pattern ko discuss karte hain dear traders kuch common trend continuation patterns mein flags, pennants, aur triangles shamil hain. Flag patterns seedhi ya diagonal lines ke zariye banti hain jo trend ke opposite hoti hain, magar baad mein trend ke saath hi continue karti hain. Pennant patterns chhoti triangles ki shakal mein hoti hain jo temporary consolidation ko dikhati hain. Symmetrical triangles dono sides se squeeze karti hain aur baad mein breakout hota hai jis direction mein trend hai. Inka sahi analysis karke aap profit aur loss ka andaza laga saktay hain aur apni strategy better bana saktay hain.

Dear traders abhi hum continuation trading patterns ko discuss Karen ge yea bahut hi important role play karte hain trading ko moasar aur profitable banane mein aur khas kar agar aik beginner trader hai to us ke liye bahut hi zaruri hai ki woh is ki important ko samjhen aur in patterns ke bare mein knowledge aur experience hasil kar ke trading ko continue karen kyun ki yah continuation pattern jab develop hote hain trading chart per to is ka matlab hota hai ki current trend jo hai vah continue rahe ga aur is mein koi bhi tabdili hone ke chance bahut hi kam hain aur kuch resistance ke baad ya phir Kuch consolidation ke baad trend wapas continue kray ga aur apni previous direction ko follow karte hue trend ko continue rakhay ga in patterns ko trend continuation patterns Kaha jata hai dear friends jab bhi aap continuation pattern dekhain toh volume ko zaroor analyze karein agar breakout ke waqt volume zyada ho, toh iska matlab trend mazboot hai. Doosra, risk management ko madde nazar rakhein aur stop-loss lagana na bhoolain, jab ek trend chal raha hota hai (upar ya neeche), toh yeh patterns is trend ki continuation ko dikhatay hain aur traders ko entry aur exit points identify karne mein madad detay hain.

Bullish / Bearish Continuation Patterns.

Dear traders ab ham yah jana ne ki koshish karte hain kay trend continuation pattern Kitni types ke hote hain aur Kis tarah say trading per in ka asar padta hai aur kis tarah say trader in ko apni judgement ke zarie judge kar ke acchi trading result shasan kar sakta hai Trend continuation patterns 2 tarha ke hotay hain bullish aur bearish.

Bullish continuation patterns tab hotay hain jab market ka trend upar ki taraf ho aur usi direction mein continue karay. Is mein common patterns symmetrical triangles, flags aur pennants hotay hain.

Bearish continuation patterns tab banti hain jab market neeche ki taraf ja raha ho aur yeh neeche hi continue kare. Yeh patterns zyada tar descending triangles aur bearish flags ki shakal mein hotay hain. Inka samajhna zaroori hai kyun ke yeh patterns timing aur strategy banane mein kaam aatay hain.

Some other Common Countinoution Patterns.

Dear friends aap ko btata chaloon kay Jo oopar hum ne zikr kiya woh Bulish aur Bearish continuation pattern the abhi ham Kuchh common types of Countinoution pattern ko discuss karte hain dear traders kuch common trend continuation patterns mein flags, pennants, aur triangles shamil hain. Flag patterns seedhi ya diagonal lines ke zariye banti hain jo trend ke opposite hoti hain, magar baad mein trend ke saath hi continue karti hain. Pennant patterns chhoti triangles ki shakal mein hoti hain jo temporary consolidation ko dikhati hain. Symmetrical triangles dono sides se squeeze karti hain aur baad mein breakout hota hai jis direction mein trend hai. Inka sahi analysis karke aap profit aur loss ka andaza laga saktay hain aur apni strategy better bana saktay hain.

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Continuation_Patterns_An_Introduction_Jul_2020-04-3a8a5359db144bc3a55a247a4be8f2e4.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Continuation_Patterns_An_Introduction_Jul_2020-06-8783de7e12c04359b2dc29af6ee39d80.jpg)

تبصرہ

Расширенный режим Обычный режим