1. Arbitrage Strategy ka Taaruf

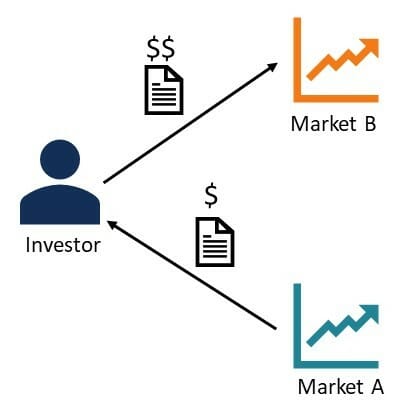

Arbitrage ek aisi trading strategy hai jo faraq (price difference) ka faida uthane ke liye use hoti hai. Is mein ek hi asset ko do ya zyada markets mein alag-alag prices par khareed aur becha jata hai. Yeh strategy un investors ke liye kaam ki hoti hai jo fast aur efficient trading karte hain. Misal ke taur par, agar kisi stock ki price ek market mein kam aur doosri market mein zyada hai, to trader usay kam price par khareed kar zyada price par bech kar profit kama leta hai.

2. Arbitrage ki Qisamain

Arbitrage ki mukhtalif qisamain hain jo trading ke alag scenarios mein use hoti hain. Sabse aam qisam spatial arbitrage hai, jo do alag locations ya markets ke darmiyan price difference ka faida uthata hai. Doosri qisam statistical arbitrage hai, jo mathematical models aur historical data ka istemal karti hai. Aik aur qisam triangular arbitrage kehlati hai, jo forex trading mein teen currencies ke darmiyan price farq ka faida uthati hai. Har qisam ka apna tareeqa aur risk factor hota hai.

3. Technology ka Kirdar

Arbitrage trading mein technology ka bohot bara kirdar hai. Advanced software aur high-frequency trading (HFT) systems ki madad se traders seconds ke andar price farq identify kar lete hain aur trades execute karte hain. Algorithms ka istemal is process ko automate karta hai, jo human error ko kam karta hai. Lekin, competition zyada hone ki wajah se yeh zaroori hai ke traders apni technology ko update rakhein aur fast execution systems use karein.

4. Arbitrage ke Risks aur Challenges

Arbitrage trading profitable hai, lekin ismein kuch challenges bhi hain. Transaction costs ya fees kabhi kabhi profit ko khatam kar deti hai. Doosri taraf, market timing risk bhi hota hai, agar price farq khatam ho jaye to loss ka samna ho sakta hai. Legal aur regulatory restrictions bhi arbitrage strategies par asar daalti hain, kyun ke har market ke apne rules aur laws hote hain. Traders ko har angle se apni strategy ko analyze karna hota hai taake wo efficiently kaam kar sakein.

Arbitrage ek aisi trading strategy hai jo faraq (price difference) ka faida uthane ke liye use hoti hai. Is mein ek hi asset ko do ya zyada markets mein alag-alag prices par khareed aur becha jata hai. Yeh strategy un investors ke liye kaam ki hoti hai jo fast aur efficient trading karte hain. Misal ke taur par, agar kisi stock ki price ek market mein kam aur doosri market mein zyada hai, to trader usay kam price par khareed kar zyada price par bech kar profit kama leta hai.

2. Arbitrage ki Qisamain

Arbitrage ki mukhtalif qisamain hain jo trading ke alag scenarios mein use hoti hain. Sabse aam qisam spatial arbitrage hai, jo do alag locations ya markets ke darmiyan price difference ka faida uthata hai. Doosri qisam statistical arbitrage hai, jo mathematical models aur historical data ka istemal karti hai. Aik aur qisam triangular arbitrage kehlati hai, jo forex trading mein teen currencies ke darmiyan price farq ka faida uthati hai. Har qisam ka apna tareeqa aur risk factor hota hai.

3. Technology ka Kirdar

Arbitrage trading mein technology ka bohot bara kirdar hai. Advanced software aur high-frequency trading (HFT) systems ki madad se traders seconds ke andar price farq identify kar lete hain aur trades execute karte hain. Algorithms ka istemal is process ko automate karta hai, jo human error ko kam karta hai. Lekin, competition zyada hone ki wajah se yeh zaroori hai ke traders apni technology ko update rakhein aur fast execution systems use karein.

4. Arbitrage ke Risks aur Challenges

Arbitrage trading profitable hai, lekin ismein kuch challenges bhi hain. Transaction costs ya fees kabhi kabhi profit ko khatam kar deti hai. Doosri taraf, market timing risk bhi hota hai, agar price farq khatam ho jaye to loss ka samna ho sakta hai. Legal aur regulatory restrictions bhi arbitrage strategies par asar daalti hain, kyun ke har market ke apne rules aur laws hote hain. Traders ko har angle se apni strategy ko analyze karna hota hai taake wo efficiently kaam kar sakein.

تبصرہ

Расширенный режим Обычный режим