Bullish Engulfing Aur Bullish Pin Bar Candlestick Patterns Mein Farq

Candlestick patterns trading mein ek ahem role ada karte hain, aur dono Bullish Engulfing aur Bullish Pin Bar candlestick patterns market ke upar jane ki soorat mein aksar dekhe jate hain. Lekin dono patterns mein kuch ahem differences hain, jo traders ko samajhna zaroori hai.

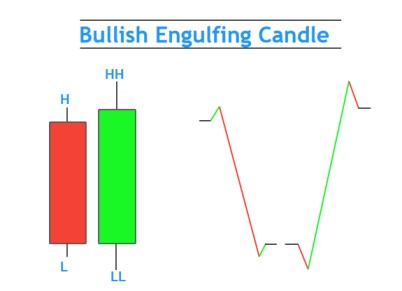

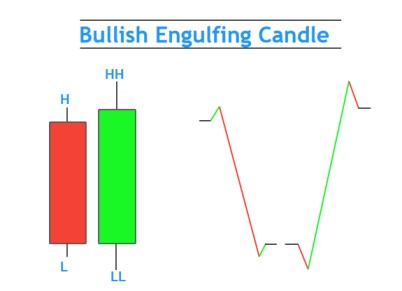

Bullish Engulfing Candlestick

Bullish Engulfing ek reversal pattern hai, jo ke market mein downtrend ke baad hota hai. Is pattern mein do candlesticks hotay hain:

1. Pehli candlestick bearish (red) hoti hai, jo market mein girawat ko show karti hai.

2. Doosri candlestick bullish (green) hoti hai aur pehli candlestick ko pura tarah se engulf (cover) karti hai. Iska matlab hai ke doosri candlestick ki body pehli candlestick ki body se zyada long hoti hai.

Key Points:

Bullish Engulfing pattern tab hota hai jab market ne pehle se decline dekh liya ho, aur phir ek strong bullish candlestick uss decline ko reverse karti hai.

Is pattern ko trade karte waqt, yeh zaroori hai ke volume bhi high ho, taake confirmation mil sake ke buying pressure barh gaya hai.

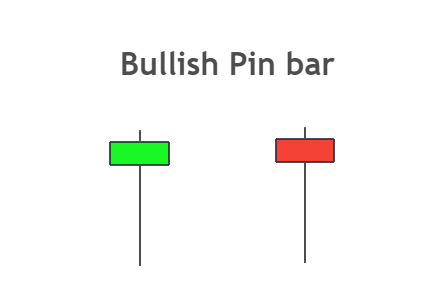

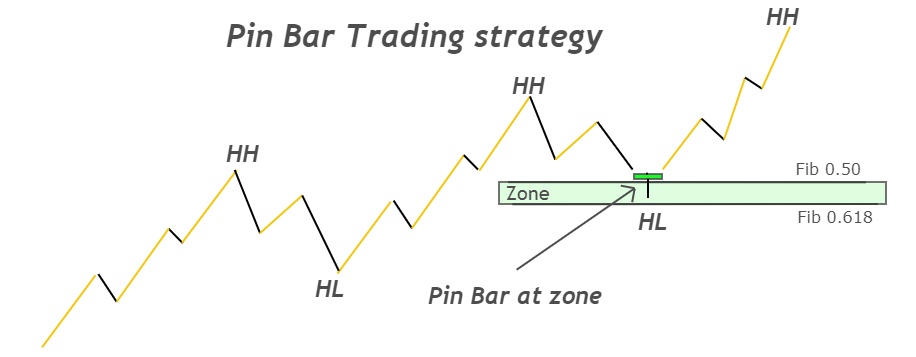

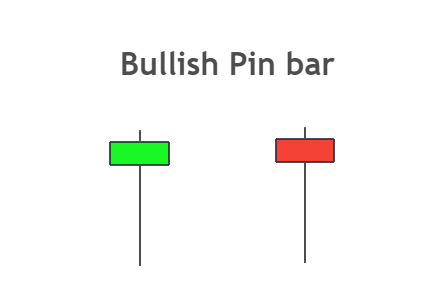

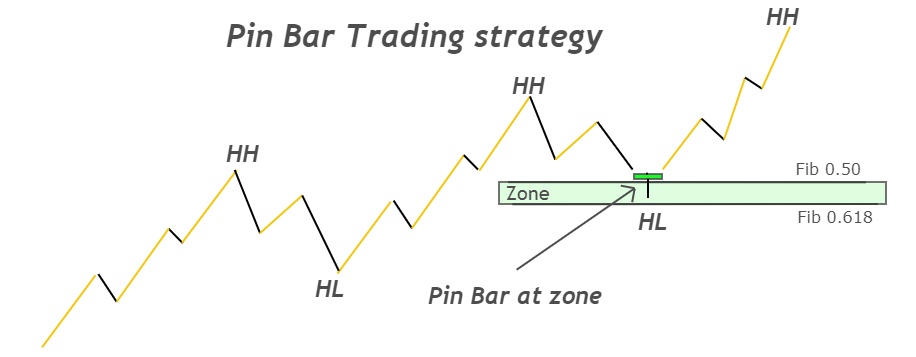

Bullish Pin Bar Candlestick

Bullish Pin Bar bhi ek reversal pattern hai, lekin yeh ek single candlestick pattern hota hai. Pin Bar mein ek chhoti body hoti hai aur ek lamba tail (wick) hota hai, jo niche ki taraf hota hai. Yeh tail market ke bearish movement ko indicate karta hai, lekin body upar ki taraf hoti hai, jo ke ek potential reversal ko signal karti hai

Key Points:

Bullish Pin Bar usually tab banta hai jab market kisi support level par hota hai, aur bearish movement ke baad ek strong reversal hota hai.

Is pattern ki khas baat yeh hai ke long wick market mein buyer ke comeback ko dikhata hai.

Yeh pattern ek strong rejection ka signal deta hai, jo ke market ke reversal ke chances ko barhata hai.

Bullish Engulfing Aur Bullish Pin Bar Mein Farq

1. Number of Candlesticks:

Bullish Engulfing:

Yeh 2 candlesticks ka pattern hai.

Bullish Pin Bar:

Yeh ek single candlestick ka pattern hai.

2. Pattern Ki Shakal:

Bullish Engulfing:

Ismein doosri candlestick puri tarah se pehli candlestick ko engulf karti hai.

Bullish Pin Bar:

Ismein ek chhoti body hoti hai aur lambi tail hoti hai.

3. Market Context:

Bullish Engulfing:

Yeh generally downtrend ke baad banta hai aur strong reversal indicate karta hai.

Bullish Pin Bar:

Yeh market ke support level par banta hai, jahan buyers ne market ko reverse kiya ho.

4. Signal Strength:

Bullish Engulfing:

Yeh strong reversal signal deta hai jab ek strong bullish candlestick puri bearish candlestick ko engulf karti hai.

Bullish Pin Bar:

Yeh signal deta hai jab market ne bearish movement ko reject kiya ho aur price wapas upar jata hai.

Conclusion

Dono candlestick patterns apni jagah kaafi effective hain, lekin unki characteristics aur signal dene ka tareeqa thoda different hai. Bullish Engulfing zyada momentum aur strong reversal ko show karta hai, jabke Bullish Pin Bar market mein ek rejection aur buyer ke comeback ko indicate karta hai. Dono patterns ko samajh kar aur market ki context ko dekh kar trade karna zaroori hota hai.

Candlestick patterns trading mein ek ahem role ada karte hain, aur dono Bullish Engulfing aur Bullish Pin Bar candlestick patterns market ke upar jane ki soorat mein aksar dekhe jate hain. Lekin dono patterns mein kuch ahem differences hain, jo traders ko samajhna zaroori hai.

Bullish Engulfing Candlestick

Bullish Engulfing ek reversal pattern hai, jo ke market mein downtrend ke baad hota hai. Is pattern mein do candlesticks hotay hain:

1. Pehli candlestick bearish (red) hoti hai, jo market mein girawat ko show karti hai.

2. Doosri candlestick bullish (green) hoti hai aur pehli candlestick ko pura tarah se engulf (cover) karti hai. Iska matlab hai ke doosri candlestick ki body pehli candlestick ki body se zyada long hoti hai.

Key Points:

Bullish Engulfing pattern tab hota hai jab market ne pehle se decline dekh liya ho, aur phir ek strong bullish candlestick uss decline ko reverse karti hai.

Is pattern ko trade karte waqt, yeh zaroori hai ke volume bhi high ho, taake confirmation mil sake ke buying pressure barh gaya hai.

Bullish Pin Bar Candlestick

Bullish Pin Bar bhi ek reversal pattern hai, lekin yeh ek single candlestick pattern hota hai. Pin Bar mein ek chhoti body hoti hai aur ek lamba tail (wick) hota hai, jo niche ki taraf hota hai. Yeh tail market ke bearish movement ko indicate karta hai, lekin body upar ki taraf hoti hai, jo ke ek potential reversal ko signal karti hai

Key Points:

Bullish Pin Bar usually tab banta hai jab market kisi support level par hota hai, aur bearish movement ke baad ek strong reversal hota hai.

Is pattern ki khas baat yeh hai ke long wick market mein buyer ke comeback ko dikhata hai.

Yeh pattern ek strong rejection ka signal deta hai, jo ke market ke reversal ke chances ko barhata hai.

Bullish Engulfing Aur Bullish Pin Bar Mein Farq

1. Number of Candlesticks:

Bullish Engulfing:

Yeh 2 candlesticks ka pattern hai.

Bullish Pin Bar:

Yeh ek single candlestick ka pattern hai.

2. Pattern Ki Shakal:

Bullish Engulfing:

Ismein doosri candlestick puri tarah se pehli candlestick ko engulf karti hai.

Bullish Pin Bar:

Ismein ek chhoti body hoti hai aur lambi tail hoti hai.

3. Market Context:

Bullish Engulfing:

Yeh generally downtrend ke baad banta hai aur strong reversal indicate karta hai.

Bullish Pin Bar:

Yeh market ke support level par banta hai, jahan buyers ne market ko reverse kiya ho.

4. Signal Strength:

Bullish Engulfing:

Yeh strong reversal signal deta hai jab ek strong bullish candlestick puri bearish candlestick ko engulf karti hai.

Bullish Pin Bar:

Yeh signal deta hai jab market ne bearish movement ko reject kiya ho aur price wapas upar jata hai.

Conclusion

Dono candlestick patterns apni jagah kaafi effective hain, lekin unki characteristics aur signal dene ka tareeqa thoda different hai. Bullish Engulfing zyada momentum aur strong reversal ko show karta hai, jabke Bullish Pin Bar market mein ek rejection aur buyer ke comeback ko indicate karta hai. Dono patterns ko samajh kar aur market ki context ko dekh kar trade karna zaroori hota hai.