Assalamu Alaikum Dosto!

Morning Doji Star Candlestick Pattern

Aaj ke market mein, strong trading signals lena mushkil ho sakta hai. Morning Doji Star wohi Forex indicator pattern hai jo sirf ek early rise nahi deta balki agar theek tarah apply kiya jaye to kaafi profitable trading opportunities bhi provide karta hai.

Is pattern ko apni kisi bhi Forex strategy mein apply karne se pehle zaroori hai ke iske peeche ki theory ko samjha jaye. Morning Doji Star ek bullish reversal pattern hai. Yeh swing low trend point par, jab sellers buyers ke samne poori tarah thak jaate hain, market mein entry ke liye acha point identify karne ka kaam karta hai.

Yeh candlestick teen mukhtalif hisson mein divide hota hai. Har part sellers ki power ko kamzor karta hai jab tak ke wo poori tarah buyers ke paas na chali jaye. Jab bhi yeh pattern banay, yeh zaroori hai ke buyers ke momentum ke sath ho. Morning Doji Star Doji family se belong karta hai, jo indecision candlestick kehlata hai.

Morning Doji Star Pattern Formation

Jaisa ke pehle bataya gaya, yeh candlestick teen candlesticks par mabni hota hai. Yeh baat Forex charts par kisi bhi level ke trader ke liye ise pehchanana asaan banati hai. Yeh aam tor par downtrends ya swing lows par nazar aata hai.

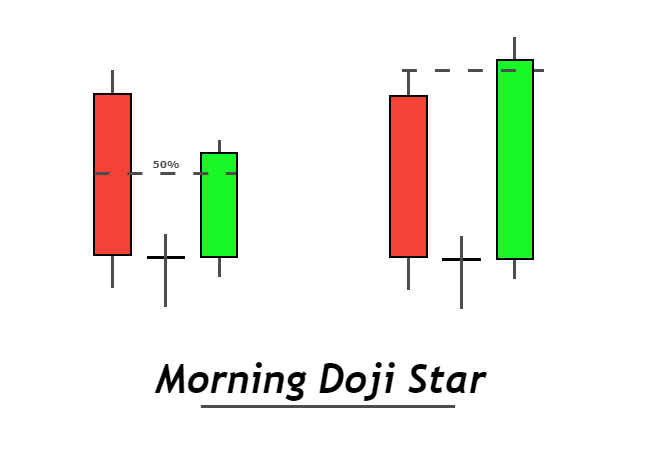

Morning Doji Star ki ek aur khasiyat iska 3-bar pattern hai jo iss order mein hota hai:

- First Candle: Bullish morning doji star candlestick pattern ki pehli candle aik long real body wali bearish candle hoti hai, jo k prices k sabeqa bearish trend ki alamat hoti hai. Ye candle color main black ya red hoti hai, jiss real body shadow ki nisbat ziada hoti hai.

- Second Candle: Bullish morning doji star candlestick pattern ki dosri candle aik doji candle hoti hai, jiss ka koi color nahi hota hai. Ye candle prices ko waqti tawar par mazeed nechay jane se rok leti hai. Ye candle pehli bearish candle se nechay banti hai. Jo k bearish aur bullish dono hososeyat rakhti hai, lekin iss ko bullish candle hi tasawar kia jata hai.

- Third Candle: Bullish morning doji star candlestick pattern ki teesri candle aik bullish candle banti hai, jo k sabeqa trend ka khatema karke new bullish trend reversal ka sabab banti hai. Ye candle strong bullish candle hoti hai, jiss ka upper ya lower side par small wick ho sakti hai, lekin ye doji candle se upper side par gap main banna chaheye.

Morning Doji Star aur Morning Star Pattern ka Faraq

Middle candlestick wo part hai jo dono patterns ko mukhtalif banata hai. Doji pattern ke middle candlestick mein buyers aur sellers ke darmiyan kaafi kareebi muqabla hota hai aur koi ek dusre ko overpower nahi kar pata.

Seedhi baat karein to hum market ke indecision ko dekhte hain. Agar logic ke sath socha jaye to ye candlestick batata hai ke buyers dominate karna shuru kar rahe hain aur sellers ka control khatam ho raha hai.

Jab market mein is tarah ka indecision ho, traders ko yeh samajhna chahiye ke doosri taraf kaise momentum barhaya ja sakta hai. Agar is logic ko technical analysis ke sath mila diya jaye, to yeh kaafi ache market entry points de sakta hai.

Morning Doji Star Pattern ko Trade Karne ke Tips

Chart patterns ke momentum ke peeche ki theory kaafi zaroori hoti hai. Yeh sikhati hai ke kis tarah logical aur sochi samjhi decisions lene hain, na ke sirf price action ko robotically follow karna hai. Candlesticks aur khaas tor par Morning Doji Star, Forex market ke sath engage hone ka naya level dete hain. Iske ilawa, yeh potentially unprofitable trades ko filter karne ka bhi acha tool hai.

Hum strongly recommend karte hain ke har level ka trader theory ko review karein taake yeh samajh saken ke candlestick patterns ke mukhtalif formations kab aur kaisay hoti hain.

Morning Doji Star ke sath trade karte waqt in steps ko consider karein:

- Downtrend ko identify karein Agar aapko chart patterns aur candlesticks parhna aata hai to downtrend identify karna mushkil nahi hoga, is liye is par zyada discuss nahi karenge.

- Pattern identify karein Dusra step Morning Doji Star ko pehchanana hai, jaisa ke pehle bataya gaya. Yeh wo jagah hai jahan aapko pattern poora hone tak intezaar karna hoga, warna yeh discredit ho sakta hai.

- Stop loss set karein Jaise hi bullish candlestick ban jaye, signal ko validate karein aur stop-loss order Doji candlestick ke low se 1-2 pips neeche lagayein.

- Trade execute karein Aam tor par traders apni entries bullish ya bearish candlestick ke high ke 1-2 pips upar lagate hain, jo bhi unmein se zyada upar ho.

- Take profit level set karein Apni risk management strategy aur trading goals ke mutabiq take profit level decide karein. Achi idea yeh hoti hai ke ise nearest resistance level par set karein.

Conclusion

Humne Morning Doji Star ke peeche ki theory aur is candlestick pattern ke sath trade karne ke tips seekhi hain. Kuch traders shayad yeh sochein ke itne saare technical indicators hote hue is pattern ka istemal kyun karein.

Iska main reason yeh hai ke yeh zyada profitable trading opportunities generate karne ki ability rakhta hai. Iske ilawa, is pattern ke zariye aap sirf price action ko follow karne ke bajaye trading logic ka istemal seekh sakte hain jo specific trades ke decisions lene mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим