Risk Management Kya Hai?

Assalamu alaikum aaj Ham trade pa ahim facts discuss karne ja rahe hain.

Risk management trading ka ek ahem hissa hai jo traders ko financial losses se bachne mein madad deta hai. Iska maqsad hai apne capital ko surakshit rakhna aur stable profits banana. Risk management ke bina, market ki volatility ya galat decisions ke natije mein traders apna sara paisa khona ka risk utha lete hain.

Position Sizing Aur Capital Allocation

Risk management ka pehla qadam position sizing aur capital allocation hai. Har trade ke liye apne overall capital ka ek chhota hissa lagana chahiye, taake agar loss ho, to overall portfolio zyada affect na ho. Aam tor par traders apne account ka sirf 1-2% ek trade mein invest karte hain. Yeh strategy aapko bade nuksaan se bachati hai aur aapko disciplined banati hai.

Stop Loss Aur Take Profit

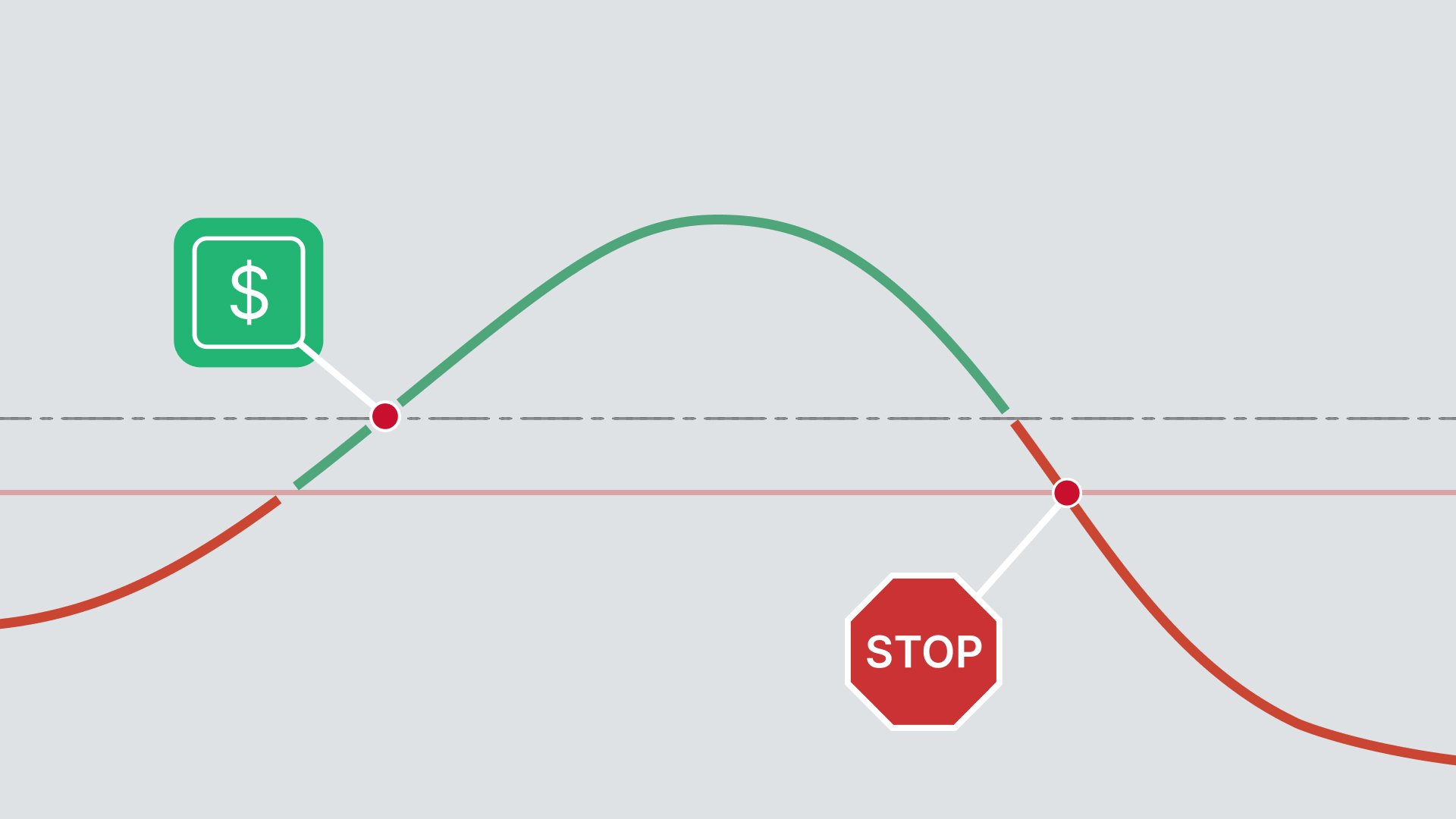

Stop loss aur take profit levels set karna risk management ka doosra zaroori hissa hai. Stop loss ek pre-decided level hota hai jahan trade automatically band ho jata hai agar market aapke against jaye. Is tarah aap zyada losses se bachte hain. Take profit ka use tab hota hai jab market aapke favor mein ho aur aap apne profits lock karna chahte hain. Yeh dono tools risk ko control karte hain aur emotional trading se bachate hain.

Diversification Aur Risk Analysis

Risk management ka teesra step hai diversification aur risk analysis. Ek hi sector ya asset class par focus karna risky ho sakta hai. Alag-alag sectors, assets aur markets mein invest karna aapko market ki unpredictability se bachata hai. Iske ilawa, market trends aur technical analysis ka use karke risk factors ko assess karna chahiye. Risk-to-reward ratio calculate karna bhi zaroori hai, jisse aapko pata chale ke ek trade lena worth hai ya nahi.

Assalamu alaikum aaj Ham trade pa ahim facts discuss karne ja rahe hain.

Risk management trading ka ek ahem hissa hai jo traders ko financial losses se bachne mein madad deta hai. Iska maqsad hai apne capital ko surakshit rakhna aur stable profits banana. Risk management ke bina, market ki volatility ya galat decisions ke natije mein traders apna sara paisa khona ka risk utha lete hain.

Position Sizing Aur Capital Allocation

Risk management ka pehla qadam position sizing aur capital allocation hai. Har trade ke liye apne overall capital ka ek chhota hissa lagana chahiye, taake agar loss ho, to overall portfolio zyada affect na ho. Aam tor par traders apne account ka sirf 1-2% ek trade mein invest karte hain. Yeh strategy aapko bade nuksaan se bachati hai aur aapko disciplined banati hai.

Stop Loss Aur Take Profit

Stop loss aur take profit levels set karna risk management ka doosra zaroori hissa hai. Stop loss ek pre-decided level hota hai jahan trade automatically band ho jata hai agar market aapke against jaye. Is tarah aap zyada losses se bachte hain. Take profit ka use tab hota hai jab market aapke favor mein ho aur aap apne profits lock karna chahte hain. Yeh dono tools risk ko control karte hain aur emotional trading se bachate hain.

Diversification Aur Risk Analysis

Risk management ka teesra step hai diversification aur risk analysis. Ek hi sector ya asset class par focus karna risky ho sakta hai. Alag-alag sectors, assets aur markets mein invest karna aapko market ki unpredictability se bachata hai. Iske ilawa, market trends aur technical analysis ka use karke risk factors ko assess karna chahiye. Risk-to-reward ratio calculate karna bhi zaroori hai, jisse aapko pata chale ke ek trade lena worth hai ya nahi.

تبصرہ

Расширенный режим Обычный режим