Cup and Handle Candlestick Pattern:

Cup and handle candlestick pattern ek popular technical analysis tool hai jo stock market aur trading mein use hota hai. Yeh pattern price chart par ek cup aur handle ki shape mein nazar aata hai aur yeh price ki potential upward movement ka signal deta hai. Is pattern ko samajhna aur pehchanna har trader ke liye zaroori hai, taake wo apne trades mein behtar decision le sake.

Cup and Handle Pattern Kya Hai?

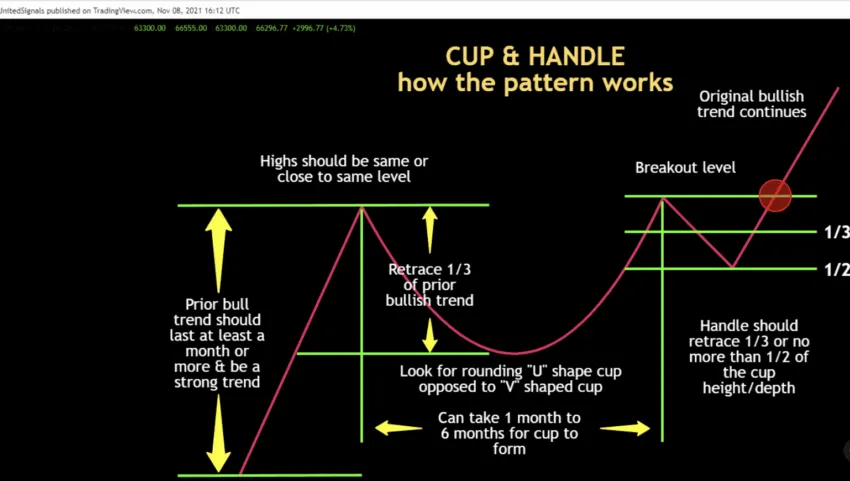

Cup and handle pattern do main parts par mushtamil hota hai:

1. Cup:

Yeh part chart par ek U-shape ya circular shape ki tarah nazar aata hai. Is phase mein price pehle girta hai, phir wapas upar aata hai aur phir se neeche girta hai, lekin pehle se kam neeche. Isse price ka retracement dikhayi deta hai.

2. Handle:

Cup ke baad jo chhota sa consolidation area hota hai, wo handle kehlata hai. Is handle ke dauran price thoda sa neeche jata hai aur phir uske baad ek upward breakout hota hai. Yeh handle typically cup ke upar ke hisse mein hota hai aur price ki bullish movement ke liye setup karta hai

Cup and Handle Pattern Ka Formation:

Cup:

Jab stock ya asset ka price girta hai, phir recovery hoti hai aur phir ek consolidation hota hai, jo cup ki shape banata hai. Is phase mein market mein chhoti corrections hoti hain.

Handle:

Cup ke baad, price thoda consolidation karta hai, yani price thoda sideways ya neeche move karta hai. Yeh handle ka part hota hai. Handle ka size zyada lamba nahi hona chahiye, varna yeh pattern weak ho sakta hai.

Cup and Handle Pattern Ki Validity:

Cup and handle pattern ko valid tab mana jata hai jab:

1. Cup ki shape smooth ho aur zyada sharp na ho.

2. Handle ka size cup ke size ke comparison mein chhota ho.

3. Breakout handle ke upper part se ho, yani jab price handle ke resistance level ko cross kare.

Cup and Handle Pattern Ka Significance:

Yeh pattern bullish hota hai, iska matlab hai ke yeh zyada tar upwards price movement ko signal deta hai. Jab price handle ke resistance level ko cross karta hai, to ek strong buying signal milta hai. Yeh pattern generally long-term bullish trend ko indicate karta hai, isliye traders isse market mein enter karte hain jab unhe lagta hai ke price upward move kar sakta hai.

Cup and Handle Pattern Ka Use:

1. Entry Point:

Jab handle ka breakout hota hai, yani price handle ke resistance level ko cross karta hai, tab traders apni buy positions open karte hain.

2. Stop-Loss:

Stop-loss ko handle ke niche rakha jata hai, jahan price ke neeche break hone ki chance hoti hai.

3. Target Price:

Cup and handle pattern ke upar se breakout ke baad, ek approximate target price set kiya jata hai. Yeh target price cup ke depth ke barabar hota hai.

Conclusion:

Cup and handle candlestick pattern ek powerful technical tool hai jo traders ko future price movements predict karne mein madad karta hai. Yeh pattern bullish trend ko signal karta hai, lekin isse sahi tarah se identify karna aur risk management karna zaroori hai. Agar aap is pattern ko apne trading strategy mein include karte hain, to aapko patience aur analysis ki zarurat hogi taake aap accurate trades le sakein.

Cup and handle candlestick pattern ek popular technical analysis tool hai jo stock market aur trading mein use hota hai. Yeh pattern price chart par ek cup aur handle ki shape mein nazar aata hai aur yeh price ki potential upward movement ka signal deta hai. Is pattern ko samajhna aur pehchanna har trader ke liye zaroori hai, taake wo apne trades mein behtar decision le sake.

Cup and Handle Pattern Kya Hai?

Cup and handle pattern do main parts par mushtamil hota hai:

1. Cup:

Yeh part chart par ek U-shape ya circular shape ki tarah nazar aata hai. Is phase mein price pehle girta hai, phir wapas upar aata hai aur phir se neeche girta hai, lekin pehle se kam neeche. Isse price ka retracement dikhayi deta hai.

2. Handle:

Cup ke baad jo chhota sa consolidation area hota hai, wo handle kehlata hai. Is handle ke dauran price thoda sa neeche jata hai aur phir uske baad ek upward breakout hota hai. Yeh handle typically cup ke upar ke hisse mein hota hai aur price ki bullish movement ke liye setup karta hai

Cup and Handle Pattern Ka Formation:

Cup:

Jab stock ya asset ka price girta hai, phir recovery hoti hai aur phir ek consolidation hota hai, jo cup ki shape banata hai. Is phase mein market mein chhoti corrections hoti hain.

Handle:

Cup ke baad, price thoda consolidation karta hai, yani price thoda sideways ya neeche move karta hai. Yeh handle ka part hota hai. Handle ka size zyada lamba nahi hona chahiye, varna yeh pattern weak ho sakta hai.

Cup and Handle Pattern Ki Validity:

Cup and handle pattern ko valid tab mana jata hai jab:

1. Cup ki shape smooth ho aur zyada sharp na ho.

2. Handle ka size cup ke size ke comparison mein chhota ho.

3. Breakout handle ke upper part se ho, yani jab price handle ke resistance level ko cross kare.

Cup and Handle Pattern Ka Significance:

Yeh pattern bullish hota hai, iska matlab hai ke yeh zyada tar upwards price movement ko signal deta hai. Jab price handle ke resistance level ko cross karta hai, to ek strong buying signal milta hai. Yeh pattern generally long-term bullish trend ko indicate karta hai, isliye traders isse market mein enter karte hain jab unhe lagta hai ke price upward move kar sakta hai.

Cup and Handle Pattern Ka Use:

1. Entry Point:

Jab handle ka breakout hota hai, yani price handle ke resistance level ko cross karta hai, tab traders apni buy positions open karte hain.

2. Stop-Loss:

Stop-loss ko handle ke niche rakha jata hai, jahan price ke neeche break hone ki chance hoti hai.

3. Target Price:

Cup and handle pattern ke upar se breakout ke baad, ek approximate target price set kiya jata hai. Yeh target price cup ke depth ke barabar hota hai.

Conclusion:

Cup and handle candlestick pattern ek powerful technical tool hai jo traders ko future price movements predict karne mein madad karta hai. Yeh pattern bullish trend ko signal karta hai, lekin isse sahi tarah se identify karna aur risk management karna zaroori hai. Agar aap is pattern ko apne trading strategy mein include karte hain, to aapko patience aur analysis ki zarurat hogi taake aap accurate trades le sakein.

تبصرہ

Расширенный режим Обычный режим