Momentum Trading Kya Hai?

Momentum trading ek aisi strategy hai jo stock ya asset ki price ki fast movement ka faida uthati hai. Is strategy mein traders un stocks ko kharidte hain jin ki prices rapidly barh rahi hoti hain, aur unhein bechte hain jab prices girne lagti hain. Momentum ka matlab hai kisi cheez ka tezi se agey barhna ya peeche girna, aur traders is trend ko samajhne ki koshish karte hain taake profit banaya ja sake. Is tarah ke trading mein market ki timing aur data analysis bohot

zaruri hota hai.

Momentum Trading Ke Principles

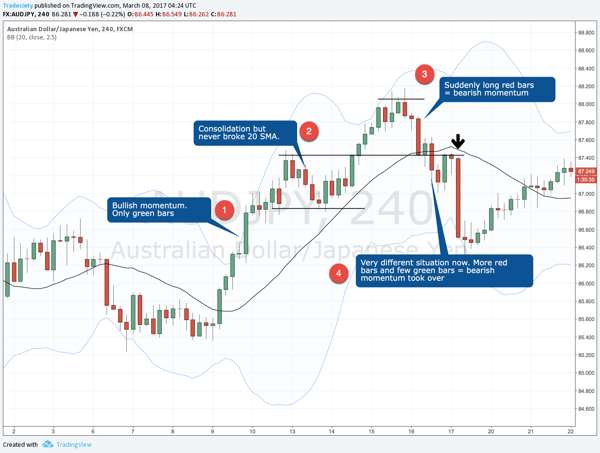

Momentum trading ka sabse zaruri principle yeh hai ke “trend is your friend,” yani agar ek stock ki price upar ja rahi hai to us trend ko follow karna chahiye. Lekin iska matlab yeh nahi ke blindly kisi stock mein invest kiya jaye. Momentum traders aksar technical indicators ka use karte hain, jaise moving averages, relative strength index (RSI), aur volume analysis, taake trend ki sustainability ka pata lagaya ja sake. Yeh tools traders ko yeh samajhne mein madad dete hain ke price kab tak barhne ya girne wali hai.

Risk Management Ki Ahmiyat

Momentum trading high-risk strategy hai, kyunke price rapid movement ke wajah se losses hone ka chance bhi hota hai. Isliye, risk management bohot ahmiyat rakhta hai. Momentum traders aksar stop-loss orders lagate hain jo unhein unexpected losses se bachate hain. Iske ilawa, diversification bhi ek zaruri tactic hai taake ek stock ke loss ko doosri investments se balance kiya ja sake. Momentum trading mein emotional control bhi zaruri hai; traders ko greed aur fear ko control karna padta hai.

Momentum Trading Mein Timing Ka Role

Momentum trading mein timing sabse bara role ada karti hai. Yeh zaruri hai ke trader sahi waqt par entry aur exit kare. Der se entry ya exit karne ka matlab hai profit miss karna ya losses lena. Isliye, momentum traders ko market ka analysis karte rehna padta hai aur unhein updated rahna padta hai. Market news, economic events, aur sector-specific trends ko dekhna zaruri hota hai. Yeh sab cheezein momentum trading ke success ke liye madadgar hoti hain.

Momentum trading ek aisi strategy hai jo stock ya asset ki price ki fast movement ka faida uthati hai. Is strategy mein traders un stocks ko kharidte hain jin ki prices rapidly barh rahi hoti hain, aur unhein bechte hain jab prices girne lagti hain. Momentum ka matlab hai kisi cheez ka tezi se agey barhna ya peeche girna, aur traders is trend ko samajhne ki koshish karte hain taake profit banaya ja sake. Is tarah ke trading mein market ki timing aur data analysis bohot

zaruri hota hai.

Momentum Trading Ke Principles

Momentum trading ka sabse zaruri principle yeh hai ke “trend is your friend,” yani agar ek stock ki price upar ja rahi hai to us trend ko follow karna chahiye. Lekin iska matlab yeh nahi ke blindly kisi stock mein invest kiya jaye. Momentum traders aksar technical indicators ka use karte hain, jaise moving averages, relative strength index (RSI), aur volume analysis, taake trend ki sustainability ka pata lagaya ja sake. Yeh tools traders ko yeh samajhne mein madad dete hain ke price kab tak barhne ya girne wali hai.

Risk Management Ki Ahmiyat

Momentum trading high-risk strategy hai, kyunke price rapid movement ke wajah se losses hone ka chance bhi hota hai. Isliye, risk management bohot ahmiyat rakhta hai. Momentum traders aksar stop-loss orders lagate hain jo unhein unexpected losses se bachate hain. Iske ilawa, diversification bhi ek zaruri tactic hai taake ek stock ke loss ko doosri investments se balance kiya ja sake. Momentum trading mein emotional control bhi zaruri hai; traders ko greed aur fear ko control karna padta hai.

Momentum Trading Mein Timing Ka Role

Momentum trading mein timing sabse bara role ada karti hai. Yeh zaruri hai ke trader sahi waqt par entry aur exit kare. Der se entry ya exit karne ka matlab hai profit miss karna ya losses lena. Isliye, momentum traders ko market ka analysis karte rehna padta hai aur unhein updated rahna padta hai. Market news, economic events, aur sector-specific trends ko dekhna zaruri hota hai. Yeh sab cheezein momentum trading ke success ke liye madadgar hoti hain.

تبصرہ

Расширенный режим Обычный режим